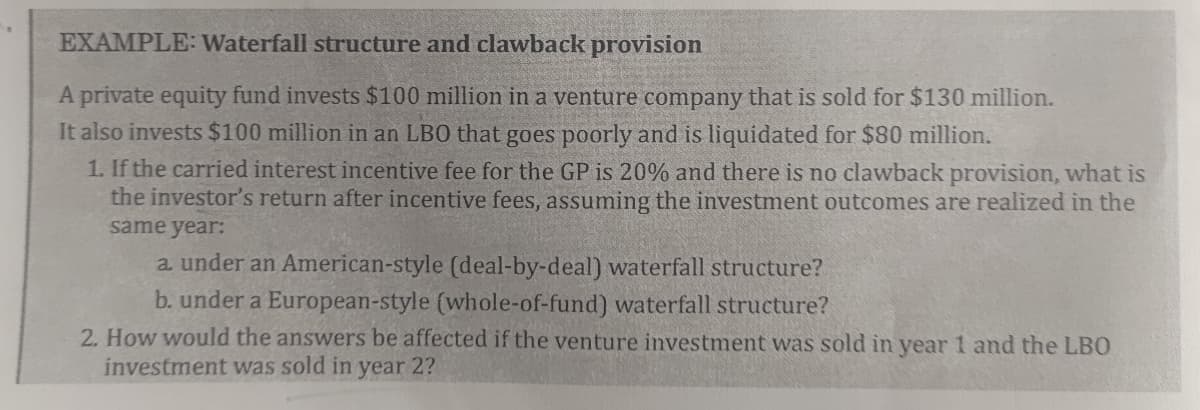

A private equity fund invests $100 million in a venture company that is sold for $130 million. It also invests $100 million in an LBO that goes poorly and is liquidated for $80 million. 1. If the carried interest incentive fee for the GP is 20% and there is no clawback provision, what is the investor's return after incentive fees, assuming the investment outcomes are realized in the same year: a under an American-style (deal-by-deal) waterfall structure? b. under a European-style (whole-of-fund) waterfall structure?

Q: Mary bought a bike payable monthly for 10 months starting at the end of the month. How much is the…

A: Mortgage is a loan to buy an asset. The cost of the asset will be paid in equal instalments of…

Q: Suppose you buy a $40,000 car and you 'put down' $5,000 and finance the rest for 72 months at 3.75%…

A: Solution:- When a loan is taken, the amount can be repaid as a lump sum payment or in instalments.…

Q: 3. Calculate the NPV at a cost of capital of 9% and the IRR for a project with an initial outlay of…

A: Net Present Value is the difference between present value of cash inflows and cash outflows.…

Q: The firm's average accounts receivable balance is P2.5 million, and they are financed by a bank loan…

A: In finance the lockbox system is a service that many banks provide. It is related to receipt of…

Q: ption for $10,000 at a premium of P7,000. The exercise price is P52.10 per dollar. On the balance…

A: A put option is an option where the buyer of a put option has the right to sell at the strike price…

Q: Stock A has an expected return of 12% and a standard deviation of 35%. Stock B has an expected…

A: Expected return on portfolio is the weighted average return on stocks in the portfolio and can be…

Q: You damage your car in an accident that is covered by your collision insurance, which has a $200…

A: Collision insurance can be defined as the contract between the insurer and insured, where, the…

Q: 1. The Dow Jones Industrial Average (DJIA30) and the Standard & Poor's Industrial Index (S&P500)…

A: The Dow Jones Industrial Average (DJIA), often known as the Dow 30, is a stock market index that…

Q: 1. To save for their new child's college education, a couple places $28,400 in an account. What…

A: Present value of a future amount With periodic compounded interest rate (i), period (n) and future…

Q: Q4 Write notes explaining EACH of the following; (i) Rent review (ii) All risks yield…

A: In this question, we will explain all the points given above in the question . 1. Rent review = It…

Q: What is the price of the bond at 3 different points in time - today, in 1 year, and in 2 years. Is…

A: Bond valuation refers to a method which is used to compute the current value or present value (PV)…

Q: ou want to issue a short-term loan for your company in 3 months. To hedge the risk due to interest…

A: Interest Rate risk is the risk which occurs due to change in interest rate in future. The investor…

Q: his question concerns an APY of 12%. a) what APR, compounded quarterly, yields this APY? b) what APR…

A: APY is the effective yield after considering the impact of compounding and APR is without…

Q: t is the interest rate that the buyer will actually earn if the bond is held to maturity and there…

A: Bond carry the payment of coupon periodically and payment of face value on the maturity of bond and…

Q: Assume you have a brand new nephew in the family and you want to contribute to the child's college…

A: Zero-coupon bond: Bonds are financial securities that allow investors to profit by lending money to…

Q: What is the fair price of a bond assuming that the annual rate is 5.32% if its face value is Php…

A: Assuming i is the annual effective rate and i(4) is the effective quarterly rate. (1+i) =…

Q: 7. Mark Hohman has decided that it is time to buy a new car. He has found his dream car for $25,502…

A: Mortgage amortization refers to a schedule which is prepared to shows the periodic loan payments,…

Q: A company has $20 billion of sales and $1 billion of net income. Its total assets are $10 billion.…

A: The net income of the company= $ 1,000,000,000 Tax rate=40% Total Assets = $10,000,000,000

Q: Inn Corporation had 30,000 ordinary shares of which were acquired during Year 2 for a total…

A: Answer - December 31, Year 2 ledger balance (30,000 x P65) P1,950,000 Cost…

Q: elstra announces a major expansion into Internet services. This announcement causes the price of…

A: Call option gives opportunity to purchase stock on expiration but would be no obligations to do…

Q: ABC Corporation bought 5 short futures. The contract size is 10,000 shares of Mining Inc. The strike…

A: ABC Corporation bought 5 short futures. It means ABC is a Put Buyer. The put Buyer will exercise…

Q: Stock price S=$21 Exercise price K= $20 Interest rate r = 0.08 Maturity T= 180 days = 0.5…

A: Options are versatile financial products. These contracts involve buyers and sellers, who pay a…

Q: 4) Jones purchased a perpetuity today for 7000. He will receive the first annual payment of 200 five…

A: Price of perpetuity = Present value of perpetuity = 7000 First payment after 5 years = 200 Every…

Q: What will be the firm's quick ratio after Nelson has raised the maximum amount of short-term funds?…

A: Current ratio is an important financial metric. It is a liquidity ratio that measures a company’s…

Q: D. What does a firm typically try to accomplish by cross listing and selling its shares on a foreign…

A: The listing of a company's common shares on an exchange other than its primary and original stock…

Q: Find the future value of a simple interest loan of $2,500 at 8.8% interest for 10 months Give your…

A: Loan amount = $2,500 Interest rate = 0.088 Loan period = 10 months Future value of simple interest…

Q: Spot Forex quote: EUR/USD = 1.06. A friend from France has asked you to purchase a Bobcat baseball…

A: Spot exchange rate EUR/USD = 1.06 Purchase cost in USD = $21 Cost in EUR = ? We will use…

Q: Wec ine, wants to increase ts free cash low by PIB0 milion during the coming vear, which should…

A: The difference between a company's current assets and current liabilities, such as cash, accounts…

Q: In a public corporation, the agency conflict is: O the exploitation of the workers by the owners O…

A: Agency conflict is a reality in many public corporations. It arises due to a conflict of interest…

Q: A loan is to be repaid quarterly for 10 years that will start at the end of 4 years. If the interest…

A: Assuming that the loan will start at the start of 5th year and will be repaid at the end of 10th…

Q: What is the total payback amount of the loan? What is the amount of each payment? /month What is the…

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: A Treasury bond that settles on October 18, 2019, matures on March 30, 2038. The coupon rate is 5.70…

A: Macaulay duration and modified duration both measure the bond's price sensitivity to the change in…

Q: The coupon rate is calculated on the bond's face value for par value). not on the issue price or…

A: Coupon rate is the interest rate for periodic interest payments on the bond. Value of the bond =…

Q: • Only provide decimal places when specifically mentioned in the problem. Round off to the decimal…

A: Ratio analysis is the method of checking the operational efficiency, liquidity, and profitability of…

Q: Interest expense should be calculated based on interest rates and debt balances and by using a trend…

A: Interest expense is the amount paid periodically on the borrowed amount. The borrowed amount can be…

Q: Which of the following methods of methods of capital budgeting is base cashflows: Payback NPV…

A: As per Bartleby guidelines, If multiple questions are posted, only the first 1 question will be…

Q: Spot Forex quote: EUR/USD = 1.06. A friend from France has asked you to purchase a Bobcat baseball…

A: Purchase cost in USD = $21 Spot exchange rate = EUR/USD = 1.06 Cost in EUR or amount need to send…

Q: Which of the following is NOT an internal consideration in analyzing the decision environment?…

A: In financial management, managers have to take various business decisions by considering the…

Q: QUESTION 4 Bob and Roberta are married and have two children. They are covered by a comprehensive…

A: Coinsurance is the amount, usually stated as a fixed percentage, an insured must pay against a claim…

Q: Currently the risk-free rate equals 5% and the expected return on the market portfolio equals 11%.…

A: Given: Risk free rate “Rf” = 5% Market return “Rm” = 11% Stock A Beta = 1.33 Stock B Beta = 0.7…

Q: What is the market price of a redeemable (at par) bond, with a maturity date in 4 years’ time, and a…

A: Price of the bond is the sum of all cashflows during the life of bond discounted at yield to…

Q: a. Calculate the average rate of return for each stock during the 5-year period. Do not round…

A: Expected return refers to the return earn by an investor on the amount invested during a period of…

Q: Suppose you have borrowed $50 from a foreign lending institution. The loan requires a payment of 6…

A: Loan Amount $ 50.00 Time Period (Days) 6 Periodic Payment $…

Q: The following financial information was provided by Anya Company: Net Income 8,255,000.00…

A: Net profit margin depends on sales and net income and all these are quite interrelated to each…

Q: What does tangible common equity reflect? Suppose that a bank has common stock of par value $200m…

A: The measure of calculating a company's financial capability to bear losses is known as the tangible…

Q: Match (drng and drop) the following options strategy with the correct expiry profit diagram. Option…

A: In case of a Long call, Payoff is (Stock price - Exercise price,0) I,e option is exercised only if…

Q: The standard homeowners policy contains both property and liability coverages. True or False

A: The standard homeowners policy can be defined as the contract between insurer and the insured where,…

Q: Assume you have secured a loan of $10,000 from a bank which will be paid in one year. The fin bank…

A: A loan is an agreement where an amount is forwarded with the promise to pay it back along with some…

Q: (b) Assume you can borrow $100,000.00, using covered interest arbitrage for a 30- day investment,…

A: Given, (b) Here, we have to find out the arbitrage value after 30 days. The working is done…

Q: On average, how much “free” trade credit does the firm receive during the year?

A: Per credit cycle purchase = purchases *time =450000*60/365 =P 73972.60

Step by step

Solved in 3 steps

- Optimal Capital Structure with Hamada Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%, and its stock price is $40 per share with 2 million shares outstanding. BEA is a zero-growth firm and pays out all of its earnings as dividends. The firm’s EBIT is $14,933 million, and it faces a 40% federal-plus-state tax rate. The market risk premium is 4%, and the risk-free rate is 6%. BEA is considering increasing its debt level to a capital structure with 40% debt, based on market values, and repurchasing shares with the extra money that it borrows. BEA will have to retire the old debt in order to issue new debt, and the rate on the new debt will be 9%. BEA has a beta of 1.0. What is BEA’s unlevered beta? Use market value D/S (which is the same as wd/ws when unlevering. What are BEA’s new beta and cost of equity if it has 40% debt? What are BEA’s WACC and total value of the firm with 40% debt?COST OF CAPITAL Coleman Technologies is considering a major expansion program that has been proposed by the companys information technology group. Before proceeding with the expansion, the company must estimate its cost of capital. Suppose you are an assistant to Jerry Lehman, the financial vice president. Your first task is to estimate Colemans cost of capital Lehman has provided you with the following data, which he believes may be relevant to your task. The firms tax rate is 25%. The current price of Colemans 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity, is 1.153.72. Coleman does not use short-term, interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. The current price of the firms 10%, 100.00 par value, quarterly dividend, perpetual preferred stock is 111.10. Colemans common stock is currently selling for 50.00 per share. Its last dividend (D0) was 4.19, and dividends are expected to grow at a constant annual rate of 5% in the foreseeable future. Colemans beta is 1.2, the yield on T-bonds is 7%, and the market risk premium is estimated to be 6%. For the bond-yield-plus-risk-premium approach, the firm uses a risk premium of 4%. Colemans target capital structure is 30% debt, 10% preferred stock, and 60% common equity. To structure the task somewhat, Lehman has asked you to answer the following questions: a. 1. What sources of capital should be included when you estimate Colemans WACC? 2. Should the component costs be figured on a before-tax or an a after-tax basis? 3. Should the costs be historical (embedded) costs or new (marginal) costs? b. What is the market interest rate on Colemans debt and its component cost of debt? c. 1. What is the firms cost of preferred stock? 2. Colemans preferred stock is riskier to investors than its debt, yet the preferreds yield to investors is lower than the yield to maturity on the debt Does this suggest that you have made a mistake? (Hint: Think about taxes) d. 1. Why is there a cost associated with retained earnings? 2. What is Colemans estimated cost of common equity using the CAPM approach? e. What is the estimated cost of common equity using the DCF approach? f. What is the bond-yield-plus-risk-premium estimate for Colemans cost of common equity? g. What is your final estimate for rs? h. Explain in words why new common stock has a higher cost than retained earnings. i. 1. What are two approaches that can be used to adjust for flotation costs? 2. Coleman estimates that if it issues new common stock, the flotation cost will be 15%. Coleman incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common stock, considering the flotation cost? j. What is Colemans overall, or weighted average, cost of capital (WACC)? Ignore flotation costs. k. What factors influence Colemans composite WACC? l. Should the company use the composite WACC as the hurdle rate for each of its projects? Explain.ABC CAPITAL is a hedge fund with $300 million of initial investment capital. They charge a 2 percent management fee based on assets under management and a 20 percent incentive fee. In its first year, ABC Capital has a 20 percent return. Assume management fees are calculated using beginning-of-period valuation. 1. What are the fees earned by ABC if the incentive and management fees are calculated independently? What is an investor’s effective return given this fee Structure? 2. What are the fees earned by ABC assuming that the incentive fee is calculated based on return net of the management fee? What is an investor’s net return given this fee structure? 3. If the fee structure specifies a hurdle rate of 5 percent and the incentive fee is based on returns in excess of the hurdle rate, what are the fees earned by ABC assuming the performance fee is calculated net of the management fee? What is an investor’s net return given this fee structure? 4. In the second year, the fund value…

- ABC CAPITAL is a hedge fund with $300 million of initial investment capital. They charge a 2 percent management fee based on assets under management at year- end and a 20 percent incentive fee. In its first year, ABC Capital has a 80 percent return. Assume management fees are calculated using end-of-period valuation. 1. What are the fees earned by ABC if the incentive and management fees are calculated independently? What is an investor’s effective return given this fee Structure? 2. What are the fees earned by ABC assuming that the incentive fee is calculated based on return net of the management fee? What is an investor’s net return given this fee structure? 3. If the fee structure specifies a hurdle rate of 5 percent and the incentive fee is based on returns in excess of the hurdle rate, what are the fees earned by ABC assuming the performance fee is calculated net of the management fee? What is an investor’s net return given this fee structure? 4. In the second year, the fund…If a Venture Capital fund with $10 million committed capital, charges 2.5% management fee per year for 10 years, and 20 percent (20%) carried interest with a basis of committed capital. If the fund earns a 2 times return on its investment. What is the IRR for Limited Partners if General Partners need to return committed capital before sharing the profit?Wanbay Corporation is interested in estimating its additional financing needed to support a growth in sales next year. Last year, revenues were RM1million; net profit margin was 6 percent; investment in assets was RM750,000; payables and accruals were RM100,000; stockholders’ equity at the end of the year was RM450,000. The venture did not pay out any dividends and does not expect to pay dividends for the future. Calculate the additional fund needed (AFN) next year to support a 30 percent increase in sales.

- Citadel LLC is one of largest hedge fund firms in the United States. Citadel now holds $360 billion in its hedge fund account. Citadel charges a 2% management fee based on assets under management at year end, and a 20% incentive fee. In its first year, Citadel appreciates 19.20%. Calculate the investor’s net return. Assume that management fees are calculated using end-of-period valuation, the performance fee is calculated net of the management fee, and no hurdle rate on its performance. A. 13.45% B. 17.25% C. 21.25% D. 24.65%Charming Miracle Co. is trying to decide how best to finance a proposed P10,000,000 capital investment. Under Plan I, the project will be financed entirely with long-term 9% bonds. The firm currently has no debt or preferred stock. Under Plan II, common stock will be sold at P20 a share; presently, 1,000,000 shares are outstanding. The corporate tax rate is 40%. REQUIRED: Calculate the indifference level of EBIT associated with the two financing plans. Which financing plan would you expect to cause the greatest changes in EPS relative to a change in EBIT? Why? If EBIT is expected to be P3,100,000, which plan will result in a higher EPS?A firm has two possible investments with the following cash inflows. Each investment costs $435, and the cost of capital is seven percent. Use Appendix B and Appendix D to answer the questions. Assume that the investments are not mutually exclusive and there are no budget restrictions. Cash Inflows Year A B 1 $ 270 $ 170 2 140 170 3 100 170 Based on each investment’s net present value, which investment(s) should the firm make? Use a minus sign to enter negative values, if any. Round your answers to the nearest dollar. Investment A: $ Investment B: $ The firm should make . Based on each investment’s internal rate of return, which investment(s) should the firm make? Round your answers to the nearest whole number. Investment A: % Investment B: % The firm should make . Is this the same answer you obtained in part b? It the same answer as obtained in part b. If the cost of capital were to increase to 9 percent, which investment(s) should the firm…

- You have made a $400,000 investment in a hedge fund that has a 2/20 fee structure. The fund has a total of $25 million of assets under management and provides a return of 10% in the first year. Assume that management fees are paid at the beginning of each year and performance fees are paid at the end of each year in which they are applicable. How much will you pay in management and performance fees for the year? Multiple Choice A)$1,000; $10,250 B)$1,000; $10,700 C)$8,000; $10,250 D)$8,000; $6,240 E)$6,240; $9,000The Omega Corporation has some excess cash it would like to invest in marketable securities for a long-term hold. Its Vice-President of Finance is considering three investments: (a) Treasury bonds at a 7 percent yield; (b) corporate bonds at a 12 percent yield; or (c) preferred stock at an 8 percent yield. Omega Corporation is in a 35 percent tax bracket and the tax rate on dividends is 20 percent.a-1. Compute the aftertax yields for the three investment options. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) After Tax Yields % a. Treasury bonds b. Corporate bonds c. Preferred Stock8. Daleel plc is trying to introduce an improved method of assessing investment projects using discounted cash flow techniques. For this it has to obtain a cost of capital to use as a discount rate. The finance department has assembled the following information: – The company has an equity beta of 0.80, which may be taken as the appropriate adjustment to the average risk premium. The yield on risk-free government securities is 6.5 per cent and the historic premium above the risk-free rate is estimated at 5 per cent for shares. – The market value of the firm’s debt is thrice the value of its equity. – The cost of borrowed money to the company is estimated at 12 per cent (before tax shield benefits). – Corporation tax is 35 per cent. Assume: No inflation. Create an estimate of the weighted average cost of capital (WACC).