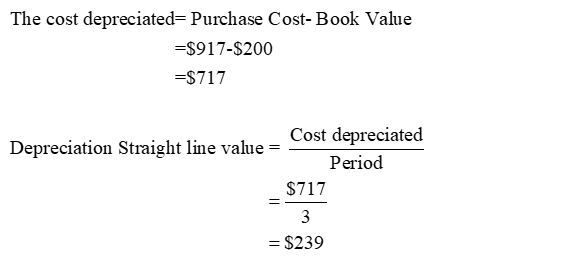

A potential new project involves an up-front purchase of equipment that would cost $917. The equipment would be depreciated on a straight-line basis over its 3 year useful life to a $200 book value. The firm's tax rate is 30%. As part of the capital budgeting process, you are asked by your boss to determine the annual net cash flow impact of the asset's depreciation. You should indicate that the cash flow impact per year (in each of years 1 through 3, not the combined amount) will be $__________. Do not round any intermediate work, but round your final answer to 2 decimal places (ex: 12.34567 should be entered as 12.35). Do not enter the $ sign. Include a negative sign if your answer is negative.

A potential new project involves an up-front purchase of equipment that would cost $917. The equipment would be

Do not round any intermediate work, but round your final answer to 2 decimal places (ex: 12.34567 should be entered as 12.35). Do not enter the $ sign. Include a negative sign if your answer is negative.

Step by step

Solved in 2 steps with 2 images