A rental car company purchased a new Toyota Camry for $35,000. The company determined this asset should be depreciated for six years using the straight-line depreciation method. At the end of six years, the car will be worth $30,500. If you were to estimate the value of the car at year 4, is that using interpolation or extrapolation? Explain. Question 5 options: Extrapolation, because the value of the car at year 4 is outside of the given information. Interpolation, because the value of the car at year 4 is outside of the given information. Extrapolation, because the value of the car at year 4 is in between the given information. Interpolation, because the value of the car at year 4 is in between the given information

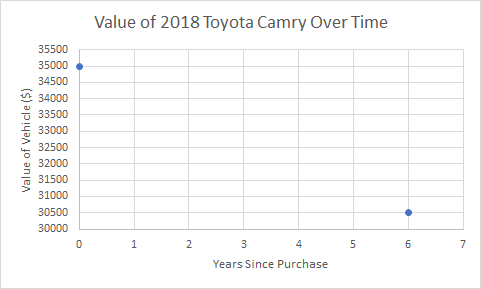

A rental car company purchased a new Toyota Camry for $35,000. The company determined this asset should be depreciated for six years using the straight-line depreciation method. At the end of six years, the car will be worth $30,500.

If you were to estimate the value of the car at year 4, is that using interpolation or extrapolation? Explain.

Question 5 options:

|

|

Extrapolation, because the value of the car at year 4 is outside of the given information. |

|

|

Interpolation, because the value of the car at year 4 is outside of the given information. |

|

|

Extrapolation, because the value of the car at year 4 is in between the given information.

|

|

|

Interpolation, because the value of the car at year 4 is in between the given information |

Step by step

Solved in 2 steps with 1 images