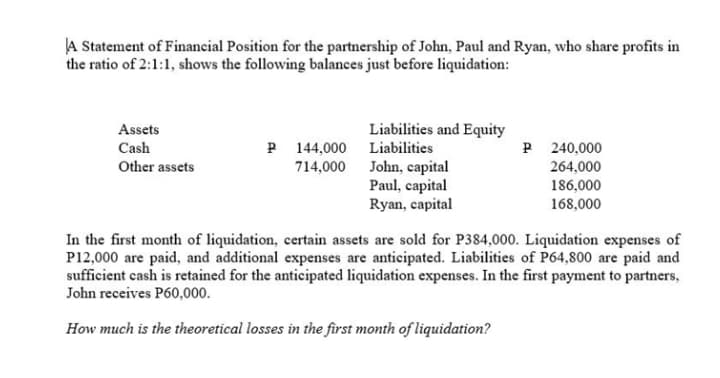

A Statement of Financial Position for the partnership of John, Paul and Ryan, who share profits in the ratio of 2:1:1, shows the following balances just before liquidation: Assets Cash Other assets Liabilities and Equity Liabilities P 144,000 240,000 714,000 John, capital 264,000 186,000 Paul, capital Ryan, capital 168,000 In the first month of liquidation, certain assets are sold for P384,000. Liquidation expenses of P12,000 are paid, and additional expenses are anticipated. Liabilities of P64,800 are paid and sufficient cash is retained for the anticipated liquidation expenses. In the first payment to partners, John receives P60,000. How much is the theoretical losses in the first month of liquidation? P

A Statement of Financial Position for the partnership of John, Paul and Ryan, who share profits in the ratio of 2:1:1, shows the following balances just before liquidation: Assets Cash Other assets Liabilities and Equity Liabilities P 144,000 240,000 714,000 John, capital 264,000 186,000 Paul, capital Ryan, capital 168,000 In the first month of liquidation, certain assets are sold for P384,000. Liquidation expenses of P12,000 are paid, and additional expenses are anticipated. Liabilities of P64,800 are paid and sufficient cash is retained for the anticipated liquidation expenses. In the first payment to partners, John receives P60,000. How much is the theoretical losses in the first month of liquidation? P

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 39P

Related questions

Question

Transcribed Image Text:A Statement of Financial Position for the partnership of John, Paul and Ryan, who share profits in

the ratio of 2:1:1, shows the following balances just before liquidation:

Assets

Cash

Other assets

Liabilities and Equity

Liabilities

240,000

P 144,000

714,000

John, capital

264,000

186,000

Paul, capital

Ryan, capital

168,000

In the first month of liquidation, certain assets are sold for P384,000. Liquidation expenses of

P12,000 are paid, and additional expenses are anticipated. Liabilities of P64,800 are paid and

sufficient cash is retained for the anticipated liquidation expenses. In the first payment to partners,

John receives P60,000.

How much is the theoretical losses in the first month of liquidation?

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning