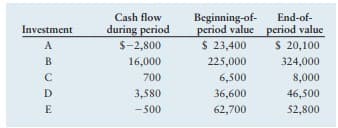

a) Return calculations For each of the investments shown in the table(Attached), calculate the rate of return earned over the unspecified time period. b) ETHICS PROBLEM Risk is a major concern of almost all investors. When shareholders invest their money in a firm, they expect managers to take risks with those funds. What do you think are the ethical limits that managers should observe when taking risks with other people’s money?

a) Return calculations For each of the investments shown in the table(Attached), calculate the rate of return earned over the unspecified time period. b) ETHICS PROBLEM Risk is a major concern of almost all investors. When shareholders invest their money in a firm, they expect managers to take risks with those funds. What do you think are the ethical limits that managers should observe when taking risks with other people’s money?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.1.1MBA

Related questions

Question

a)

Return calculations For each of the investments shown in the table(Attached), calculate the

b)

ETHICS PROBLEM Risk is a major concern of almost all investors. When shareholders invest their money in a firm, they expect managers to take risks with those funds. What do you think are the ethical limits that managers should observe when taking risks with other people’s money?

Transcribed Image Text:Cash flow

Beginning-of-

period value period value

$ 23,400

End-of-

Investment

during period

A

$-2,800

S 20,100

B

16,000

225,000

324,000

6,500

36,600

62,700

C

700

8,000

D

3,580

46,500

E

-500

52,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning