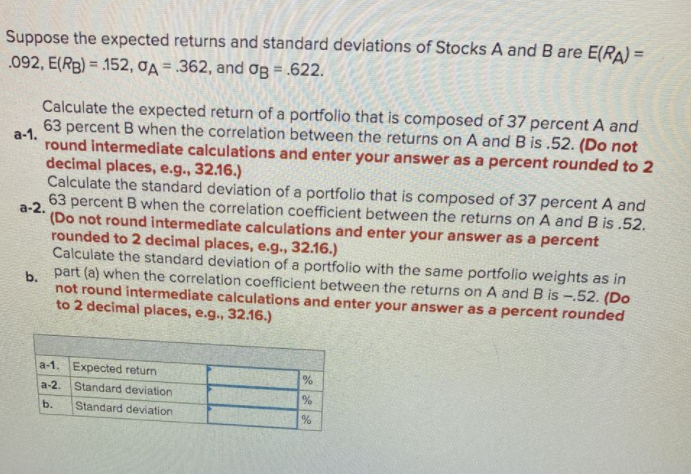

Suppose the expected returns and standard deviations of Stocks A and B are E(RA) = .092, E(RB) = 152, đA = .362, and Og = .622. %3D Calculate the expected return of a portfolio that is composed of 37 percent A and 63 percent B when the correlation between the returns on A and B is .52. (Do not a-1. round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Calculate the standard deviation of a portfolio that is composed of 37 percent A and 63 percent B when the correlation coefficient between the returns on A and B is .52. а-2. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Calculate the standard deviation of a portfolio with the same portfolio weights as in h part (a) when the correlation coefficient between the returns on A and B is -.52. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a-1. Expected return a-2. Standard deviation b. Standard deviation

Suppose the expected returns and standard deviations of Stocks A and B are E(RA) = .092, E(RB) = 152, đA = .362, and Og = .622. %3D Calculate the expected return of a portfolio that is composed of 37 percent A and 63 percent B when the correlation between the returns on A and B is .52. (Do not a-1. round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Calculate the standard deviation of a portfolio that is composed of 37 percent A and 63 percent B when the correlation coefficient between the returns on A and B is .52. а-2. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Calculate the standard deviation of a portfolio with the same portfolio weights as in h part (a) when the correlation coefficient between the returns on A and B is -.52. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a-1. Expected return a-2. Standard deviation b. Standard deviation

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9PROB

Related questions

Question

Transcribed Image Text:Suppose the expected returns and standard deviations of Stocks A and B are E(RA) =

.092, E(RB) = 152, đA = .362, and Og = .622.

%3D

Calculate the expected return of a portfolio that is composed of 37 percent A and

63 percent B when the correlation between the returns on A and B is .52. (Do not

a-1.

round intermediate calculations and enter your answer as a percent rounded to 2

decimal places, e.g., 32.16.)

Calculate the standard deviation of a portfolio that is composed of 37 percent A and

63 percent B when the correlation coefficient between the returns on A and B is .52.

а-2.

(Do not round intermediate calculations and enter your answer as a percent

rounded to 2 decimal places, e.g., 32.16.)

Calculate the standard deviation of a portfolio with the same portfolio weights as in

h part (a) when the correlation coefficient between the returns on A and B is -.52. (Do

not round intermediate calculations and enter your answer as a percent rounded

to 2 decimal places, e.g., 32.16.)

a-1. Expected return

a-2. Standard deviation

b.

Standard deviation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning