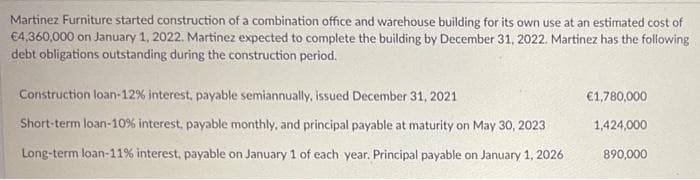

Martinez Furniture started construction of a combination office and warehouse building for its own use at an estimated cost of €4,360,000 on January 1, 2022. Martinez expected to complete the building by December 31, 2022. Martinez has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2021 €1,780,000 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2023 1,424,000 Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2026 890,000

Martinez Furniture started construction of a combination office and warehouse building for its own use at an estimated cost of €4,360,000 on January 1, 2022. Martinez expected to complete the building by December 31, 2022. Martinez has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2021 €1,780,000 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2023 1,424,000 Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2026 890,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 9MC

Related questions

Question

1

Transcribed Image Text:Martinez Furniture started construction of a combination office and warehouse building for its own use at an estimated cost of

€4,360,000 on January 1, 2022. Martinez expected to complete the building by December 31, 2022. Martinez has the following

debt obligations outstanding during the construction period.

Construction loan-12% interest, payable semiannually, issued December 31, 2021

€1,780,000

Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2023

1,424,000

Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2026

890,000

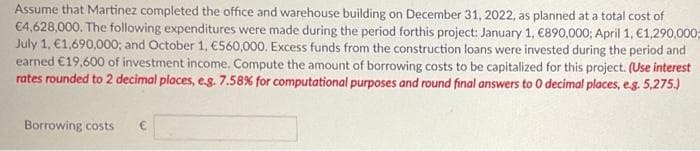

Transcribed Image Text:Assume that Martinez completed the office and warehouse building on December 31, 2022, as planned at a total cost of

€4,628,000. The following expenditures were made during the period forthis project: January 1, €890,000; April 1, €1,290,000

July 1, €1,690,000; and October 1, €560,000. Excess funds from the construction loans were invested during the period and

earned €19,600 of investment income. Compute the amount of borrowing costs to be capitalized for this project. (Use interest

rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final answers to 0 decimal places, e.g. 5,275.)

Borrowing costs €

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning