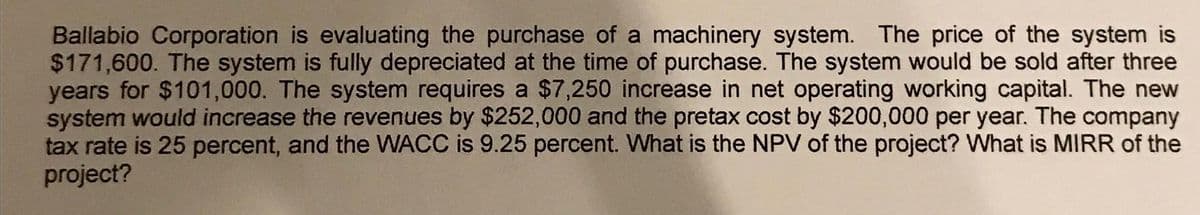

Ballabio Corporation is evaluating the purchase of a machinery system. The price of the system is $171,600. The system is fully depreciated at the time of purchase. The system would be sold after three years for $101,000. The system requires a $7,250 increase in net operating working capital. The new system would increase the revenues by $252,000 and the pretax cost by $200,000 per year. The company tax rate is 25 percent, and the WACC is 9.25 percent. What is the NPV of the project? What is MIRR of the

Ballabio Corporation is evaluating the purchase of a machinery system. The price of the system is $171,600. The system is fully depreciated at the time of purchase. The system would be sold after three years for $101,000. The system requires a $7,250 increase in net operating working capital. The new system would increase the revenues by $252,000 and the pretax cost by $200,000 per year. The company tax rate is 25 percent, and the WACC is 9.25 percent. What is the NPV of the project? What is MIRR of the

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 10P

Related questions

Question

am. 120.

Transcribed Image Text:Ballabio Corporation is evaluating the purchase of a machinery system. The price of the system is

$171,600. The system is fully depreciated at the time of purchase. The system would be sold after three

years for $101,000. The system requires a $7,250 increase in net operating working capital. The new

system would increase the revenues by $252,000 and the pretax cost by $200,000 per year. The company

tax rate is 25 percent, and the WACC is 9.25 percent. What is the NPV of the project? What is MIRR of the

project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning