A service provider has a 12-month agreement to provide a customer with services for which the custom pays $1,000 per month. The agreement does not include any provisions for automatic extensions, and expires on 30 November 2018. The two parties sign a new agreement on 28 February 2019 that requir the customer to pay $1,250 per month in fees, retroactive to 1 December 2018. The customer continued to pay $1,000 per month during December, January and February, and the servi provider continued to provide services during that period. There are no performance issues being disput between the parties in the expired period, only negotiation of rates under the new contract. Required Does a contract exist in December, January and February (prior to the new agreement being signed)?

A service provider has a 12-month agreement to provide a customer with services for which the custom pays $1,000 per month. The agreement does not include any provisions for automatic extensions, and expires on 30 November 2018. The two parties sign a new agreement on 28 February 2019 that requir the customer to pay $1,250 per month in fees, retroactive to 1 December 2018. The customer continued to pay $1,000 per month during December, January and February, and the servi provider continued to provide services during that period. There are no performance issues being disput between the parties in the expired period, only negotiation of rates under the new contract. Required Does a contract exist in December, January and February (prior to the new agreement being signed)?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 6C: On October 1, 2019, Grahams WeedFeed Inc. signs a contract to maintain the grounds for BigData Corp....

Related questions

Question

100%

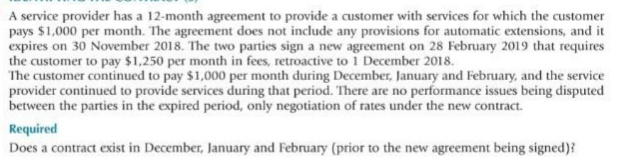

Transcribed Image Text:A service provider has a 12-month agreement to provide a customer with services for which the customer

pays $1,000 per month. The agreement does not include any provisions for automatic extensions, and it

expires on 30 November 2018. The two parties sign a new agreement on 28 February 2019 that requires

the customer to pay $1,250 per month in fees, retroactive to 1 December 2018.

The customer continued to pay $1,000 per month during December, January and February, and the service

provider continued to provide services during that period. There are no performance issues being disputed

between the parties in the expired period, only negotiation of rates under the new contract.

Required

Does a contract exist in December, January and February (prior to the new agreement being signed)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning