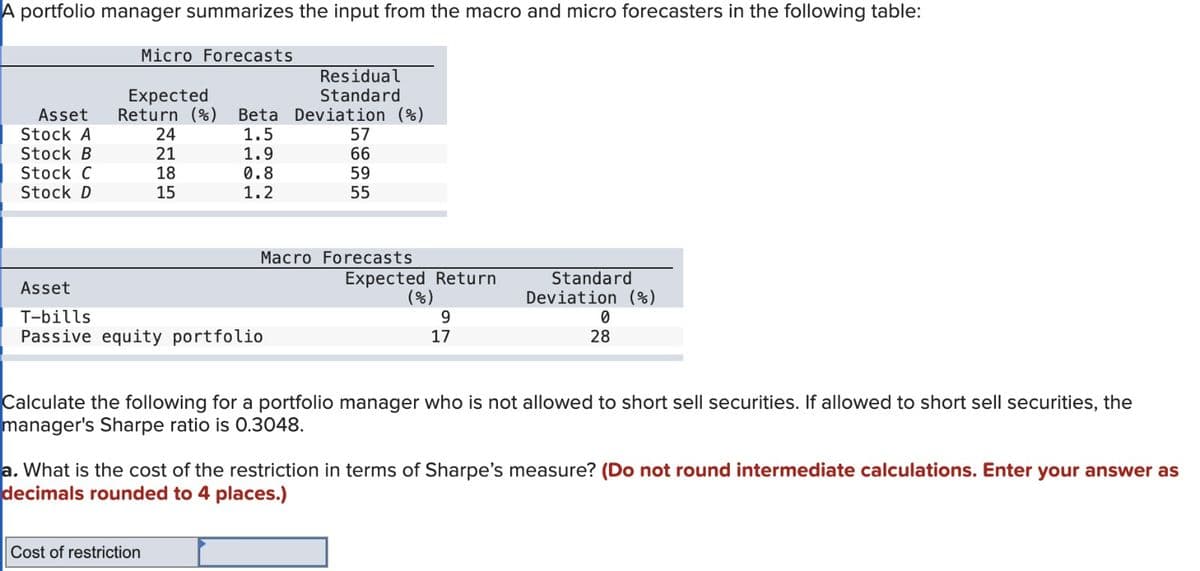

A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Micro Forecasts Expected Residual Standard Return (%) Beta Deviation (%) Asset Stock A 24 1.5 57 Stock B 21 1.9 Stock C 18 0.8 Stock D 15 1.2 6625 59 55 Asset T-bills Macro Forecasts Expected Return (%) 9 17 Standard Deviation (%) 0 28 Passive equity portfolio Calculate the following for a portfolio manager who is not allowed to short sell securities. If allowed to short sell securities, the manager's Sharpe ratio is 0.3048. a. What is the cost of the restriction in terms of Sharpe's measure? (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Cost of restriction

A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Micro Forecasts Expected Residual Standard Return (%) Beta Deviation (%) Asset Stock A 24 1.5 57 Stock B 21 1.9 Stock C 18 0.8 Stock D 15 1.2 6625 59 55 Asset T-bills Macro Forecasts Expected Return (%) 9 17 Standard Deviation (%) 0 28 Passive equity portfolio Calculate the following for a portfolio manager who is not allowed to short sell securities. If allowed to short sell securities, the manager's Sharpe ratio is 0.3048. a. What is the cost of the restriction in terms of Sharpe's measure? (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Cost of restriction

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 20P

Related questions

Question

Baghiben

Transcribed Image Text:A portfolio manager summarizes the input from the macro and micro forecasters in the following table:

Micro Forecasts

Expected

Residual

Standard

Return (%) Beta Deviation (%)

Asset

Stock A

24

1.5

57

Stock B

21

1.9

Stock C

18

0.8

Stock D

15

1.2

6625

59

55

Asset

T-bills

Macro Forecasts

Expected Return

(%)

9

17

Standard

Deviation (%)

0

28

Passive equity portfolio

Calculate the following for a portfolio manager who is not allowed to short sell securities. If allowed to short sell securities, the

manager's Sharpe ratio is 0.3048.

a. What is the cost of the restriction in terms of Sharpe's measure? (Do not round intermediate calculations. Enter your answer as

decimals rounded to 4 places.)

Cost of restriction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT