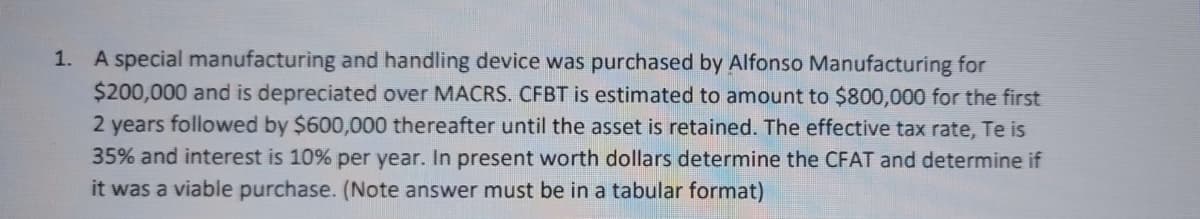

1. A special manufacturing and handling device was purchased by Alfonso Manufacturing for $200,000 and is depreciated over MACRS. CFBT is estimated to amount to $800,000 for the first 2 years followed by $600,000 thereafter until the asset is retained. The effective tax rate, Te is 35% and interest is 10% per year. In present worth dollars determine the CFAT and determine if it was a viable purchase. (Note answer must be in a tabular format)

1. A special manufacturing and handling device was purchased by Alfonso Manufacturing for $200,000 and is depreciated over MACRS. CFBT is estimated to amount to $800,000 for the first 2 years followed by $600,000 thereafter until the asset is retained. The effective tax rate, Te is 35% and interest is 10% per year. In present worth dollars determine the CFAT and determine if it was a viable purchase. (Note answer must be in a tabular format)

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 29CE

Related questions

Question

Transcribed Image Text:1. A special manufacturing and handling device was purchased by Alfonso Manufacturing for

$200,000 and is depreciated over MACRS. CFBT is estimated to amount to $800,000 for the first

2 years followed by $600,000 thereafter until the asset is retained. The effective tax rate, Te is

35% and interest is 10% per year. In present worth dollars determine the CFAT and determine if

it was a viable purchase. (Note answer must be in a tabular format)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College