PAYROLL ACCT.,2019 ED.(LL)-TEXT

19th Edition

ISBN: 9781337619783

Author: BIEG

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 10PB

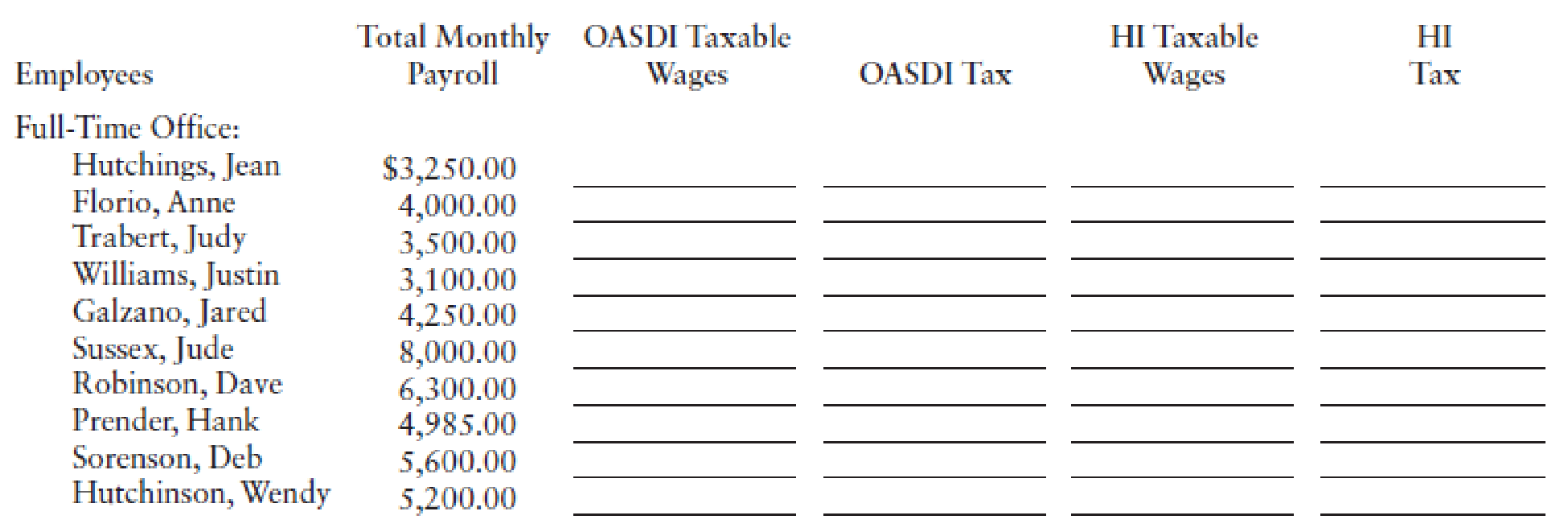

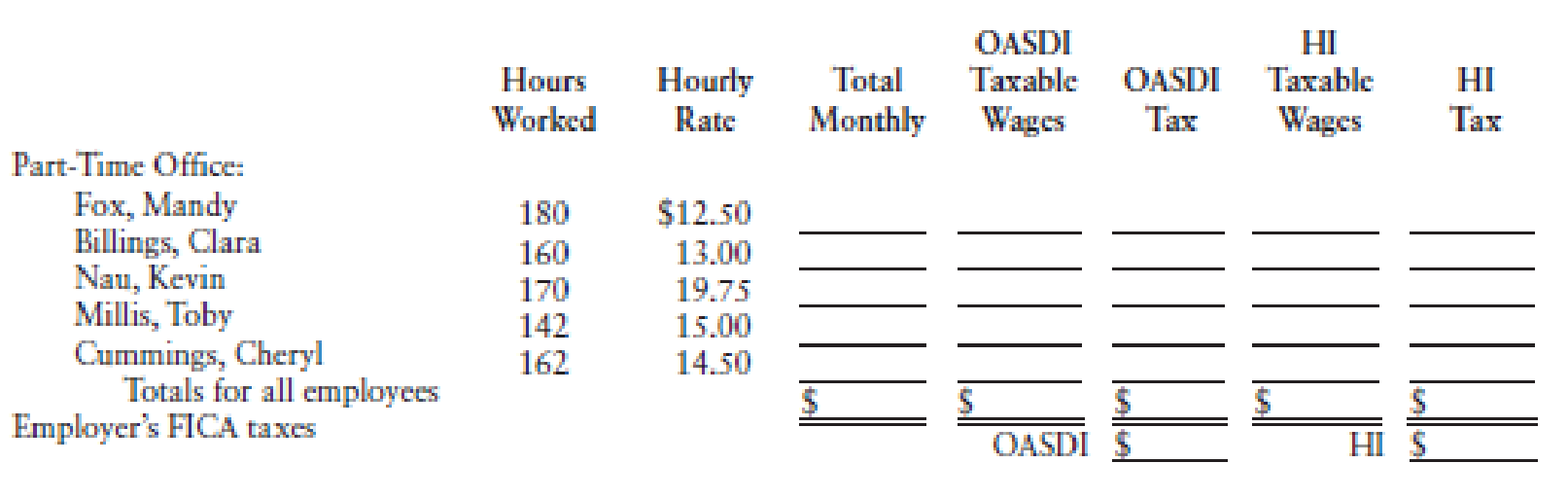

The monthly and hourly wage schedule for the employees of Quincy, Inc., follows. No employees are due overtime pay. Compute the following for the last monthly pay of the year:

- a. The total wages of each part-time employee for December 2019.

- b. The OASDI and HI taxable wages for each employee.

- c. The FICA taxes withheld from each employee’s wages for December.

- d. Totals of columns.

- e. The employer’s FICA taxes for the month.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 3 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

Ch. 3 - Which of the following are covered by FICA...Ch. 3 - Prob. 2SSQCh. 3 - Prob. 3SSQCh. 3 - Lori Kinmark works as a jeweler for a local...Ch. 3 - _____1. Johnson Industries, a semiweekly...Ch. 3 - _____1. Employees FICA tax rates A. Severance pay...Ch. 3 - For social security purposes, what conditions must...Ch. 3 - Prob. 2QRCh. 3 - Prob. 3QRCh. 3 - Prob. 4QR

Ch. 3 - What are an employers responsibilities for FICA...Ch. 3 - Prob. 6QRCh. 3 - Prob. 7QRCh. 3 - Prob. 8QRCh. 3 - Prob. 9QRCh. 3 - Prob. 10QRCh. 3 - Prob. 11QRCh. 3 - Prob. 12QRCh. 3 - Prob. 13QRCh. 3 - Prob. 14QRCh. 3 - Prob. 15QRCh. 3 - During the year, employee Sean Matthews earned...Ch. 3 - In order to improve the cash flow of the company,...Ch. 3 - Prob. 3QDCh. 3 - Prob. 4QDCh. 3 - The biweekly taxable wages for the employees of...Ch. 3 - During 2019, Rachael Parkins, president of...Ch. 3 - Prob. 3PACh. 3 - Ken Gorman is a maitre d at Carmel Dinner Club. On...Ch. 3 - In 20-- the annual salaries paid each of the...Ch. 3 - Audrey Martin and Beth James are partners in the...Ch. 3 - Prob. 7PACh. 3 - Ralph Henwood was paid a salary of 64,600 during...Ch. 3 - Empty Fields Company pays its salaried employees...Ch. 3 - The monthly and hourly wage schedule for the...Ch. 3 - Prob. 11PACh. 3 - Prob. 12PACh. 3 - Prob. 13PACh. 3 - During the third calendar quarter of 20--, Bayview...Ch. 3 - Prob. 15PACh. 3 - Prob. 16PACh. 3 - Prob. 17PACh. 3 - Prob. 1PBCh. 3 - During 2019, Matti Conner, president of Maggert...Ch. 3 - Prob. 3PBCh. 3 - Moisa Evans is a maitre d at Red Rock Club. On...Ch. 3 - In 20-- the annual salaries paid each of the...Ch. 3 - Amanda Autry and Carley Wilson are partners in A ...Ch. 3 - Prob. 7PBCh. 3 - George Parker was paid a salary of 74,700 during...Ch. 3 - Prob. 9PBCh. 3 - The monthly and hourly wage schedule for the...Ch. 3 - Prob. 11PBCh. 3 - Prob. 12PBCh. 3 - Prob. 13PBCh. 3 - During the third calendar quarter of 20--, the...Ch. 3 - Prob. 15PBCh. 3 - Prob. 16PBCh. 3 - Prob. 17PBCh. 3 - Your assistant has just completed a rough draft of...Ch. 3 - Prob. 2CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following form is used by Matsuto Manufacturing Co. to compute payroll taxes incurred during April: Required: 1. Using the above form, calculate the employers payroll taxes for April. Assume that none of the employees has achieved the maximums for FICA and unemployment taxes. 2. Assuming that the employer payroll taxes on factory wages are treated as factory overhead, the taxes covering administrative salaries are an administrative expense, and the taxes covering sales salaries are a selling expense, prepare a general journal entry to record the employer's liability for the April payroll taxes.arrow_forwardDuring 2019, Matti Conner, president of Maggert Company, was paid a semimonthly salary of 6,000. Compute the amount of FICA taxes that should be withheld from her:arrow_forward

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes; Author: Whats Up Dude;https://www.youtube.com/watch?v=fzK3KDDYCQw;License: Standard Youtube License