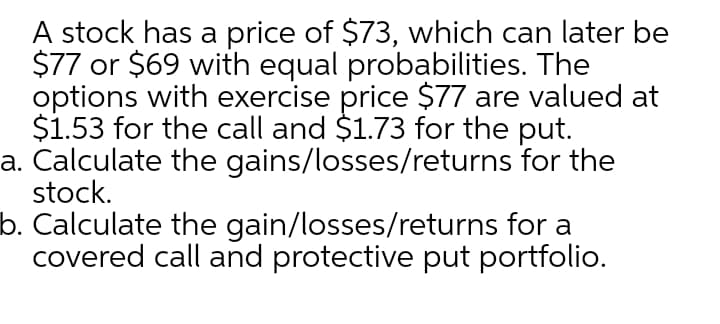

A stock has a price of $73, which can later be $77 or $69 with equal probabilities. The options with exercise price $77 are valued at $1.53 for the call and $1.73 for the put. a. Calculate the gains/losses/returns for the stock. b. Calculate the gain/losses/returns for a covered call and protective put portfolio.

Q: A stock has a required return of 12%, the risk-free rate is 2.5%, and the market risk premium is 5%.…

A: The Capital Asset Pricing Model (CAPM) is a model that describes the relationship between the…

Q: porlfolio p consists of two stocks: 50% is invested in stock A and 50% is invested in stock B. stock…

A: Formula for portfolio standard deviation is: Sigma = (w1^2*sigma1^2 + w2^2*sigma2^2 +…

Q: Consider the following stocks with equal probabilities of return: Outcome Return Stock A Return…

A:

Q: Consider the following stocks with equal probabilities of return: Outcome | Return (Stock A) |…

A: The expected return is the return of the portfolio which is the sum of each potential return that is…

Q: Suppose securities A, B, and C have the following expected return and risk.…

A: Stock with lowest coefficient of variance is mean variance dominant stock. coefficient of variance…

Q: An investor purchases a stock for $38 and a put for $.50 with a strike price of $35. The investor…

A: The calculation of the maximum profit is as follows: Hence, the maximum profit for this position is…

Q: A portfolio has three stocks. Their portfolio weights and expected returns are as follows.…

A: The expected return on a portfolio indicates the overall expected return from the portfolio. The…

Q: How would i do this question?

A: The most general form of expression for the portfolio variance is as shown on the white board. The…

Q: A stock will provide a rate of return of either -18% or 26%. If both possibilities are equally…

A: Standard deviation is measure of risk and it measures the deviation from mean of the return and how…

Q: A stock has a required return of 7%, the risk-free rate is 2.5%, and the market risk premium is 3%.…

A: Required rate of return as per CAPM :— Expected Return = Rf + (Rm - Rf) beta of the…

Q: You are investing in a portfolio consisting two shares - D and E. You plan to invest 70% of your…

A: the expected return of a portfolio is weighted average return of individual stocks or funds or…

Q: A stock will provide a rate of return of either -18% or 26%. If both possibilities are equally…

A: Expected Return = (rate of return ×probability) + (rate of return ×probability) Standard deviation…

Q: The following information for Stock A, Stock B and Stock C are given: State of Economy Probability…

A: Here, Proportion invested in Stock A is 20% Proportion invested in Stock B is 35% Proportion…

Q: From the following information, calculate covariance between stocks A and B and expected return and…

A: Expected return on portfolio E(Rp) is calculated by sum product of stock returns and weight in the…

Q: You have a portfolio with the following: Expected Return Stock Number of Shares Price 825 $ 50 12%…

A: Expected Return: The expected return is the minimum required rate of return which an investor…

Q: Show how you would make a portfolio delta-neutral and also self-financing by including bonds and…

A: What is delta neutral ? Delta neutral is a portfolio methodology using different situations with…

Q: A stock has a price of $73, which can later be $77 or $69 with equal probabilities. The options with…

A: Stock price = $73 Option with exercise price = $77 Call = $1.53 Put = $1.73 Gain or loss = ?

Q: An investor is considering to buy one of the following stocks: Stock Expected rate of return Risk…

A: An investor invests their funds in various securities and the instruments of the stock market. All…

Q: Assume the stock’s future prices of stock A and stock B as the following distribution State Future…

A: Here, State Future Price Stock A Future price Stock B 1 $10 $7 2 $8 $9…

Q: Describe the effect on a call option’s price that results from an increasein each of the following…

A: The effect on a call option’s price that results from an increase in each of the following factors…

Q: Assume the market portfolio's and risk-free rate's projected returns are 13% and 3%, respectively.…

A: There are various portfolio performance measures and one such measure is Treynors' ratio. This ratio…

Q: You have the following data on three stocks: Stock Standard Deviation Beta A. 0.15 0.79 0.25 0.61 C…

A:

Q: You have a portfolio with the following: Stock Number of Shares Price Expected Return W 1,000…

A: Portfolio is a bundle of different investments. Investor invest the money in different investment to…

Q: Following is information for two stocks: Investment r σ Stock X 8% 10%…

A: Relative risk can be judged by comparing the coefficient of variation (CV) of both the securities.…

Q: A three-step binomial tree with terminal stock prices being 1.103, 0.875, 0.695, and 0.552. At time…

A: Insider information is information related to the company which has not yet been published for…

Q: Which of the following could be a delta-neutral portfolio? (choose all that apply) A long position…

A: A portfolio is a set of various types of assets which may include different types of asset class…

Q: Using the data in the following table, calculate the volatility (standard deviation) of a portfolio…

A: Given: Weight 75% 25% Year Stock A Stock B 2010 -10% 16% 2011 5% 20% 2012 2% 26% 2013…

Q: The following three stocks are available in the market: E(R) β Stock A 10.9 % 1.18…

A: Given the following information Expected return of Stock A: 10.9%Beta of Stock A: 1.18 Expected…

Q: You have a portfolio with the following: Stock Number of Shares Price Expected Return W 725…

A: Stock Number of share Price Investment Investment Ratio I II III = I*II IV=III/96250 W 725 46…

Q: You own a portfolio that has $2,800 invested in Stock A and $3,900 invested in Stock B. Assume the…

A: Portfolio return is the gain or loss realized investment portfolio with different stock. formula:…

Q: a. The range of S is 58 while that of Pis 29 across the two states. What is the hedge ratio of the…

A: Hedge Ratio: In finance, the hedge ratio is a comparison between the value of a position protected…

Q: e Target's stock has an expected return of 22% and a volatility of 40%, Hershey's stock has an…

A: Return on portfolio and volatility of the portfolio depends on weights of different components of…

Q: You have a portfolio with the following: Stock Number of Shares Price Expected Return W 1,025…

A: Portfolio return = Expected return for each stock * Weight of each return

Q: An investor has the following expectations on the performance of Stock X and Stock Y: Probability…

A:

Q: Answer the following two questions with respect to the table below. A financial institution has the…

A: First the delta and gamma of the portfolio is calculated as sum of the product of delta/gamma of the…

Q: A portfolio consists of two stocks: Stock Expected Return Standard Deviation Weight Stock 1 10% 15%…

A: An Expected Return of the investment is the weighted average of all possible returns. It is the sum…

Q: A portfolio is invested 24 percent in Stock G, 39 percent in Stock J, and 37 percent in Stock K. The…

A: Information Stock Weight Return G 24% 10.5% J 39% 13.0% K 37% 18.4%

Q: Suppose you are given the following information about 2 stocks, what is the return standard…

A: The degree of data dispersion from the mean is indicated by the standard deviation. Standard…

Q: What are the portfolio weights for a portfolio that has 110 shares of Stock that sell for $79 per…

A: Number of shares of stock A = 110 Shares Price per share stock A = $79 Number of shares of stock B =…

Q: Assume a stock is selling for GH¢48.50 with options available at 40, 50, and 60 strike prices. The…

A: A put option is an agreement that grants the option buyer the opportunity, but not the…

Q: Consider information given in the table below and answers the question asked thereafter: State…

A:

Q: Assume the risk-free rate is r = 3%. Consider the data in the table below: Stock Expected Return…

A: The capital market line (CML) represents portfolios that optimally combine risk and return. capital…

Q: A two-share portfolio held by an institutional investor has the following information: Years (t)…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Suppose Target's stock has an expected return of 20% and a volatility of 40%, Hershey's stock has an…

A: T's expected return = 20% T's Volatility = 40% H's expected return = 10% H's Volatility = 21% New…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

- Two-Asset Portfolio Stock A has an expected return of 12% and a standard deviation of 40%. Stock B has an expected return of 18% and a standard deviation of 60%. The correlation coefficient between Stocks A and B is 0.2. What are the expected return and standard deviation of a portfolio invested 30% in Stock A and 70% in Stock B?An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is 3.2%, and the return on the HML portfolio (rHML) is 4.8%. If ai = 0, bi = 1.2, ci = 20.4, and di = 1.3, what is the stock’s predicted return?A stock has a price of $73, which can later be $77 or $69 with equal probabilities. The options with exercise price $77 are valued at $1.53 for the call and $1.73 for the put. Calculate the gains/losses/returns for the stock. Calculate the gain/losses/returns for a covered call and protective put portfolio.

- A portfolio is invested 24 percent in Stock G, 39 percent in Stock J, and 37 percent in Stock K. The expected returns on these stocks are 10.5 percent, 13 percent, and 18.4 percent, respectively. What is the portfolio's expected return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)The following information describes the expected return and risk relationship for the stocks of two of WAH’s competitors. Stock X 12.0% 20% 1.3 Stock Y 9.0 15 0.7 Market Index 10.0 12 1.0 Risk-free rate 5.0 Using only the data shown in the preceding table: Draw and label a graph showing the security market line, and position Stocks X and Y relative to it. Compute the alphas both for Stock X and for Stock Y. Show your work. Assume that the risk-free rate increases to 7 percent, with the other data in the preceding matrix remaining unchanged. Select the stock providing the higher expected risk adjusted return and justify your selection. Show your calculations.Consider the following stocks with equal probabilities of return: Outcome | Return (Stock A) | Return (Stock B) 1 -5% 2% 2 10% 12% 3 18% 15% Compute the expected returns of stock A and B. Compute the total risk and relative risk of stock A and B. Which stock is risky? Ignoring the probabilities, what is the total risk and relative risk of stock A and B? Which stock is risky? Round-off final answers only to two decimal places.

- You own a portfolio that has $1,600 invested in Stock A and $2,700 invested in Stock B. Assume the expected returns on these stocks are 11 percent and 17 percent, respectively. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)Consider information given in the table below and answers the question asked thereafter: State Probability return on stock A Return on stock B A 0.15 10% 9% B 0.15 6% 15% C 0.10 20% 10% D 0.18 5% -8% E 0.12 -10% 20% F 0.30 8% 5% i. Calculate expected return on each stock? On the basis of this measure, which stockyou will choose?ii. Calculate standard deviation of the returns on each stock? On the basis of thismeasure, which stock you will choose?iii. Calculate coefficient of variance of the returns on each stock? On the basis of thismeasure, which stock you will choose?From the following information, calculate covariance between stocks A and B and expected return and risk of a portfolio in which A and B are equally weighted.Which stock would be recommend if investment in individual stock is to be made? Justify answer using numerical calculations. Stock A Stock B Expected return 24% 35% Standard deviation 12% 18% Coefficient of correlation 0.65 0.65

- A stock has a beta of 1.8 and an expected return of 13 percent. A risk-free asset currently earns 3.2 percent. a. What is the expected return on a portfolio that is equally invested in the two assets? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return % b. If a portfolio of the two assets has a beta of .99, what are the portfolio weights? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Weight of stock Risk-free weight c. If a portfolio of the two assets has an expected return of 9 percent, what is its beta? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) Beta d. If a portfolio of the two assets has a beta of 3.6, what are the portfolio weights? (Do not round intermediate calculations. A negative answer should be indicated by a minus sign. Round your answers to…You own a portfolio that is 1 percent invested in Stock W, 23 percent invested in Stock X,22 percent in Stock Y , and the rest invested in Stock Z. The expected returns on these three stocks are 3 percent. 15.73 percent, 8.29 percent, and 9.03 percent, respectively. What is the expected return on the portfolio? (Do not round any intermediate calculations. List your answer as a percent, round your final answer to 2 decimal places and enter it in the box below.)financial advisor evaluates four stocks for inclusion in an investor's portfolio. A orrelation matrix showing each stock's correlation with the other stocks is shown below Stock ALK CMN BTY DLE ALK 0.40 0.58 1.00 -0.25 BTY 0.40 1.00 0.16 -0.04 CMN -.25 .16 1.00 .37 DLE .58 .04 .37 1.00 f the goal is to reduce the investor's overall portfolio risk, which two stocks should the advisor recommend? a. ALK and DLE b. ALK and CMN c. BTY and DLE BTY and CM