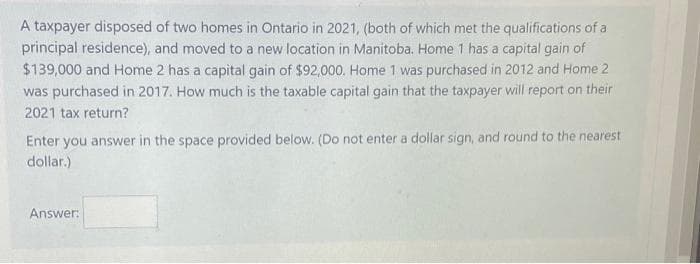

A taxpayer disposed of two homes in Ontario in 2021, (both of which met the qualifications of a principal residence), and moved to a new location in Manitoba. Home 1 has a capital gain of $139,000 and Home 2 has a capital gain of $92,000. Home 1 was purchased in 2012 and Home 2 was purchased in 2017. How much is the taxable capital gain that the taxpayer will report on their 2021 tax return? Enter you answer in the space provided below. (Do not enter a dollar sign, and round to the nearest dollar.) Answer:

A taxpayer disposed of two homes in Ontario in 2021, (both of which met the qualifications of a principal residence), and moved to a new location in Manitoba. Home 1 has a capital gain of $139,000 and Home 2 has a capital gain of $92,000. Home 1 was purchased in 2012 and Home 2 was purchased in 2017. How much is the taxable capital gain that the taxpayer will report on their 2021 tax return? Enter you answer in the space provided below. (Do not enter a dollar sign, and round to the nearest dollar.) Answer:

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 30P

Related questions

Question

Transcribed Image Text:A taxpayer disposed of two homes in Ontario in 2021, (both of which met the qualifications of a

principal residence), and moved to a new location in Manitoba. Home 1 has a capital gain of

$139,000 and Home 2 has a capital gain of $92,000. Home 1 was purchased in 2012 and Home 2

was purchased in 2017. How much is the taxable capital gain that the taxpayer will report on their

2021 tax return?

Enter you answer in the space provided below. (Do not enter a dollar sign, and round to the nearest

dollar.)

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT