An investor has the following expectations on the performance of Stock X and Stock Y: Probability Scenario Returns (6) Stock X Stock Y 0.20 Good 50% 14% 0.50 Average 30% 66 0.30 Bad -10% 6% Estimate the portfolio return with an allocation of 70:30 (XY) in the two stocks. Select one: O a. 11.92% ОБ. 14.80% Oc 32.00% Od. 17.68% Following Quession 18, estimate the correlasion coefficient between the two stocks. Select one: O a. 0.63 O b. 0.45 Oc 0.84 Od. 0.76 Following Quession 18 and 19. estimate the portfolio standard deviation with an allocation of 40:60 in these two stocks. Select one: O a. 9.6% ОБ. 10.8% Oc 10.2% O d. 9.2%

An investor has the following expectations on the performance of Stock X and Stock Y: Probability Scenario Returns (6) Stock X Stock Y 0.20 Good 50% 14% 0.50 Average 30% 66 0.30 Bad -10% 6% Estimate the portfolio return with an allocation of 70:30 (XY) in the two stocks. Select one: O a. 11.92% ОБ. 14.80% Oc 32.00% Od. 17.68% Following Quession 18, estimate the correlasion coefficient between the two stocks. Select one: O a. 0.63 O b. 0.45 Oc 0.84 Od. 0.76 Following Quession 18 and 19. estimate the portfolio standard deviation with an allocation of 40:60 in these two stocks. Select one: O a. 9.6% ОБ. 10.8% Oc 10.2% O d. 9.2%

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter3: Risk And Return: Part Ii

Section: Chapter Questions

Problem 3P: Two-Asset Portfolio

Stock A has an expected return of 12% and a standard deviation of 40%. Stock B...

Related questions

Question

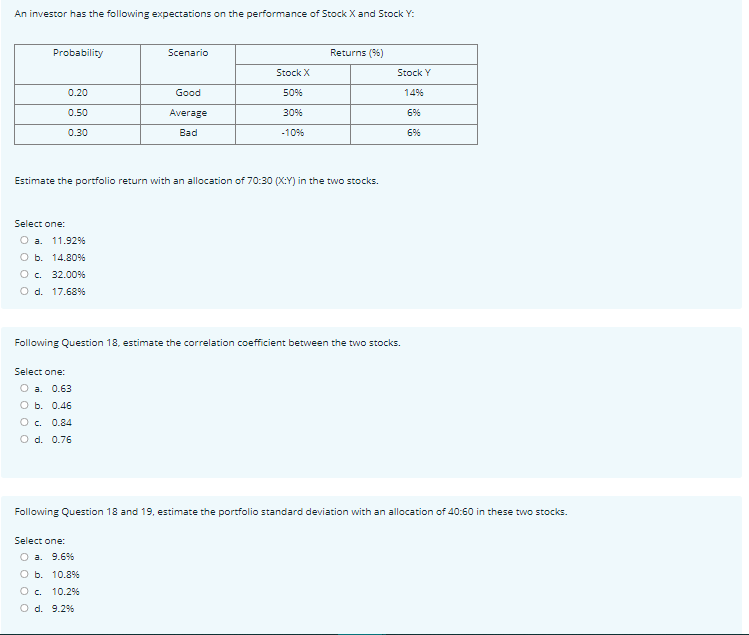

Transcribed Image Text:An investor has the following expectations on the performance of Stock X and Stock Y:

Probability

Scenario

Returns (%)

Stock X

Stock Y

0.20

Good

50%

14%

0.50

Average

30%

6%

0.30

Bad

-10%

6%

Estimate the portfolio return with an allocation of 70:30 (X:Y) in the two stocks.

Select one:

O a. 11.92%

ОБ. 14.80%

O. 32.00%

O d. 17.68%

Following Question 18, estimate the correlation coefficient between the two stocks.

Select one:

O a. 0.63

оъ. 0.46

O c. 0.84

O d. 0.76

Following Question 18 and 19, estimate the portfolio standard deviation with an allocation of 40:60 in these two stocks.

Select one:

O a. 9.6%

о ь. 10.8%

O c. 10.2%

O d. 9.2%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT