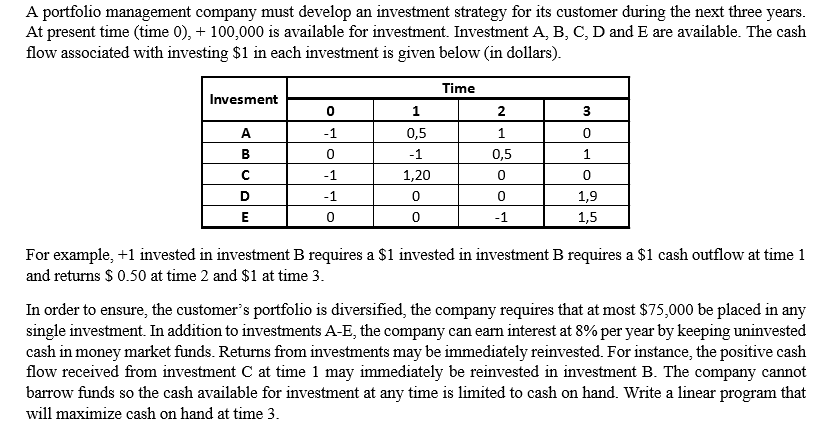

A portfolio management company must develop an investment strategy for its customer during the next three years. At present time (time 0), + 100,000 is available for investment. Investment A, B, C, D and E are available. The cash flow associated with investing $1 in each investment is given below (in dollars). Time Invesment 1 2 A. -1 0,5 В -1 0,5 1 -1 1,20 D -1 1,9 E -1 1,5 For example, +1 invested in investment B requires a $1 invested in investment B requires a $1 cash outflow at time 1 and returns $ 0.50 at time 2 and $1 at time 3. In order to ensure, the customer's portfolio is diversified, the company requires that at most $75,000 be placed in any single investment. In addition to investments A-E, the company can earn interest at 8% per year by keeping uninvested cash in money market funds. Returns from investments may be immediately reinvested. For instance, the positive cash flow received from investment C at time 1 may immediately be reinvested in investment B. The company cannot barrow funds so the cash available for investment at any time is limited to cash on hand. Write a linear program that will maximize cash on hand at time 3.

A portfolio management company must develop an investment strategy for its customer during the next three years. At present time (time 0), + 100,000 is available for investment. Investment A, B, C, D and E are available. The cash flow associated with investing $1 in each investment is given below (in dollars). Time Invesment 1 2 A. -1 0,5 В -1 0,5 1 -1 1,20 D -1 1,9 E -1 1,5 For example, +1 invested in investment B requires a $1 invested in investment B requires a $1 cash outflow at time 1 and returns $ 0.50 at time 2 and $1 at time 3. In order to ensure, the customer's portfolio is diversified, the company requires that at most $75,000 be placed in any single investment. In addition to investments A-E, the company can earn interest at 8% per year by keeping uninvested cash in money market funds. Returns from investments may be immediately reinvested. For instance, the positive cash flow received from investment C at time 1 may immediately be reinvested in investment B. The company cannot barrow funds so the cash available for investment at any time is limited to cash on hand. Write a linear program that will maximize cash on hand at time 3.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter4: Linear Programming Models

Section: Chapter Questions

Problem 62P

Related questions

Question

Transcribed Image Text:A portfolio management company must develop an investment strategy for its customer during the next three years.

At present time (time 0), + 100,000 is available for investment. Investment A, B, C, D and E are available. The cash

flow associated with investing $1 in each investment is given below (in dollars).

Time

Invesment

1

2

A.

-1

0,5

В

-1

0,5

1

-1

1,20

D

-1

1,9

E

-1

1,5

For example, +1 invested in investment B requires a $1 invested in investment B requires a $1 cash outflow at time 1

and returns $ 0.50 at time 2 and $1 at time 3.

In order to ensure, the customer's portfolio is diversified, the company requires that at most $75,000 be placed in any

single investment. In addition to investments A-E, the company can earn interest at 8% per year by keeping uninvested

cash in money market funds. Returns from investments may be immediately reinvested. For instance, the positive cash

flow received from investment C at time 1 may immediately be reinvested in investment B. The company cannot

barrow funds so the cash available for investment at any time is limited to cash on hand. Write a linear program that

will maximize cash on hand at time 3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,