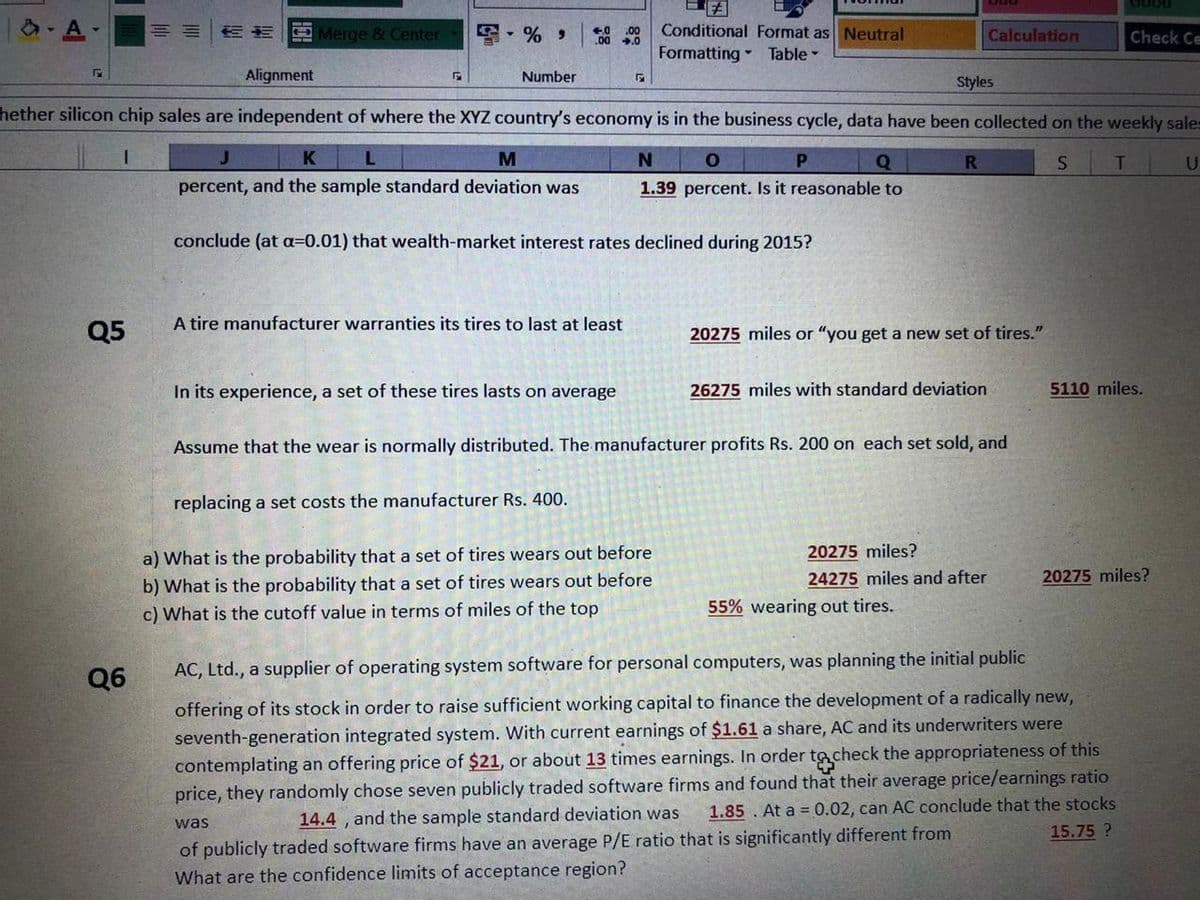

A tire manufacturer warranties its tires to last at least 20275 miles or "you get a new set of tires." In its experience, a set of these tires lasts on average 26275 miles with standard deviation 5110 miles. Assume that the wear is normally distributed. The manufacturer profits Rs. 200 on each set sold, and replacing a set costs the manufacturer Rs. 400. 20275 miles? a) What is the probability that a set of tires wears out before 24275 miles and after 20275 miles? b) What is the probability that a set of tires wears out before

A tire manufacturer warranties its tires to last at least 20275 miles or "you get a new set of tires." In its experience, a set of these tires lasts on average 26275 miles with standard deviation 5110 miles. Assume that the wear is normally distributed. The manufacturer profits Rs. 200 on each set sold, and replacing a set costs the manufacturer Rs. 400. 20275 miles? a) What is the probability that a set of tires wears out before 24275 miles and after 20275 miles? b) What is the probability that a set of tires wears out before

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Topic Video

Question

attempt Q5

Transcribed Image Text:FA

Conditional Format as Neutral

Formatting Table

A-

OMerge & Center

6 %

.00

00 .0

Calculation

Check Ce

Alignment

Number

Styles

hether silicon chip sales are independent of where the XYZ country's economy is in the business cycle, data have been collected on the weekly sales

J

K

M

Q

R.

U

percent, and the sample standard deviation was

1.39 percent. Is it reasonable to

conclude (at a=0.01) that wealth-market interest rates declined during 2015?

A tire manufacturer warranties its tires to last at least

Q5

20275 miles or "you get a new set of tires."

In its experience, a set of these tires lasts on average

26275 miles with standard deviation

5110 miles.

Assume that the wear is normally distributed. The manufacturer profits Rs. 200 on each set sold, and

replacing a set costs the manufacturer Rs. 400.

a) What is the probability that a set of tires wears out before

20275 miles?

20275 miles?

b) What is the probability that a set of tires wears out before

c) What is the cutoff value in terms of miles of the top

24275 miles and after

55% wearing out tires.

Q6

AC, Ltd., a supplier of operating system software for personal computers, was planning the initial public

offering of its stock in order to raise sufficient working capital to finance the development of a radically new,

seventh-generation integrated system. With current earnings of $1.61 a share, AC and its underwriters were

contemplating an offering price of $21, or about 13 times earnings. In order to check the appropriateness of this

price, they randomly chose seven publicly traded software firms and found that their average price/earnings ratio

1.85. At a 0.02, can AC conclude that the stocks

15.75 ?

was

14.4 , and the sample standard deviation was

of publicly traded software firms have an average P/E ratio that is significantly different from

What are the confidence limits of acceptance region?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill