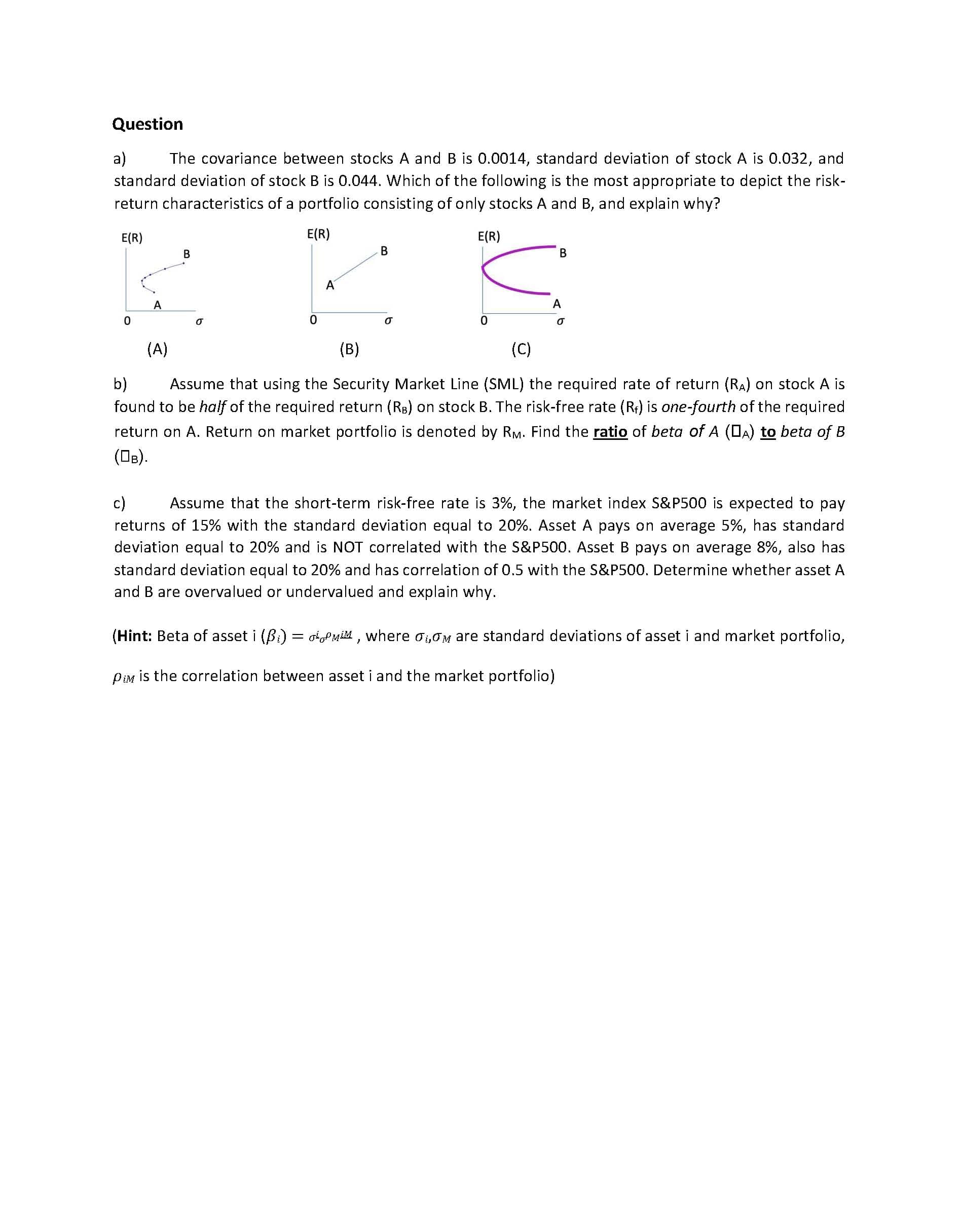

a) The covariance between stocks A and B is 0.0014, standard deviation of stock A is 0.032, and standard deviation of stock B is 0.044. Which of the following is the most appropriate to depict the risk- return characteristics of a portfolio consisting of only stocks A and B, and explain why? E(R) E(R) E(R) A A A (A) (B) (C) b) found to be half of the required return (Rs) on stock B. The risk-free rate (R) is one-fourth of the required Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (DA) to beta of B (OB). c) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standard deviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also has standard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whether asset A and B are overvalued or undervalued and explain why. (Hint: Beta of asset i (B:) = ofoL MiM , where oi,0M are standard deviations of asset i and market portfolio, Pim is the correlation between asset i and the market portfolio)

a) The covariance between stocks A and B is 0.0014, standard deviation of stock A is 0.032, and standard deviation of stock B is 0.044. Which of the following is the most appropriate to depict the risk- return characteristics of a portfolio consisting of only stocks A and B, and explain why? E(R) E(R) E(R) A A A (A) (B) (C) b) found to be half of the required return (Rs) on stock B. The risk-free rate (R) is one-fourth of the required Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (DA) to beta of B (OB). c) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standard deviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also has standard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whether asset A and B are overvalued or undervalued and explain why. (Hint: Beta of asset i (B:) = ofoL MiM , where oi,0M are standard deviations of asset i and market portfolio, Pim is the correlation between asset i and the market portfolio)

Chapter6: Risk And Return

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:a)

The covariance between stocks A and B is 0.0014, standard deviation of stock A is 0.032, and

standard deviation of stock B is 0.044. Which of the following is the most appropriate to depict the risk-

return characteristics of a portfolio consisting of only stocks A and B, and explain why?

E(R)

E(R)

E(R)

A

A

A

(A)

(B)

(C)

b)

found to be half of the required return (Rs) on stock B. The risk-free rate (R) is one-fourth of the required

Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is

return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (DA) to beta of B

(OB).

c)

Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay

returns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standard

deviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also has

standard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whether asset A

and B are overvalued or undervalued and explain why.

(Hint: Beta of asset i (B:) = ofoL MiM , where oi,0M are standard deviations of asset i and market portfolio,

Pim is the correlation between asset i and the market portfolio)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning