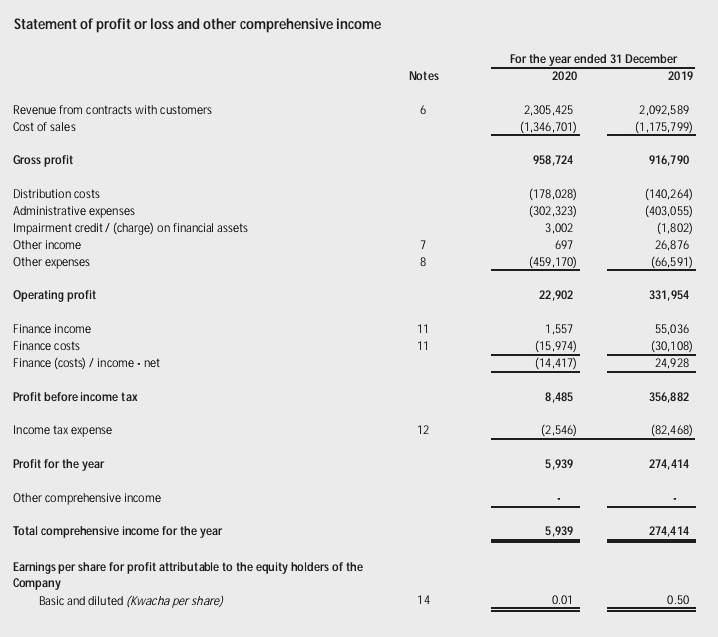

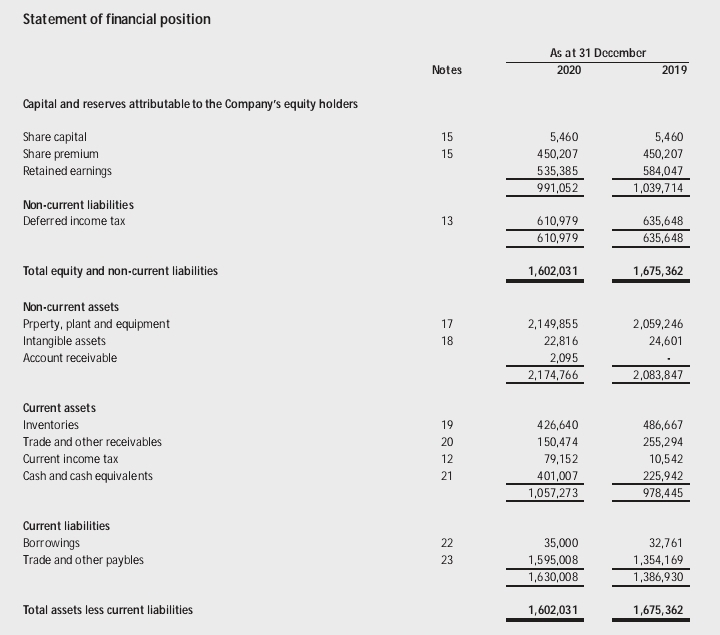

A shareholder of a certain company is concerned that the company has recorded a reduced level of profits in 2020 compared to 2019. The Profit for the year has reduced from K272.4m to K5.9m. You have been requested by the concerned shareholder to prepare a detailed report analysing the financial performance and financial position of the company for the year ended 31 st December 2020From the given Financial statements. Calculate the following ratios for 2020 and 2019 I. Gross Profit % ii. Operating profit % iii. Profit for the Year % iv. Current Ratio v. Acid Test Ratio vi. Cash Ratio vii. Average Debt collection Period in days viii. Average Creditor Payment Period in days ix. Average Stock Holding Period in days x. Total liabilities to Total Equity Ratio xi. Total liabilities to Total Asset Ratio xii. Return on Total Assets xiii. Return on Equity

A shareholder of a certain company is concerned that the company has recorded a reduced

level of profits in 2020 compared to 2019. The Profit for the year has reduced from K272.4m to

K5.9m. You have been requested by the concerned shareholder to prepare a detailed report

analysing the financial performance and financial position of the company for the year ended 31 st

December 2020From the given Financial statements. Calculate the following ratios for 2020 and 2019

I. Gross Profit %

ii. Operating profit %

iii. Profit for the Year %

iv.

v. Acid Test Ratio

vi. Cash Ratio

vii. Average Debt collection Period in days

viii. Average Creditor Payment Period in days

ix. Average Stock Holding Period in days

x. Total liabilities to Total Equity Ratio

xi. Total liabilities to Total Asset Ratio

xii. Return on Total Assets

xiii. Return on Equity

Step by step

Solved in 2 steps with 1 images