a) Textile Industry recently in Pakistan is effected badly due to unfavorable economic performance in year 2019-2020. Government T-bill rate average in this year is 8.3 %. Expected return of the market portfolio for this year is calculated as 19 %. Calculate the Expected stock return of each Textile company and draw financial suggestion for this Textile sector based on the answer. Stocks Honda Pak Suzuki Тoyota FAW ΚΙΑ Pearl Beta 1.4 0.8 1.7 1.5 1 1.4 b) TEEZ Sugar Mills Limited has sale in year 2019-2020 is Rs.2982 Million with a 21 % profit before tax margin while current assets equal to Rs.398.2 Million & fixed Assets equal to Rs.1091.2 Million. The top management is considering the potential cash insolvency. So considering, current assets should be at higher level in case of any unforeseen condition. If the new level of current asset should be Rs.500 Million and Rs.690 Million. Determine Return and risk under the three alternative levels of current assets.

a) Textile Industry recently in Pakistan is effected badly due to unfavorable economic performance in year 2019-2020. Government T-bill rate average in this year is 8.3 %. Expected return of the market portfolio for this year is calculated as 19 %. Calculate the Expected stock return of each Textile company and draw financial suggestion for this Textile sector based on the answer. Stocks Honda Pak Suzuki Тoyota FAW ΚΙΑ Pearl Beta 1.4 0.8 1.7 1.5 1 1.4 b) TEEZ Sugar Mills Limited has sale in year 2019-2020 is Rs.2982 Million with a 21 % profit before tax margin while current assets equal to Rs.398.2 Million & fixed Assets equal to Rs.1091.2 Million. The top management is considering the potential cash insolvency. So considering, current assets should be at higher level in case of any unforeseen condition. If the new level of current asset should be Rs.500 Million and Rs.690 Million. Determine Return and risk under the three alternative levels of current assets.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 25SP: Start with the partial model in the file Ch07 P25 Build a Model.xlsx on the textbook’s Web site....

Related questions

Question

Transcribed Image Text:Question # 5

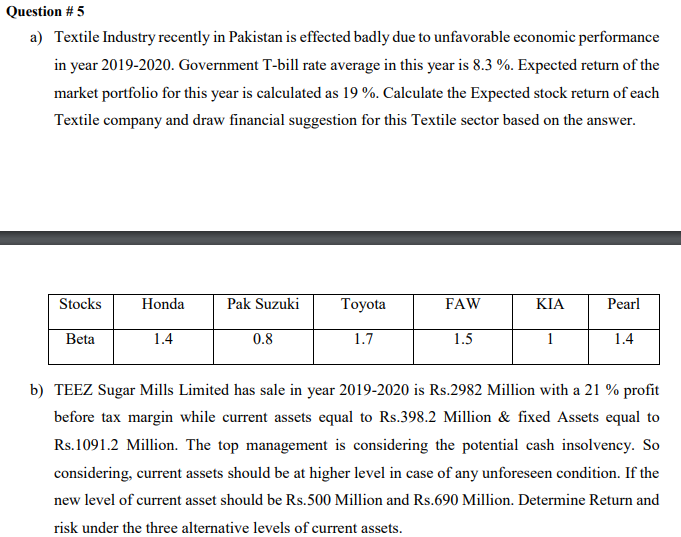

a) Textile Industry recently in Pakistan is effected badly due to unfavorable economic performance

in year 2019-2020. Government T-bill rate average in this year is 8.3 %. Expected return of the

market portfolio for this year is calculated as 19 %. Calculate the Expected stock return of each

Textile company and draw financial suggestion for this Textile sector based on the answer.

Stocks

Honda

Pak Suzuki

Тoyota

FAW

KIA

Pearl

Beta

1.4

0.8

1.7

1.5

1

1.4

b) TEEZ Sugar Mills Limited has sale in year 2019-2020 is Rs.2982 Million with a 21 % profit

before tax margin while current assets equal to Rs.398.2 Million & fixed Assets equal to

Rs.1091.2 Million. The top management is considering the potential cash insolvency. So

considering, current assets should be at higher level in case of any unforeseen condition. If the

new level of current asset should be Rs.500 Million and Rs.690 Million. Determine Return and

risk under the three alternative levels of current assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning