7-37 Bbavika Investments, a group of financial advisors and retirement planners, is providing advice on how to invest $200,000 for one of its clients in the stock market and in money market funds. Each dollar invested in the stock market gives a return of 10%, and each dollar invested in money market funds gives a return of 5%. However, there is risk involved: the risk measure for each dollar invested in the stock market

7-37 Bbavika Investments, a group of financial advisors and retirement planners, is providing advice on how to invest $200,000 for one of its clients in the stock market and in money market funds. Each dollar invested in the stock market gives a return of 10%, and each dollar invested in money market funds gives a return of 5%. However, there is risk involved: the risk measure for each dollar invested in the stock market

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter4: Linear Programming Models

Section4.7: Financial Models

Problem 31P

Related questions

Question

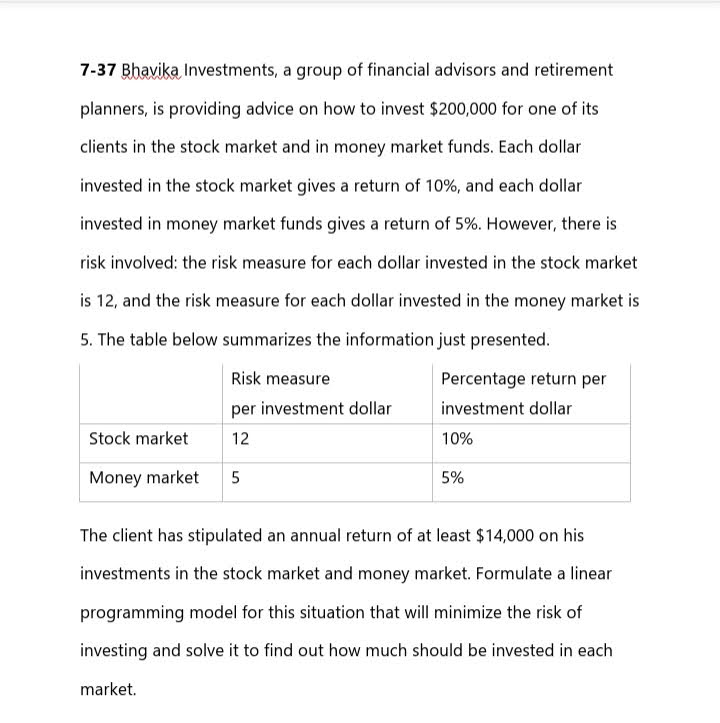

Transcribed Image Text:7-37 Bbavika Investments, a group of financial advisors and retirement

planners, is providing advice on how to invest $200,000 for one of its

clients in the stock market and in money market funds. Each dollar

invested in the stock market gives a return of 10%, and each dollar

invested in money market funds gives a return of 5%. However, there is

risk involved: the risk measure for each dollar invested in the stock market

is 12, and the risk measure for each dollar invested in the money market is

5. The table below summarizes the information just presented.

Risk measure

Percentage return per

per investment dollar

investment dollar

Stock market

12

10%

Money market

5%

The client has stipulated an annual return of at least $14,000 on his

investments in the stock market and money market. Formulate a linear

programming model for this situation that will minimize the risk of

investing and solve it to find out how much should be invested in each

market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,