A taxpayer must report the full amount of gambling winnings on Schedule 1, line 8. How are gambling losses reported? Select one O a On Schedule 1, line 22 b. On Schedule A, line 16, limited to gambling winnings included on Schedule 1 C. Subtracted from gambling winnings before reporting on Schedule 1, line 8 d. On Form 1040, line 8a as an adjustment to income

A taxpayer must report the full amount of gambling winnings on Schedule 1, line 8. How are gambling losses reported? Select one O a On Schedule 1, line 22 b. On Schedule A, line 16, limited to gambling winnings included on Schedule 1 C. Subtracted from gambling winnings before reporting on Schedule 1, line 8 d. On Form 1040, line 8a as an adjustment to income

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter7: Property Transactions: Basis, Gain And Loss, And Nontaxable Exchanges

Section: Chapter Questions

Problem 9P

Related questions

Question

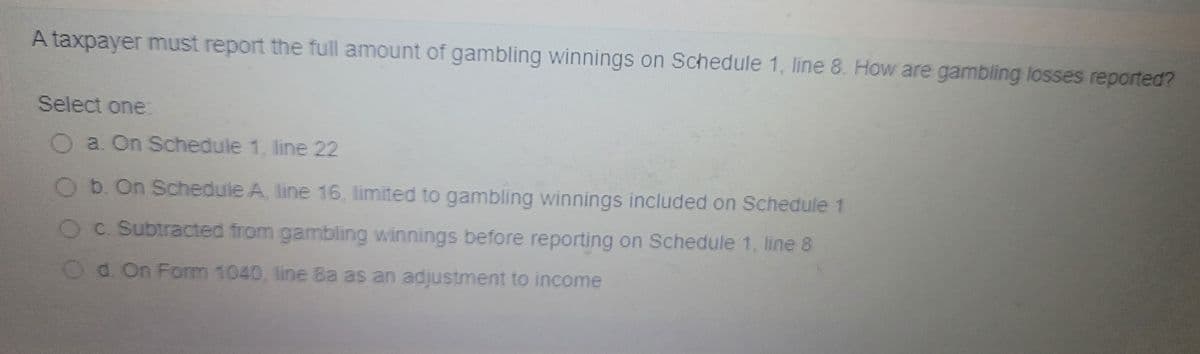

Transcribed Image Text:A taxpayer must report the full amount of gambling winnings on Schedule 1, line 8. How are gambling losses reported?

Select one:

a. On Schedule 1, line 22

Ob. On Schedule A, line 16, limited to gambling winnings included on Schedule 1

OC. Subtracted from gambling winnings before reporting on Schedule 1, line 8

Od. On Form 1040, line Ba as an adjustment to income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT