A property was purchased for $7060 00 down and payments of $1451.00 at the end of every year for 3 years. Interest is 5% per annum compounded semi-annually What was the purchase price of the property? How much is the cost of financing? Trent has opened an RRSP account by making an initial deposit of $1000. He intends to make annual deposits for 19 years increasing at a constant rate of 2% How much of the accumulated value just after the last deposit was made is interest if interest is 8 5% compounded annually? The amount of interest included in the accumulated value is $ (Round the final answer to the nearest cent as needed Round all intermediate values in six decimal nlaces as needed i

A property was purchased for $7060 00 down and payments of $1451.00 at the end of every year for 3 years. Interest is 5% per annum compounded semi-annually What was the purchase price of the property? How much is the cost of financing? Trent has opened an RRSP account by making an initial deposit of $1000. He intends to make annual deposits for 19 years increasing at a constant rate of 2% How much of the accumulated value just after the last deposit was made is interest if interest is 8 5% compounded annually? The amount of interest included in the accumulated value is $ (Round the final answer to the nearest cent as needed Round all intermediate values in six decimal nlaces as needed i

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.21MCE

Related questions

Question

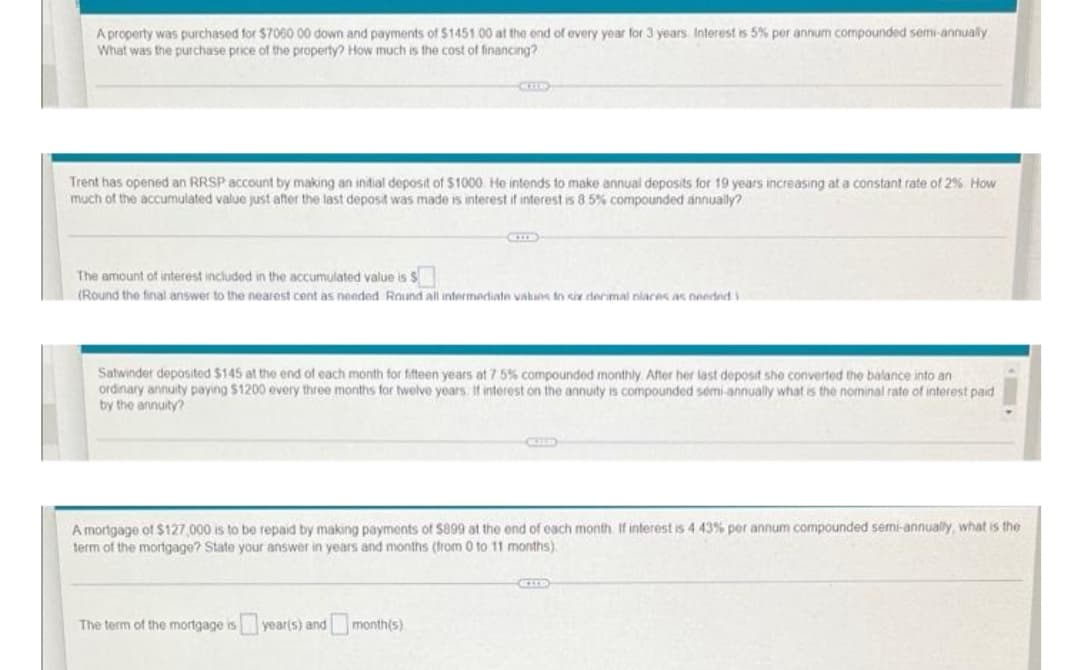

Transcribed Image Text:A property was purchased for $7060.00 down and payments of $1451.00 at the end of every year for 3 years Interest is 5% per annum compounded semi-annually

What was the purchase price of the property? How much is the cost of financing?

CID

Trent has opened an RRSP account by making an initial deposit of $1000 He intends to make annual deposits for 19 years increasing at a constant rate of 2% How

much of the accumulated value just after the last deposit was made is interest if interest is 8 5% compounded annually?

The amount of interest included in the accumulated value is $

(Round the final answer to the nearest cent as needed Round all intermediate values in six decimal nlaces as needed i

Satwinder deposited $145 at the end of each month for fifteen years at 7 5% compounded monthly. After her last deposit she converted the balance into an

ordinary annuity paying $1200 every three months for twelve years. If interest on the annuity is compounded semi-annually what is the nominal rate of interest paid

by the annuity?

CULD

A mortgage of $127,000 is to be repaid by making payments of $899 at the end of each month. If interest is 4 43% per annum compounded semi-annually, what is the

term of the mortgage? State your answer in years and months (from 0 to 11 months)

The term of the mortgage is year(s) and month(s)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College