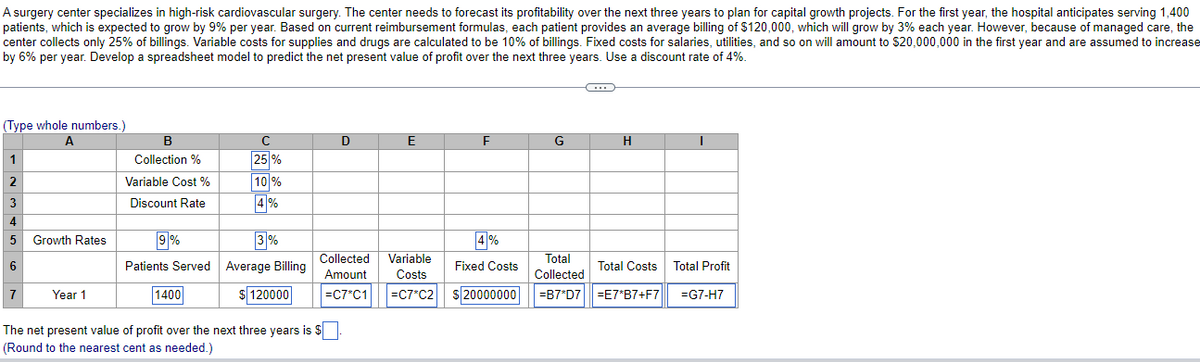

A surgery center specializes in high-risk cardiovascular surgery. The center needs to forecast its profitability over the next three years to plan for capital growth projects. For the first year, the hospital anticipates serving 1,400 patients, which is expected to grow by 9% per year. Based on current reimbursement formulas, each patient provides an average billing of $120,000, which will grow by 3% each year. However, because of managed care, the center collects only 25% of billings. Variable costs for supplies and drugs are calculated to be 10% of billings. Fixed costs for salaries, utilities, and so on will amount to $20,000,000 in the first year and are assumed to increase by 6% per year. Develop a spreadsheet model to predict the net present value of profit over the next three years. Use a discount rate of 4%.

A surgery center specializes in high-risk cardiovascular surgery. The center needs to forecast its profitability over the next three years to plan for capital growth projects. For the first year, the hospital anticipates serving 1,400 patients, which is expected to grow by 9% per year. Based on current reimbursement formulas, each patient provides an average billing of $120,000, which will grow by 3% each year. However, because of managed care, the center collects only 25% of billings. Variable costs for supplies and drugs are calculated to be 10% of billings. Fixed costs for salaries, utilities, and so on will amount to $20,000,000 in the first year and are assumed to increase by 6% per year. Develop a spreadsheet model to predict the net present value of profit over the next three years. Use a discount rate of 4%.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 4CE: Manzer Enterprises is considering two independent investments: A new automated materials handling...

Related questions

Question

Transcribed Image Text:A surgery center specializes in high-risk cardiovascular surgery. The center needs to forecast its profitability over the next three years to plan for capital growth projects. For the first year, the hospital anticipates serving 1,400

patients, which is expected to grow by 9% per year. Based on current reimbursement formulas, each patient provides an average billing of $120,000, which will grow by 3% each year. However, because of managed care, the

center collects only 25% of billings. Variable costs for supplies and drugs are calculated to be 10% of billings. Fixed costs for salaries, utilities, and so on will amount to $20,000,000 in the first year and are assumed to increase

by 6% per year. Develop a spreadsheet model to predict the net present value of profit over the next three years. Use a discount rate of 4%.

(Type whole numbers.)

B

C

D

E

H

1

Collection %

25 %

Variable Cost %

10 %

3

Discount Rate

4%

4

9%

Patients Served Average Billing

Growth Rates

3%

4%

Collected

Variable

Total

6

Fixed Costs

Total Costs

Total Profit

Amount

Costs

Collected

1400

$ 120000

|=C7°C1

s 20000000

=B7*D7| =E7*B7+F7

=G7-H7

Year 1

=C7*C2

The net present value of profit over the next three years is $

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College