(a) Suppose we have the following production function: Q= Suppose K is fixed in the short- run at 16. State the firm's short-run cost minimization problem given the fixed input. Discuss.< (b) Letr = $200 and w = $300. Derive the short-run cost function so that we have costs as a function of Q: eg C(Q) = ? Show your work/reasoning.< (c) Show that average costs first fall then rise with greater output. Note: look at Q in the range 0 to 100. You can do this in a table or mathematically. Why does AC fall then rise? < (d) State the firm's profit maximizing problem. (e) Let P = $600. Find optimal output where r = $200 and w = $300. You can do this in a table or mathematically. What are profits? < (f) A break-even price is one where the best a firm can do is earn zero profits. That is, total revenues equal total costs. How is the break-even price related to average costs? Explain. < fac

(a) Suppose we have the following production function: Q= Suppose K is fixed in the short- run at 16. State the firm's short-run cost minimization problem given the fixed input. Discuss.< (b) Letr = $200 and w = $300. Derive the short-run cost function so that we have costs as a function of Q: eg C(Q) = ? Show your work/reasoning.< (c) Show that average costs first fall then rise with greater output. Note: look at Q in the range 0 to 100. You can do this in a table or mathematically. Why does AC fall then rise? < (d) State the firm's profit maximizing problem. (e) Let P = $600. Find optimal output where r = $200 and w = $300. You can do this in a table or mathematically. What are profits? < (f) A break-even price is one where the best a firm can do is earn zero profits. That is, total revenues equal total costs. How is the break-even price related to average costs? Explain. < fac

Chapter10: Cost Functions

Section: Chapter Questions

Problem 10.4P

Related questions

Question

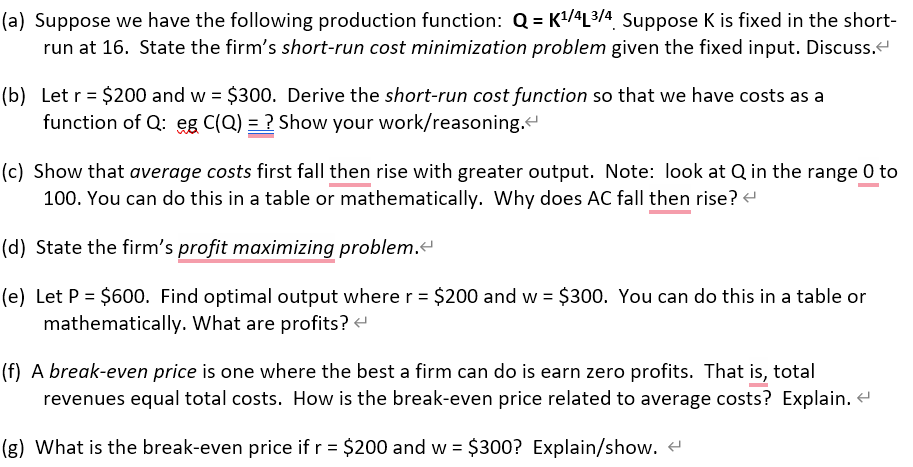

Transcribed Image Text:(a) Suppose we have the following production function: Q=K¹/4L³/4 Suppose K is fixed in the short-

run at 16. State the firm's short-run cost minimization problem given the fixed input. Discuss.<

(b) Let r = $200 and w = $300. Derive the short-run cost function so that we have costs as a

function of Q: eg C(Q) = ? Show your work/reasoning.<

(c) Show that average costs first fall then rise with greater output. Note: look at Q in the range 0 to

100. You can do this in a table or mathematically. Why does AC fall then rise? <

(d) State the firm's profit maximizing problem.<

(e) Let P = $600. Find optimal output where r = $200 and w = $300. You can do this in a table or

mathematically. What are profits? <

(f) A break-even price is one where the best a firm can do is earn zero profits. That is, total

revenues equal total costs. How is the break-even price related to average costs? Explain. <

(g) What is the break-even price if r = $200 and w = $300? Explain/show. <

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning