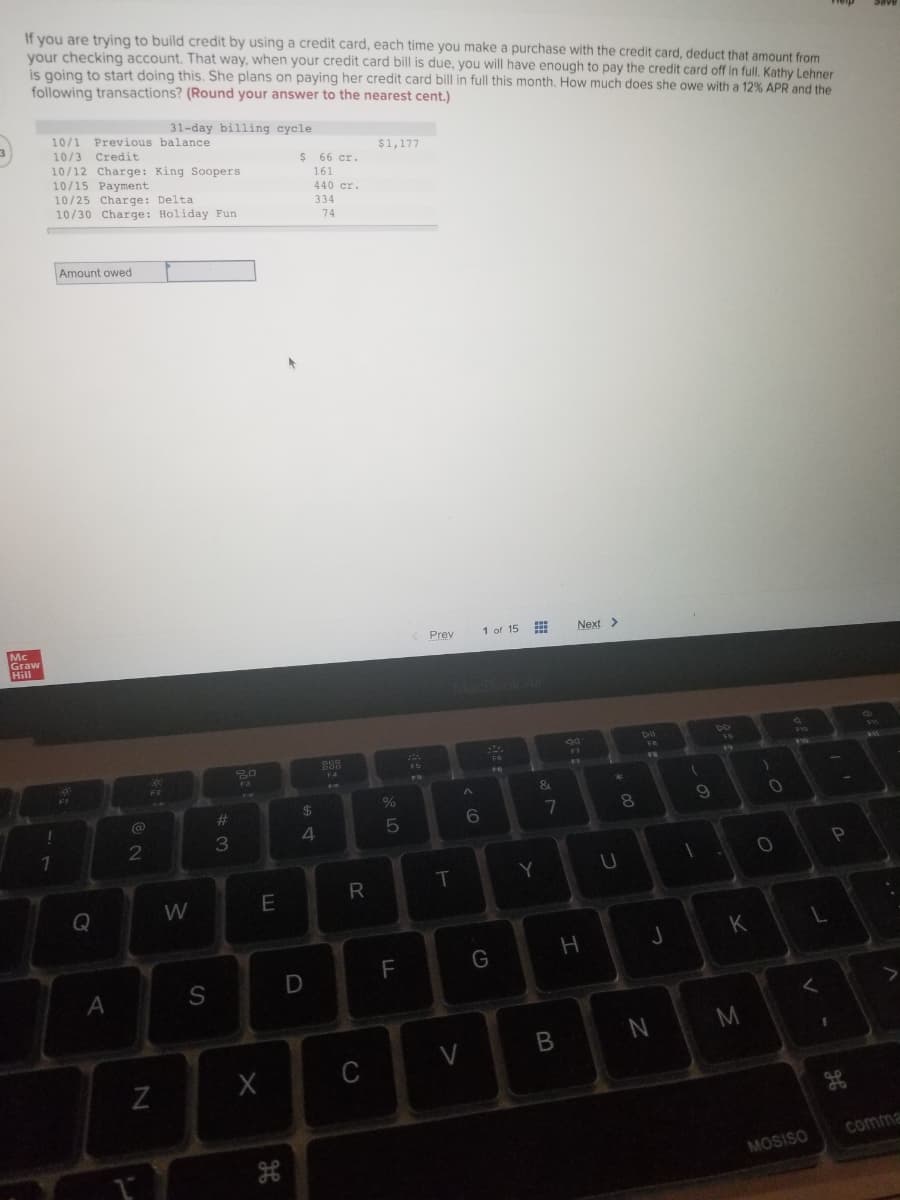

If you are trying to build credit by using a credit card, each time you make a purchase with the credit card, deduct that amount from your checking account. That way, when your credit card bill is due, you will have enough to pay the credit card off in full. Kathy Lehner is going to start doing this. She plans on paying her credit card bill in full this month. How much does she owe with a 12% APR and the following transactions? (Round your answer to the nearest cent.) 31-day billing cycle Previous balance Credit 10/12 Charge: King Soopers 10/1 $1,177 10/3 $ 66 er. 161 10/15 Payment 440 cr. 10/25 Charge: Delta 10/30 Charge: Holiday Fun 334 74 Amount owed

If you are trying to build credit by using a credit card, each time you make a purchase with the credit card, deduct that amount from your checking account. That way, when your credit card bill is due, you will have enough to pay the credit card off in full. Kathy Lehner is going to start doing this. She plans on paying her credit card bill in full this month. How much does she owe with a 12% APR and the following transactions? (Round your answer to the nearest cent.) 31-day billing cycle Previous balance Credit 10/12 Charge: King Soopers 10/1 $1,177 10/3 $ 66 er. 161 10/15 Payment 440 cr. 10/25 Charge: Delta 10/30 Charge: Holiday Fun 334 74 Amount owed

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter6: Using Credit

Section: Chapter Questions

Problem 8FPE

Related questions

Question

100%

Transcribed Image Text:If you are trying to build credit by using a credit card, each time you make a purchase with the credit card, deduct that amount from

your checking account. That way, when your credit card bill is due, you will have enough to pay the credit card off in full. Kathy Lehner

is going to start doing this. She plans on paying her credit card bill in full this month. How much does she owe with a 12% APR and the

following transactions? (Round your answer to the nearest cent.)

31-day billing cycle

10/1 Previous balance

10/3 Credit

10/12 Charge: King Soopers

10/15 Payment

10/25 Charge: Delta

10/30 Charge: Holiday Fun

$1,177

$ 66 cr.

161

440 cr.

334

74

Amount owed

1 of 15 E

Next >

Mc

Graw

Hill

Prev

...

DO

bo

1O

244

16

17

20

14

17

F3

F2

&

23

%24

7

8.

6.

2

Y

Q

W

K

G

H

F

N.

V

C

comma

MOSISO

V

S4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning