a) Should the toll bridge be constructed? Justify your answer using B-C ratio method and show all your calculations. b) In order to have a B-C ratio of 1 (Break even point), how many vehicle should across the bridge per year? c) Write down the meaning of B-C ratio calculated in (a) using your own words.

a) Should the toll bridge be constructed? Justify your answer using B-C ratio method and show all your calculations. b) In order to have a B-C ratio of 1 (Break even point), how many vehicle should across the bridge per year? c) Write down the meaning of B-C ratio calculated in (a) using your own words.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 3E

Related questions

Question

S

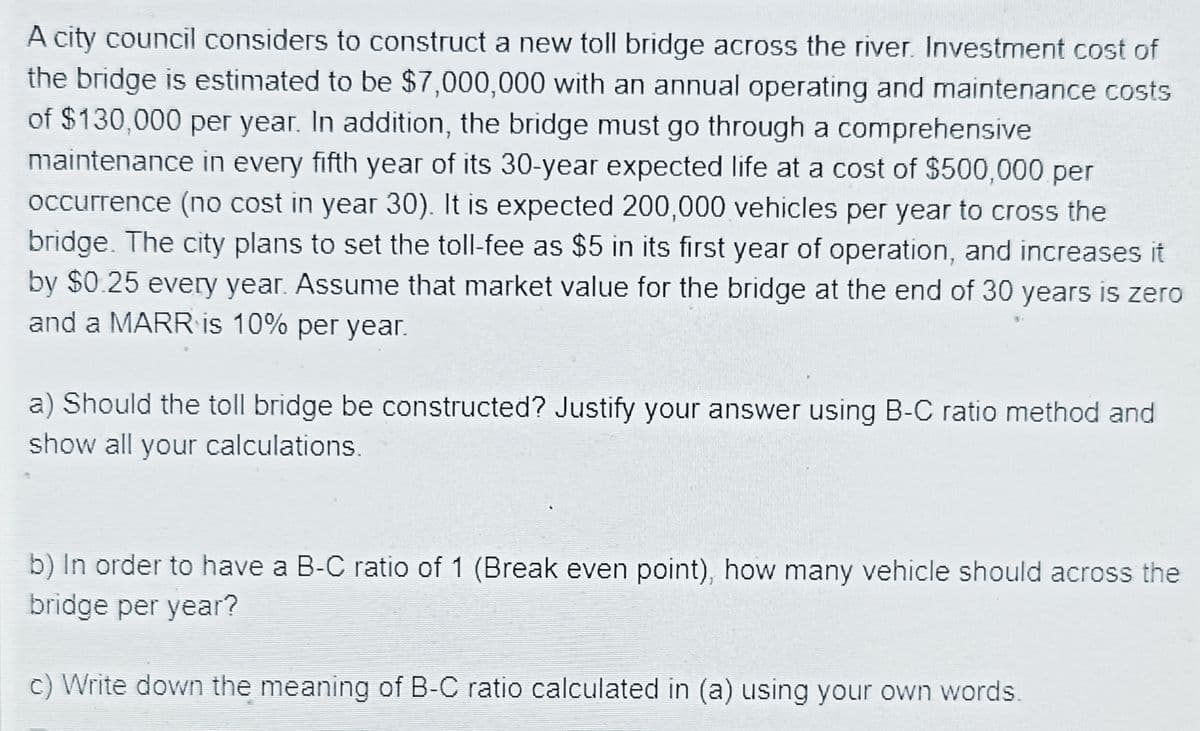

Transcribed Image Text:A city council considers to construct a new toll bridge across the river. Investment cost of

the bridge is estimated to be $7,000,000 with an annual operating and maintenance costs

of $130,000 per year. In addition, the bridge must go through a comprehensive

maintenance in every fifth year of its 30-year expected life at a cost of $500,000 per

occurrence (no cost in year 30). It is expected 200,000 vehicles per year to cross the

bridge. The city plans to set the toll-fee as $5 in its first year of operation, and increases it

by $0.25 every year. Assume that market value for the bridge at the end of 30 years is zero

and a MARR is 10% per year.

a) Should the toll bridge be constructed? Justify your answer using B-C ratio method and

show all your calculations.

b) In order to have a B-C ratio of 1 (Break even point), how many vehicle should across the

bridge per year?

c) Write down the meaning of B-C ratio calculated in (a) using your own words.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning