In January of 1980 DTM purchased a building for $15,000,000 and at that time estimated that the building would have a useful life of 50 years and no residual value. DTM uses the straight line method to depreciate all of its assets. During 2020, the following expenditures were made: 1. On January 1st, 2020 the original siding was replaced with new siding. The old siding cost $1,000,000 and the new siding cost $2,500,000. The new siding is expected to have a useful life of 15 years. 2. On February 6th, 2020 there was $60,000 of uninsured damage to the building caused by severe weather that was repaired. This major repair did not change the estimated useful life of the building or its residual value. 3. The buildings old air filtration system was replaced with a new one on June 22nd, 2020. The new air filtration system cost $800,0000 and it is estimated that it will have a useful life of 10 years. The cost of the old air filtration system is unknown, but it is estimated to be $150,000 and is fully depreciated. 4. Regular repairs on the building occurred throughout 2020 totalled $122,000. In the space provided below, prepare the journal entries to record the expenditures related to the building during 2020.

In January of 1980 DTM purchased a building for $15,000,000 and at that time estimated that the building would have a useful life of 50 years and no residual value. DTM uses the straight line method to depreciate all of its assets. During 2020, the following expenditures were made: 1. On January 1st, 2020 the original siding was replaced with new siding. The old siding cost $1,000,000 and the new siding cost $2,500,000. The new siding is expected to have a useful life of 15 years. 2. On February 6th, 2020 there was $60,000 of uninsured damage to the building caused by severe weather that was repaired. This major repair did not change the estimated useful life of the building or its residual value. 3. The buildings old air filtration system was replaced with a new one on June 22nd, 2020. The new air filtration system cost $800,0000 and it is estimated that it will have a useful life of 10 years. The cost of the old air filtration system is unknown, but it is estimated to be $150,000 and is fully depreciated. 4. Regular repairs on the building occurred throughout 2020 totalled $122,000. In the space provided below, prepare the journal entries to record the expenditures related to the building during 2020.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.8MCP

Related questions

Question

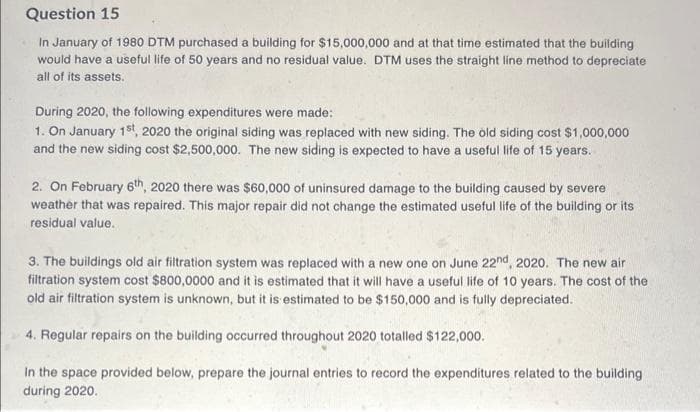

Transcribed Image Text:Question 15

In January of 1980 DTM purchased a building for $15,000,000 and at that time estimated that the building

would have a useful life of 50 years and no residual value. DTM uses the straight line method to depreciate

all of its assets.

During 2020, the following expenditures were made:

1. On January 1st, 2020 the original siding was replaced with new siding. The old siding cost $1,000,000

and the new siding cost $2,500,000. The new siding is expected to have a useful life of 15 years.

2. On February 6th, 2020 there was $60,000 of uninsured damage to the building caused by severe

weather that was repaired. This major repair did not change the estimated useful life of the building or its

residual value.

3. The buildings old air filtration system was replaced with a new one on June 22nd, 2020. The new air

filtration system cost $800,0000 and it is estimated that it will have a useful life of 10 years. The cost of the

old air filtration system is unknown, but it is estimated to be $150,000 and is fully depreciated.

4. Regular repairs on the building occurred throughout 2020 totalled $122,000.

In the space provided below, prepare the journal entries to record the expenditures related to the building

during 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT