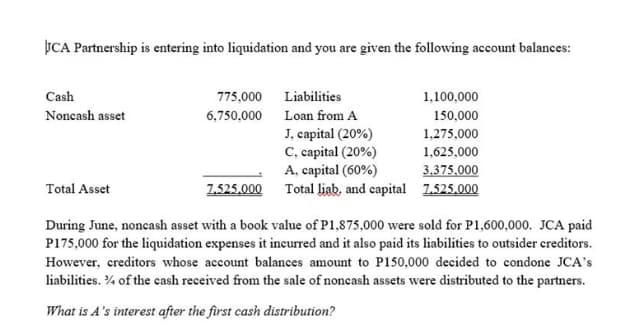

What is A's interest after the first cash distribution?

Q: Estimated total machine-hours used 2,500 4,000 $ 27,800 Estimated total fixed manufacturing overhead…

A: The overhead rate is calculated as estimated overhead cost divided by estimated base activity.

Q: Which factor should be considered appropriate to have rotation of auditors Select one: a. A…

A: The auditor is the person who audits the books of the company. The auditor verifies all the reports…

Q: In 2019, Nonie a married Filipino resident was the sole support of his uncle, cousin, nephew, niece…

A: Answer:- Dependent meaning:- A dependent is someone who relies on another person for help, most…

Q: FIFO met

A: Given as, Material 3600 Labour 3400 Overheads 1000

Q: A 65 year-old man is retiring and can take either $500,000 in cash or an ordinary annuity that…

A: Solution Concept Time value of money As per the concept of time value of money , the value of amount…

Q: A company is considering an investment of €50.000 made at the beginning of the year for a period of…

A:

Q: CABLES General Professional Partnership, a business formed by Carlo and Jamie, have the following…

A: Partnership is one of the agreement or arrangement between two or more than two persons, in which…

Q: National Company manufactures Copper masks The company has a policy of maintaining a finished goods…

A: Solution: Budgeted labor hours for June = Budgeted labor cost/ direct labor rate per hour =…

Q: A limited partnership is formed once two individuals agree to be limited partners.

A: A partnership is a form of business that agrees to carry a business and share the profits according…

Q: MN and OP decided to form a partnership on June 01, 2020. The partnership will take over their…

A: Partnership means the agreement between the two or more person to do the business together and share…

Q: How much is the capital of A as of December 31 if net income for 2021 is ₱693,000?

A: The determination of Capital of A as of 31 December is shown hereunder. Net income for 2021 P…

Q: Accounting Tom can use the 1031 like kind exchange rules to exchange his personal vehicle for…

A: The answer for the True or false question and relevant explanation are presented hereunder : 1031…

Q: Carlo runs a butcher shop, Carlo Angus MNL, in Manila. Jamie, a close friend who lives in Makati,…

A: Partnership is one of the agreement or arrangement between two or more than two persons, under which…

Q: and E of c

A: Inventory management is the process of planning, monitoring, and controlling the movement of…

Q: Scare-2-B-U (S2BU) specializes in costumes for all occasions. The average price of each of its…

A: a Expected Revenues for S2BU for Each Month April May June July August September Number of…

Q: An equipment cost P67,000 and has a life of 10 years and salvage value of P53,500. Determine its…

A: Depreciation means the amount fixed assets written off due to normal wear and tear , normal usage…

Q: nstruction: Do its general ledgers, trial balance, and worksheet Date Particulars Debit…

A: The general ledger is the ledger that accounts for each and every transaction. The balance of these…

Q: Anderson disposes a vacant lot for P3,000,000. The lot has an Assessor's fair value of P2,800,000,…

A: What is the basis in the valuation of real property? The value of the real property will be based…

Q: REQUIRED: 51. Compute the amount of investment attributable to goodwill. a. 480,000 b. 192,000 -2.…

A: On January 4,2021 Did something Bad Inc. acquired 30% of the shares of Did Something good Inc. at…

Q: Carlo runs a butcher shop, Carlo Angus MNL, in Manila. Jamie, a close friend who lives in Makati,…

A: A partnership is a form of business that is operated and managed by two or more individuals by…

Q: Which of the following is NOT true about the statement of financial position of a partnership? The…

A: Statement of financial position is a part of financial statements in which assets and liabilities…

Q: You were engaged by CPA Co. to audit its financial statements for the first time. In ex: you found…

A: Retained Earnings- Retained earnings are the accumulated portion of a company's profits in a fiscal…

Q: can u help me finish the other sub parts from 4-8

A: Formula used in required calculation: Total Assets Turnover = Net Sales / Total Assets Profit Margin…

Q: Sanjay Company has monthly fixed costs of $112,000. The variable costs are $5.00 per unit. The sales…

A: Formula: Sales revenue = Sales price per unit x Number of units sold

Q: Problem 8. Persian Corporation is planning to introduce changes in its collection procedures. The…

A: 1. Option C . 900000 Explanation : Total Budgeted Sales is P32,400,000 Average Accounts Receivable…

Q: The company sells on terms 2/10, net 30. Total sales for the year are P1,000,000, of which P100,000…

A: The average amount of account receivable is based on the customer who is paying early for grabbing…

Q: What is the variable cost per unit for National Company?

A: Variable costs are those costs which changes with changes in level of activity. For example,…

Q: e in her behavior. They confront her and Melinda denies that anything is different. She po

A: Business ownership illustrates the command over the firm by its owners. Kinds of business ownership:…

Q: what is the income tax due if Sandbox is a non-resident foreign corporation? P75,000…

A: Non Resident Foreign Corporation A Non Resident Foreign Corporation is one which does not have any…

Q: Items 59 and 60 are based on the following information: Kupasin Textiles Company manufactures a…

A: Under average costing it is assumed that whole of opening inventory is completed during the period,…

Q: The estimated purchases of raw materials would be

A: Raw materials are those materials which are used directly for the production and manufacturing of…

Q: Company. has been reviewing its total cost over the last few weeks and has established the…

A: The high-low method is used to differentiate the mixed cost. The mixed cost is the combination of…

Q: The company’s budgeted sales for the coming year are P30,000,000 of which 70% are expected to be…

A: The company makes cash as well as sales on account. The sales on the account become the accounts…

Q: After working for years as a regional manager for a retail organization, Scott Parry opened his own…

A: Business Transaction- A business transaction is also known as a financial transaction because it is…

Q: Statement on Auditing Standards No. 99 (AU 316) includes which of these recommendations? Group of…

A: SAS no. 99 defines a procedure in which the auditor acquires data to find risks of significant…

Q: Variable costs of Spring Roll LtD are 2000 €, fixed costs are 1000 € and revenue is 7000 €…

A: The break even sales are the sales where business earns no profit no loss during the period.

Q: Which of the following taxpayers cannot claim deductions from gross income? General…

A: Gross income refers to the income which is earned from the wages, dividends, business income etc. In…

Q: How long will it take for $5000 to double at 4% annual interest compounded monthly?

A: This would require the use of future value formula or present value formula to calculate the number…

Q: Case 6-5 Vertical Pharmaceuticals Inc. et al. v. Deloitte & Touche LLP1 On December 13, 2012,…

A: An Auditor has certain basic responsibilities towards audit and it is important that an auditor…

Q: Category Prior Year Current Year Accounts payable 3,147.00 5,976.00 Accounts receivable 6,925.00…

A: calculation of above requirement re as follows

Q: Bonus, as a compensation for good performance, occurs only when there is a favorable partnership…

A: A bonus is a compensation that is above and beyond the normal payment expectations of its recipient.…

Q: How does income taxation differs from transfer and business tax?

A: Income tax is a direct tax that governments impose on income generated by individuals and business…

Q: On January 1,2020, Carlo and Jamie formed a partnership with investments of P160,000 and P240,000…

A: Capital balance on December 31, 2021 = Amount invested- share of Carlo in net loss for the year…

Q: Unger has the following third party and intersegment revenue for its 10 operating segments Third…

A: If total external revenue reported by reportable segments is less than 75% of entities total revenue…

Q: 3) Misnap is a manufacturing firm. In April, it had a beginning inventory balance in its raw…

A: Raw materials used = Beginning inventory + Purchases - Ending inventory.

Q: Much capital structure theory focusses upon minimising agency costs, taxes, and bankruptcy costs. It…

A: capital structure theory says that for any company or investment there is an optimal mix of debt and…

Q: Prepare all the journal entries to record the disposal of the vehicle on 31 March 2021 Journal…

A: Depreciation: - Depreciation is the total reduction in the book value of the asset by its regular…

Q: in Hong Kon business own

A: The answers for the questions on operating a business through branches in a country other than its…

Q: AS 1 was reissued on _____. (MM/DD/YYY

A: solution concept IAS refers to international accounting standard IAS is issued by international…

Q: What is the amount of fringe benefits subject to the fringe benefit tax if a supervisory employee…

A: Additional benefits offered to employees without pay are minimal benefits.

Step by step

Solved in 3 steps

- The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after Tatum receives a 10,000 salary and Brook receives a 15,000 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A. $40,000 B. $25,000 C. ($5,000) In addition, show the resulting entries to each partners capital account. Tatums capital account balance is $50,000 and Brooks is $60,000.ENTRIES: PARTNERSHIP LIQUIDATION On liquidation of the partnership of J. Hui and K. Cline, as of November 1, 20--, inventory with a book value of 180,000 is sold for 230,000. Given that Hui and Cline share profits and losses equally, prepare the entries for the sale and the allocation of gain.Before liquidation, the following is the financial position of the partnership W, X, Y and Z: W, capital 275,000 W, loan 50,000 X, capital 225,000 Y, capital 257,500 Z, capital 342,500 P&L ratio is 4:3:2:1, respectively. 300,000 was received from certain assets are sold and are distributed to partners. What cash amount should Z receive? a. 300,000 b. 0 c. 135,834 d. 166,166

- The ABC Partnership is to be liquidated. The ledger shows the following: Cash $ 70,000 Noncash Assets 220,000 Liabilities 90,000 A, Capital 85,000 B, Capital 90,000 C, Capital 25,000 A,B, and C's income ratios are 5:3:2, respectively. The non-cash assets are sold for $170,000. Instructions Prepare a schedule of liquidation using the following chart: Cash NC assets Liabilities A, Cap B, Cap C, Cap Beg Balance Sale of assets Balance Pay liabilities Balance Distribute cash End Balance Prepare the 4…The statement of financial position for the partnership of AA, BB and CC who share profits in the ratio of 2:1:1, shows the following balances just before the liquidation: Cash P12,000 Other assets 59,500 Liabilities 49,000 AA, capital 22,000 BB, capital 15,500 CC, capital (15,000) On the first instalment of the liquidation, a gain of P8,525 was realized from the sale of certain assets. Liquidation expenses of P1,000 was paid, and additional liquidation expenses are anticipated. Liabilities paid amounted to P34,000. Remaining book value of other assets is P1,550. On the first payment to partners, AA receives P6,250. How much is the amount of cash withheld for anticipated liquidation expenses and unpaid liabilities?A balance sheet for the QRS Partnership, which shares profits and losses in the ratio of 5:3:2 shows the following balances just before liquidation: Cash, P30,000; Other assets, P148,750; Liabilities, P50,000; Q, Capital, P55,000; R, Capital, P38,750; and S Capital, P35,000. On the first month of liquidation, certain assets are sold for P80,000. Liquidation expenses of P2,500 is paid, and additional expenses are anticipated. Liabilities are paid amounting to P13,500, and sufficient cash is retained to ensure payment to creditors before making payment to partners. On the payments to partners, Q receives P15,625. Calculate the amount of cash withheld for anticipated liquidation expenses.

- Partners E, F, and G who share profits and losses in the ratio of 2: 2: 1, respectively decided to liquidate. The condensed statement of financial position immediately prior to the liquidation shows the following: Cash P 400,000 Non-cash Assets 1,600,000 Liabilities 560,000 E, Loan 40,000 E, Capital 180,000 F, Capital 420,000 G, Capital 800,000 After paying liabilities to partnership creditors, cash of P830,000 is available for distribution to partners. Any…The following are the account balances as of June 30, 2022 of JPP Partnership just before liquidation:Cash - 100000Inventory - 600000Furniture - 200000Equipment - 400000Accounts Payable - 200000Loans from Pedro - 200000Juan, capital - 20% - 300000Pedro, capital -35% - 310000Pablo, capital - 45% - 280000The following events occurred thereafter:Jul 1 - Equipment was sold for P380,000Jul 15 - Furniture was sold for P 210,000Jul 30 - Inventory with book value of P500,000 was sold for P200,000Aug 15 - Remaining inventory was sold for P 80,000a. Prepare a liquidation report.b. Prepare a cash distribution report/computation for safe payment for each time the partnership will be paying off the partners.c. Prepare a cash priority program and show how it can be used to settle the partner’s equity balances.d. Indicate on the space provided the total cash each partner would receive.Prior to liquidation, the capitals are reported with the following balances: Partners Capitals P/L Ratio Alaska P160,000 1/3 Bilasa 290,000 2/3 The total liabilities of the partnership amount to P150,000, and all assets available are noncash assets were realized at P540,000. The cash distribution to Alaska and Bilasa respectively would be A. P130,000 P260,000 B. P190,000 P350,000 C. P135,000 P270,000 D. P140,000 P250,000 As of December 31, 2022, the books of AME Partnership showed capital balances of A, P40,000; M, P25,000; E P50,000. The partner’s profit and loss ratio was 3:2:1, respectively. The partners decided to liquidate and they sold all non-cash assets for P37,000. After settlement of all liabilities amounting to P12,000, they still have cash of P28,000 left for distribution. Assuming that any capital debit balance is uncollectible, the share of A in distribution of the P28,000 cash would be: A. P18,000 B. P0…

- A, B and C partnership had the following balances just before entering liquidation: Cash P10,000 Liabilities P130,000 Non-Cash Assets 300,000 A, Capital 60,000 B, Capital 40,000 C, Capital 80,000 Total P310,000 Total P310,000 A,B and C share profits and losses in the ratio of 3:4:3. Non cash assets were sold for P200,000. Liquidation expenses were P12,000. Assume that partner A was personally insolvent, B and C were both solvent and able to cover deficit in their capital accounts, if any. What amount of cash should be paid to partner A?ABC partnership has the following account balancesbefore liquidation: Cash, P15,000; Non-cash assets, 225,000; Accounts Payable, P50,000; A Capital, P40,000; B Capital, P100,000; and C Capital,P50,000. The partners have profit and loss ratio: A = 30%; B = 50%; and C = 20%Compute for the amount to be received by each partner after liquidation if the non-cash assets were sold for P75,000. If all partners are solvent, what is the final cash distribution for C?RST partnership begins the liquidation process with the following balance sheet and profit and loss percentages Cash 280,000 Liabilities 200,000 Noncash Assets 300,000 R Capital (40%) 100,000 S Capital (30%) 150,000 T Capital (30%) 130,000 Liquidation expenses are estimated at $50,000. Assume any deficit balance in a partner’s capital account will not be repaid. What is the safe payment that can be made to partner T. answer please