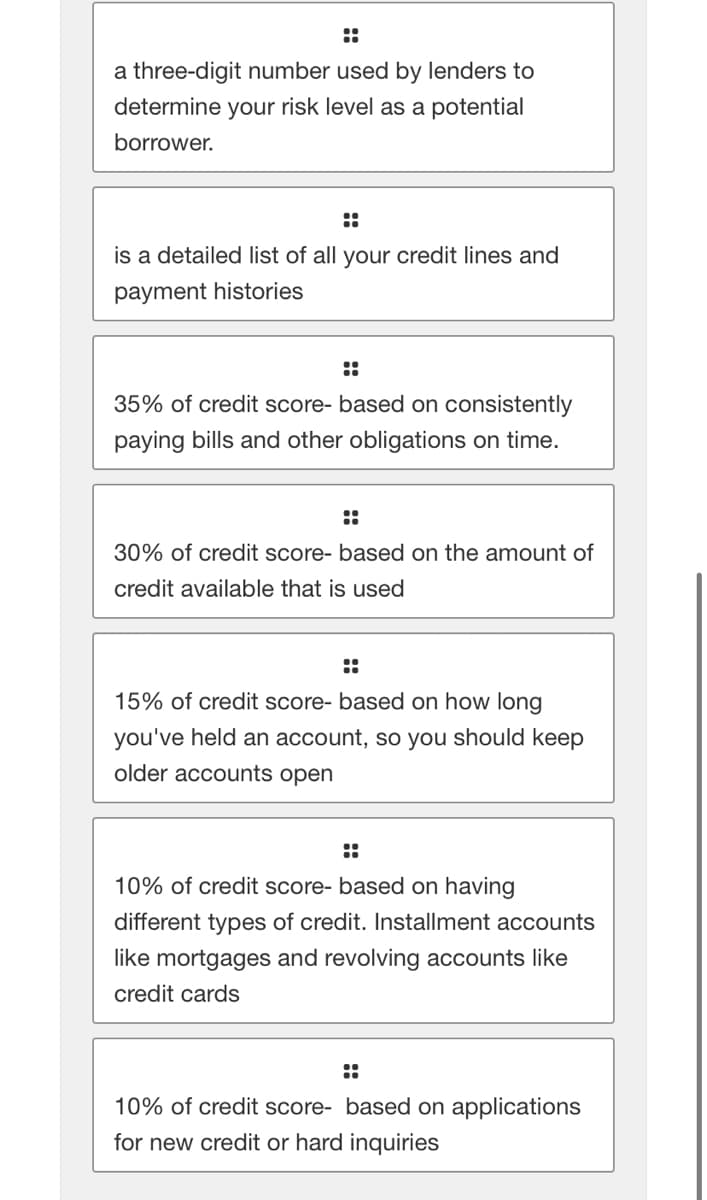

a three-digit number used by lenders to determine your risk level as a potential borrower. :: is a detailed list of all your credit lines and payment histories :: 35% of credit score- based on consistently paying bills and other obligations on time. :: 30% of credit score- based on the amount of credit available that is used 15% of credit score- based on how long you've held an account, so you should keep older accounts open :: 10% of credit score- based on having different types of credit. Installment accounts like mortgages and revolving accounts like credit cards 10% of credit score- based on applications for new credit or hard inquiries

a three-digit number used by lenders to determine your risk level as a potential borrower. :: is a detailed list of all your credit lines and payment histories :: 35% of credit score- based on consistently paying bills and other obligations on time. :: 30% of credit score- based on the amount of credit available that is used 15% of credit score- based on how long you've held an account, so you should keep older accounts open :: 10% of credit score- based on having different types of credit. Installment accounts like mortgages and revolving accounts like credit cards 10% of credit score- based on applications for new credit or hard inquiries

Chapter7: Credit Cards And Consumer Loans

Section7.2: Managing Credit Cards Wisely

Problem 2CC

Related questions

Question

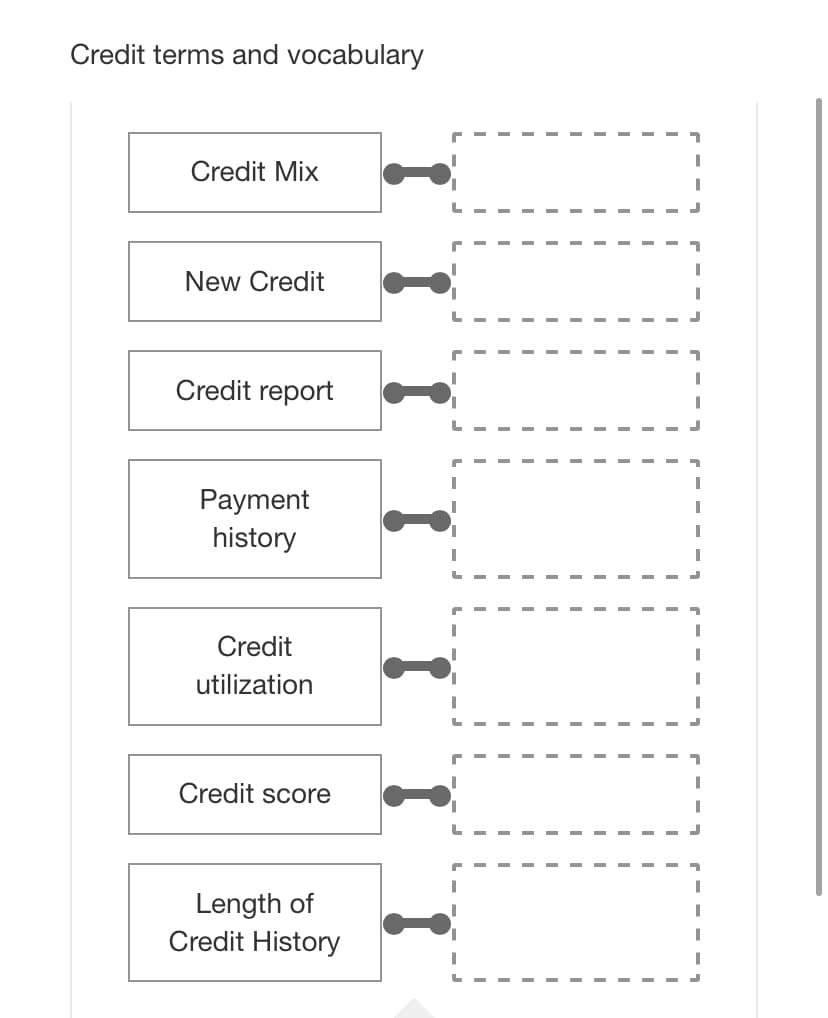

Transcribed Image Text:Credit terms and vocabulary

Credit Mix

New Credit

Credit report

Payment

history

Credit

utilization

Credit score

Length of

Credit History

Transcribed Image Text:::

a three-digit number used by lenders to

determine your risk level as a potential

borrower.

::

is a detailed list of all your credit lines and

payment histories

::

35% of credit score- based on consistently

paying bills and other obligations on time.

::

30% of credit score- based on the amount of

credit available that is used

::

15% of credit score- based on how long

you've held an account, so you should keep

older accounts open

10% of credit score- based on having

different types of credit. Installment accounts

like mortgages and revolving accounts like

credit cards

::

10% of credit score- based on applications

for new credit or hard inquiries

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub