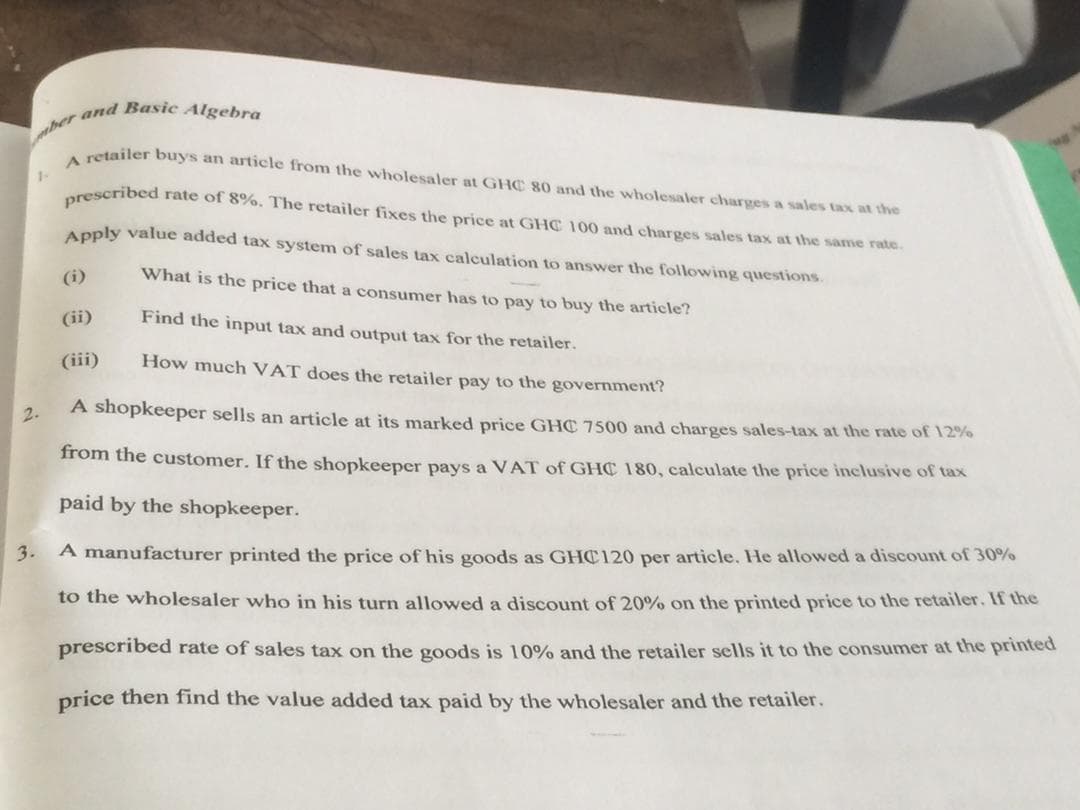

A retailer buys an article from the wholesaler at GHC 80 and the wholesaler charges a sales tax at the arescribed rate of 8%. The retailer fixes the price at GHC 100 and charges sales tax at the same rate. Apply value added tax system of sales tax calculation to answer the following questions. (i) What is the price that a consumer has to pay to buy the article? (ii) Find the input tax and output tax for the retailer. (iii) How much VAT does the retailer pay to the government'?

A retailer buys an article from the wholesaler at GHC 80 and the wholesaler charges a sales tax at the arescribed rate of 8%. The retailer fixes the price at GHC 100 and charges sales tax at the same rate. Apply value added tax system of sales tax calculation to answer the following questions. (i) What is the price that a consumer has to pay to buy the article? (ii) Find the input tax and output tax for the retailer. (iii) How much VAT does the retailer pay to the government'?

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 2PA: Stork Enterprises delivers care packages for special occasions. They charge $45 for a small package,...

Related questions

Question

Transcribed Image Text:A retailer buys an article from the wholesaler at GHC 80 and the wholesaler charges a sales tax at the

1-

arescribed rate of 8%. The retailer fixes the price at GHC 100 and charges sales tax at the same rate.

Apply value added tax system of sales tax calculation to answer the following questions.

(i)

What is the price that a consumer has to pay to buy the article?

(ii)

Find the input tax and output tax for the retailer.

(iii)

How much VAT does the retailer pay to the government?

2.

A shopkeeper sells an article at its marked price GHC 7500 and charges sales-tax at the rate of 12%

from the customer. If the shopkeeper pays a VAT of GHC 180, calculate the price inclusive of tax

paid by the shopkeeper.

3.

A manufacturer printed the price of his goods as GHC120 per article. He allowed a discount of 30%

to the wholesaler who in his turn allowed a discount of 20% on the printed price to the retailer. If the

prescribed rate of sales tax on the goods is 10% and the retailer sells it to the consumer at the printed

price then find the value added tax paid by the wholesaler and the retailer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage