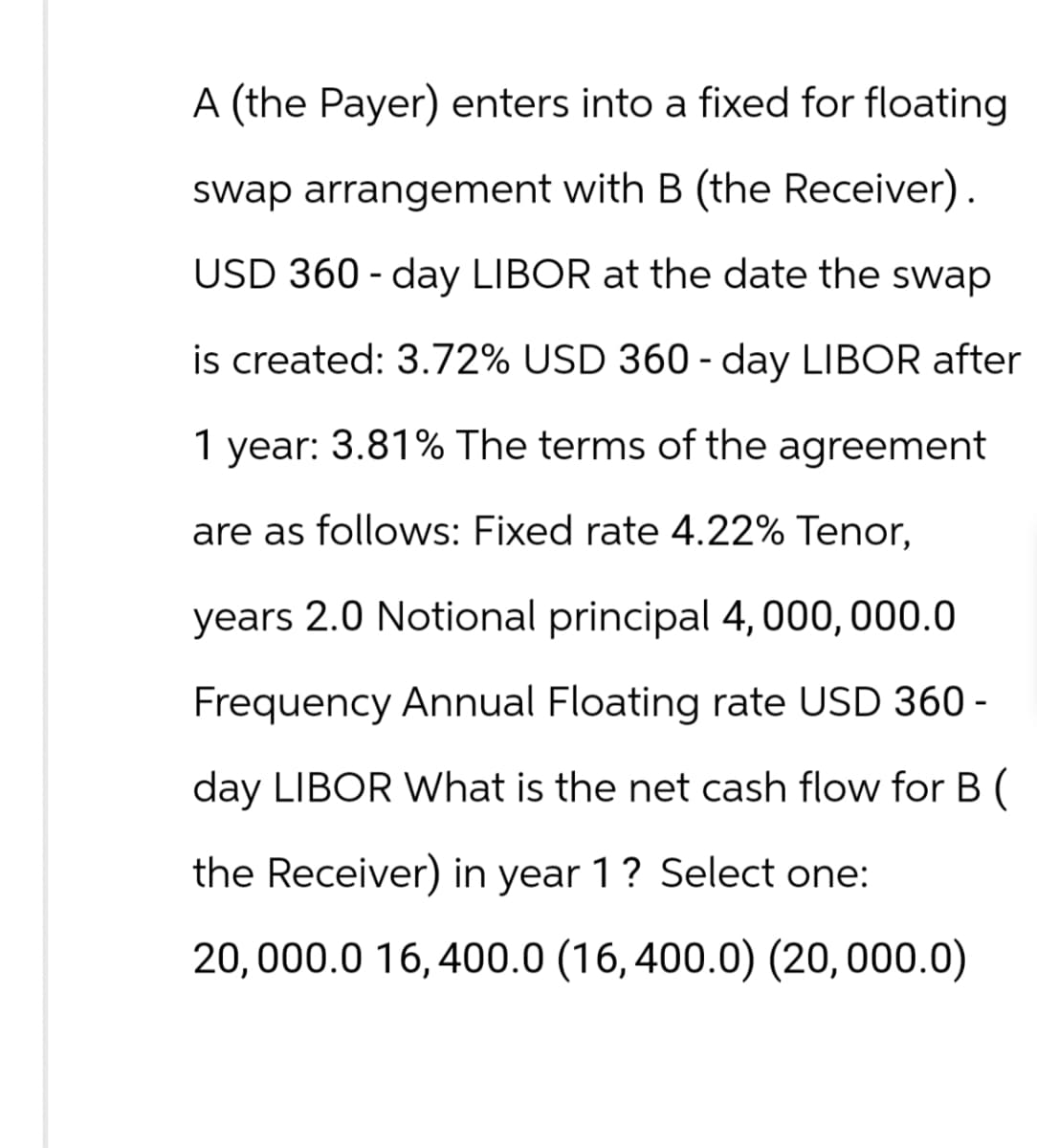

A (the Payer) enters into a fixed for floating swap arrangement with B (the Receiver). USD 360-day LIBOR at the date the swap is created: 3.72% USD 360 - day LIBOR after 1 year: 3.81% The terms of the agreement are as follows: Fixed rate 4.22% Tenor, years 2.0 Notional principal 4,000,000.0 Frequency Annual Floating rate USD 360- day LIBOR What is the net cash flow for B ( the Receiver) in year 1 ? Select one: 20,000.0 16,400.0 (16,400.0) (20,000.0)

Q: Last year Janet purchased a $1,000 face value corporate bond with a 7% annual coupon rate and a…

A: Bonds are a type of debt security that represents a loan made by an investor to a borrower. In…

Q: terry's tees has their new seasons' invventory coming in and they need to clear out thier old stock.…

A: The objective of the question is to find out the sale price at which Terry's Tees should sell their…

Q: Things Get Messi Enterprises is issuing new bonds for a capital budgeting project. The bonds will…

A: Bond pricing refers to the process of determining the fair value of a bond based on various factors…

Q: A 4.60 percent coupon municipal bond has 17 years left to maturity and has a price quote of 104.60.…

A: A bond can be defined as an instrument that entitles the investor a fixed rate of periodic payments…

Q: Joan Lucky won the $44,000,000 lottery. She is to receive $1.3 million a year for the next 25 years…

A: Present value is the current worth of a future sum of money, discounted back to the present. It…

Q: Discuss the concepts of "Convexity" used by bond portfolio managers in managing interest rates risk…

A: Bond portfolio managers utilize various tools and techniques to manage interest rate risk…

Q: Bhupatbhai

A: Future Value = fv = $230,000Present Value = pv = $41,000Interest Rate = r = 4.5%

Q: Kinky Copies may buy a high-volume copier. The machine costs $100,000 and this cost can be fully…

A: NPV means Net present value.It is a capital budgeting technique used for making investment…

Q: calculate the costs of buying and of leasing a motor vehicle.

A: A lease is an agreement in which two parties, usually a lessor and a lessee, agree on a regular…

Q: Suppose a seven-year, $1,000 bond with a coupon rate of 7.8% and semiannual coupons is trading with…

A: Coupon Rate: The coupon rate is the fixed interest rate that the bond issuer agrees to pay to the…

Q: Idaho International Inc. borrows $86,600 from a bank at 3.08% compounded semi-annually for 7 years…

A: Compound = Semiannually = 2Present Value = pv = $86,600Interest Rate = r = 3.08 / 2 = 1.54%Time = t…

Q: The table below shows current and expected future one year interest rates, as well as current…

A: Liquidity premium will be calculated by subtracting the average rate from the multiyear bond rate in…

Q: A 15 -ear 7% coupon (semiannual) bond sells for $1030, what is the bond holder’s YTM?

A: The objective of the question is to calculate the Yield to Maturity (YTM) for a bond. YTM is the…

Q: ear investment yields a total return of 16.2%, and t yields a total return of 28.5%. If an initial…

A: Formulate the Problem:Objective function: Maximize…

Q: Suppose a certain car audio manufacturer receives an order of a certain brand of satellite radios…

A: Trade discount is the discount provided on the retail price of goods and services. This is done to…

Q: Suppose your expectations regarding the stock market are as follows: State of the Economy Boom…

A: HPR refers to holding period return.E(r) is the mean or the expected return. It is the average of…

Q: son.2

A: The objective of this question is to find the effective interest rate charged on a loan of $138,160…

Q: Which of the following assets dominates Asset X that has 9% expected return andstandard deviation of…

A: The objective of the question is to identify which asset dominates Asset X according to the…

Q: a. Calculate the estimated price (intrinsic value) for a share of this firm's stock. b. Use Goal…

A: The constant growth model is a stock valuation method used in finance to determine a stock's…

Q: You bought a house for $500,000 with a 30 year bank loan that has quarterly payments at an interest…

A: The objective of this question is to calculate the remaining balance on a loan after a certain…

Q: JKL Co. issues zero coupon bonds on the market at a price of $338 per bond. Each bond has a face…

A: A zero coupon bond is a bond that does not pay any coupon.Price of the zero coupon bond = Face value…

Q: A bond's credit rating provides a guide to its risk. Long-term bonds rated Aa currently offer yields…

A: The price of the bond refers to the current market value of the bond that can be determined by the…

Q: Rajiv informs his Broker that he took a second mortgage on his home from his friend. What should the…

A: A mortgage is a type of loan specifically used to finance the purchase of real estate, such as a…

Q: What is the result in B12? A 1 Settlement Date 2 Maturity Date 3 First Call Date 4 Time to Maturity…

A: The entire return an investor might anticipate to get if they hold a callable bond until its call…

Q: A newly issued 10-year maturity, 7% coupon bond making annual coupon payments is sold to the public…

A: Bond taxation refers to the process of determining the taxable income generated from owning bonds.…

Q: finance your new SUV with an auto loan of $38,000. This loan will b d compounding) at a 4% annual…

A: Auto loan=$38000Monthly interest rate=r=0.33%Period 3 years=36 months

Q: An annuity is set up that will pay $1,700 per year for ten years. What is the present value (PV) of…

A: The objective of this question is to calculate the present value of an annuity. An annuity is a…

Q: blems option of company has decided to end it's pension program. The company has given employees t…

A: Lump sump amount=$350000Monthly amount=$3000Interest rate=8%Period=20 years

Q: Synovec Company is growing quickly. Dividends are expected to grow at a rate of 30 percent for the…

A: Growth Rate for next 3 Years = g3 = 30%Growth Rate after 3 Years = g = 4%Required Rate of Return = r…

Q: Milton Corporation has 10 percent coupon bonds making annual payments with a YTM of 9.3 percent. The…

A: Bonds are the type of loans where the company raises funds in order to finance the assets of the…

Q: "Internal Controls are very Important for any Organization because they will detect the potential…

A: The objective of the question is to understand the principles of a good Internal Control System and…

Q: You're planning to buy a car. The loan will have monthly payments of $510 for 36 months, and your…

A: Here,Monthly Payment (A) is $510Monthly Interest Rate (i) is 1%Time Period of Loan (N) is 36…

Q: ospital and must decid hether you want to Le

A: calculate the annual depreciation expense for the purchased scanner:Depreciation per year = Cost of…

Q: For 2019 through 2022, Tanisha, who is single, borrowed a total of $25,000 for higher education…

A: Maximizing tax benefits involves understanding and strategically utilizing available deductions. For…

Q: Determine the present value of the following single amounts. Note: Use tables, Excel, or a financial…

A: Time value of money is a financial concept which is used to analyze various investments and…

Q: alternate answer?

A: Yield to Maturity (YTM):Yield to Maturity (YTM) is the total return anticipated on a bond if it is…

Q: Your local bank has offered you a mortgage of 100,000). The mortgage is to be paid back over 10…

A: The loan amount is $100,000.The loan period is 10 years.The annual rate of interest is 12%.

Q: A firm's bonds have a maturity of 8 years with a $1,000 face value, have an 8% semiannual coupon,…

A: Bond is financial security used by organizations to raise debt funds. Bond carries fixed coupon that…

Q: . calculate the net present value of the following: Project A requires an initial investment of…

A: The objective of the question is to calculate the net present value (NPV) of Project A. The NPV is a…

Q: Hank's Barbecue just paid a dividend of $1.85 per share. The dividends are expected to grow at a 12…

A: The dividend discount model will be used here. As per the dividend discount model the value of a…

Q: annual payments of $1,500 per year, at a disco

A: PV = PMT * [(1 - (1 + r)^(-n)) / r]Where:PV is the present value of the annuityPMT is the amount of…

Q: Futuristic Development (FD) generated $2 million in sales last year with assets equal to $5 million.…

A: In finance, AFN stands for "Additional Funds Needed." AFN refers to the amount of financing required…

Q: The Clark family began savings for their child's college 11 years ago. Each year they contributed…

A: Here,Annual Contribution for 11 years is $8,000Addition Contribution in second years is…

Q: Given the information below for StartUp Company, compute the expected share price at the end of 2022…

A: Here,…

Q: It is now December 31, 2020 (t = 0), and a jury just found in favor of a woman who sued the city for…

A: Value of money changes with time and is not same again due to interest rate and inflation in the…

Q: Suppose you observe the following exchange rates: Bid $/EUR $/GBP ask 1.2225 1.6389 .7524 1.2167…

A: Here,BidAsk$/EUR1.21671.2225$/GBP1.63751.6389GBP/EUR0.74950.7524

Q: A purchaser just paid $32,152.94 for a pickup truck. If 47% was the seller's markup, based on the…

A: Purchase Price = pp = $32,152.94Markup Rate =mr = 47%

Q: You have been issued a patent giving you exclusive rights to sell a new type of software. You…

A: The present value (PV) of the patent, calculated using the present value of an annuity formula,…

Q: Ballabio Corporation is evaluating the purchase of a machinery system. The price of the system is…

A: Initial investment = $171,600Salvage value = $101,000Increase in net working capital = $7,250Revenue…

Q: What would be the maximum recommended limit for an individual's debt payments-to-income ratio,…

A: Without including a home mortgage, the maximum advised limit for a person's debt-to-income ratio is…

Step by step

Solved in 3 steps with 3 images

- Tuba Co. enters into a “receive variable, pay fixed” interest swap on January 1, 20x1 for a notional amount of ₱1,000,000. Under the terms of the contract, if the current rate increases above 12% (i.e., the set rate), Tuba Co. shall receive the excess interest. If the current rate falls below 12%, Tuba Co. shall pay the deficiency. Swap payment shall be made on December 31, 20x2. The current rates are as follows: Jan. 1, 20x1……………………………12% Jan. 1, 20x2……………………………15% How much is the net cash settlement on December 31, 20x2? 30,0000 payment 30,000 receipt 26,087 payment 26,087 receiptCommercial bank A and Savings bank B entered into a swap contract. The swap has a notional principal amount of $200 million and calls for Commercial Bank A to make annual floating interest rate payment of LIBOR minus 0.75% to Savings Bank B. In return, Savings Bank B pays fixed 8% interest rate to Commercial Bank A. If LIBOR is 8%, what is the net payment?mazon corporation and Microsoft corporation agree to enter an interest swap agreement with a nominal value of $1,000,000. The two companies enter into two-year interest rate swap contract with the specified nominal value of $1,000,000. Amazon corporation offers Microsoft corporation a fixed rate of 5% in exchange for receiving a floating rate of the LIBOR rate plus 1%. The current LIBOR rate at the beginning of the interest rate swap agreement is 4%. a) If LIBOR rate increases to 5.25% by the end of the first year what are the payment due between both companies? Assume interest payment will be made annually and the floating rate for Microsoft corporation will be calculated using the prevailing LIBOR rate at the time that interest payments are due. b) Critically evaluate interest rate swap agreements focusing on their significance and advantages in financial management.

- On January 1, 20x1, ABC Co. obtained a five-year, ₱1,000,000 variable-rate loan with interest payments due at each year-end and the principal due on December 31, 20x5. As protection from possible fluctuations in current market rates, ABC Co. enters into an interest rate swap for the whole principal of the loan. Under the agreement, ABC Co. shall receive variable interest and pay fixed interest based on a fixed rate of 8%. Swap payments shall be made at each year-end. The following are the current market rates: Jan. 1, 20x1 8% Jan. 1, 20x2 9% Jan. 1, 20x3 12% 16. How much is the fair value of the interest rate swap on December 31, 20x1? (Indicate whether it is a derivative asset or liability.) a. 32,397 asset b. 32,397 liability c. 46,884 asset d. 53,223 liabilityAmazon corporation and Microsoft corporation agree to enter an interest swap agreement with a nominal value of $1,000,000. The two companies enter into two-year interest rate swap contract with the specified nominal value of $1,000,000. Amazon corporation offers Microsoft corporation a fixed rate of 5% in exchange for receiving a floating rate of the LIBOR rate plus 1%. The current LIBOR rate at the beginning of the interest rate swap agreement is 4%. a) If LIBOR rate increases to 5.25% by the end of the first year what are the payment due between both companies? Assume interest payment will be made annually and the floating rate for Microsoft corporation will be calculated using the prevailing LIBOR rate at the time that interest payments are due. b) Critically evaluate interest rate swap agreements focusing on their significance and advantages in financial management.A U.S. company has entered into an interest rate swap with a dealer in which the notional principal is $50 million.The company will pay a floating rate of LIBOR and receive a fixed rate of 5.75 percent. Interest is paid semiannually,and the current LIBOR is 5.15 percent. Calculate the first payment. Assume that floating-rate payments will be madeon the basis of 180/360 and fixed-rate payments will be made on the basis of 180/365.a. $130,308.20, the floating-rate payer will receive b. $130,308.20, the fixed-rate payer will receivec. $50 million, the fixed-rate payer will pay d. $50 million, the floating-rate payer will pay

- Amazon corporation and Microsoft corporation agree to enter an interest swap agreement with a nominal value of $1,000,000. The two companies enter into two-year interest rate swap contract with the specified nominal value of $1,000,000. Amazon corporation offers Microsoft corporation a fixed rate of 5% in exchange for receiving a floating rate of the LIBOR rate plus 1%. The current LIBOR rate at the beginning of the interest rate swap agreement is 4%. If LIBOR rate increases to 5.25% by the end of the first year what are the payment due between both companies? Assume interest payment will be made annually and the floating rate for Microsoft corporation will be calculated using the prevailing LIBOR rate at the time that interest payments are due.Commercial bank A and Savings bank B entered into a swap contract. The swap has a notional principal amount of $100 million and calls for Commercial Bank A to make annual floating interest rate payment of LIBOR minus 1% to Savings Bank B. In return, Savings Bank B pays fixed 8% interest rate to Commercial Bank A. If LIBOR is 8%, what is the net payment? Commercial Bank A Savings Bank B Savings Bank B pays Commercial Bank A by $1 million Commercial Bank A pays Savings Bank B by $1 million Net pay is 0 Can’t get the answer based on the given information15) U.S. Bancorp and Wells Fargo & Company entered into the fixed-for floating interest rate swap with the following terms, effective for the reset date:Notional principal: $ 10 millionFixed rate: 6.5%Floating rate: 4.6 % + 220 bpsFrequency of payments: quarterlyWhich of the following is most accurate? Select one: at the settlement date the party which has a floating leg will make a payment of $7 500 at the settlement date the party which has a fixed leg will make a payment of $7 500 at the settlement date the party which has a floating leg will make a payment of $30 000 at the settlement date the party which has a floating leg will make a payment of $680 000, and the party which has a fixed leg will make a payment of $650 000 at the settlement date the party which has a floating leg will make a payment of $170 000, and the party which has a fixed leg will make a payment of $162 500 at the settlement date the party which has a fixed leg will make a payment…

- E26-4 (Fair Value Hedge) Company issues a four-year, 7.5% fixed-rate interest only, nonpre-payable $1,000,000 note payable on December 31, 2000. It decides to change the interest rate from a fixed rate to variable rate and enters into a swap agreement with M&S Corp. The swap agreement specifies that Sarazan will receive a fixed rate at 7.5% and pay variable with settlement dates that match the interest payments on the debt. Assume that interest rates have declined during 2001 and that Sarazan received $13,000 as an adjustment to Interest expense for the settlement at December 31, 2001. The loss related to the debt (due to interest rate changes) was $48,000. The value of the swap contract increased $48,000. a. Prepare the journal entry to record the payment of interest expense on December 31, 2001. b. Prepare the journal entry to record the receipt of the swap settlement on December 31, 2001. c. Prepare the journal entry to record the change in the fair value of the swap contract…On January 1, 20X1, Novak, Inc., enters into an interest rate swap and agrees to receive fixed and pay variable on a notional amount of $5,000,000. The contract calls for cash settlement of the net interest amount at December 31 of each year. The yield curve is flat, and the agreement is to last until December 31, 20X9. Both the fixed annual rate and the variable annual rate at January 1, 20X1, are 7.00%. The variable interest rate is reset at the end of each year and becomes effective for the next year. On December 31, 20X1, the variable rate is reset to 8.00% per year, and on December 31, 20X2, the variable rate is reset to 5.00%. 1. Compute the fair value of the swap agreement at December 31, 20X1. Asset or a liability?2. Compute the fair value of the swap agreement at December 31, 20X2. Asset or a liability?On January 1, 20X1, Novak, Inc., enters into an interest rate swap and agrees to receive fixed and pay variable on a notional amount of $5,000,000. The contract calls for cash settlement of the net interest amount at December 31 of each year. The yield curve is flat, and the agreement is to last until December 31, 20X9. Both the fixed annual rate and the variable annual rate at January 1, 20X1, are 7.00%. The variable interest rate is reset at the end of each year and becomes effective for the next year. On December 31, 20X1, the variable rate is reset to 8.00% per year, and on December 31, 20X2, the variable rate is reset to 5.00%. Required: Compute the fair value of the swap agreement at December 31, 20X1. Be sure to indicate whether it is an asset or a liability. Compute the fair value of the swap agreement at December 31, 20X2. Be sure to indicate whether it is an asset or a liability.