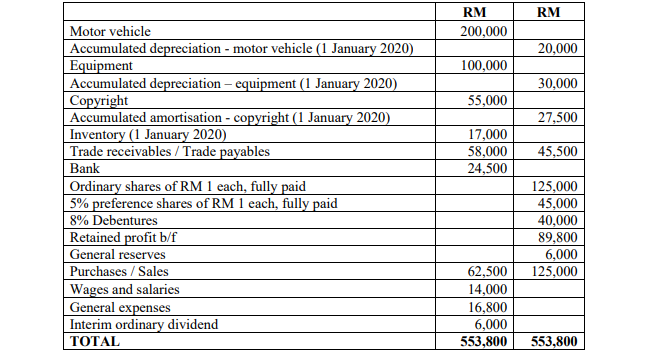

(a) Statement of Profit or Loss for the year ended 31 December 2020. (b) Statement of Financial Position as at 31 December 2020.

Additional information:

(1) Motor vehicles is to be

(2) The copyright in the above

(3) The company registered a trademark on 1 October 2020 for RM9,000 and has a useful life of 10 years.

(4) Inventory is valued at RM27,000 as at 31 December 2020. Return inward and return outward from credit basis transaction are RM15,000 and RM12,500 respectively.

(5) Provisions are required for the outstanding debenture interest and the

(6) The company received cheque for commission amounting to RM30,000. No record was made for the transaction.

(7) On 31 December 2020, the board of directors declared a final ordinary share dividend of RM0.03 per share

(8) Transfer to general reserves amounting RM 8,000.

(9) Provision is to be made for

Required:

Prepare the following statements using vertical format presentation:

(a) Statement of Profit or Loss for the year ended 31 December 2020.

(b)

Step by step

Solved in 3 steps