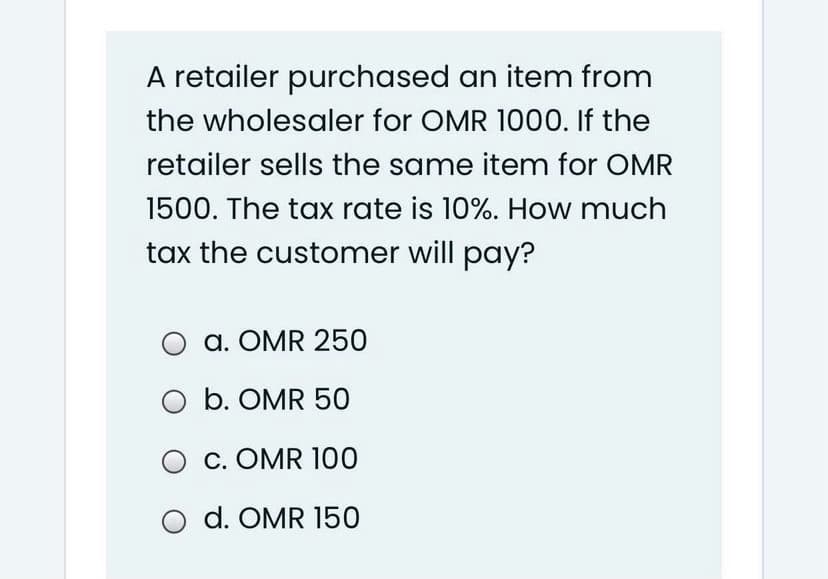

A retailer purchased an item from the wholesaler for OMR 1000. If the retailer sells the same item for OMR 1500. The tax rate is 10%. How much tax the customer will pay?

A retailer purchased an item from the wholesaler for OMR 1000. If the retailer sells the same item for OMR 1500. The tax rate is 10%. How much tax the customer will pay?

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 6EA: Elegant Electronics sells a cellular phone on September 2 for $450. On September 6, Elegant sells...

Related questions

Question

100%

Transcribed Image Text:A retailer purchased an item from

the wholesaler for OMR 1000. If the

retailer sells the same item for OMR

1500. The tax rate is 10%. How much

tax the customer will pay?

a. OMR 250

b. OMR 50

O c. OMR 100

O d. OMR 150

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning