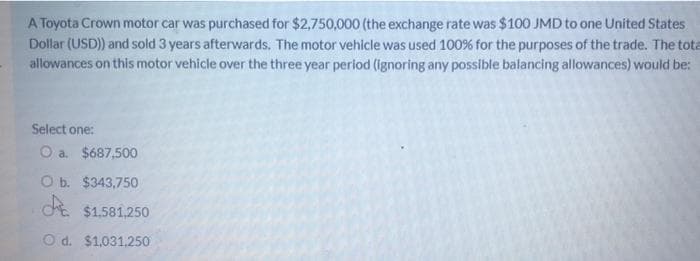

A Toyota Crown motor car was purchased for $2,750,000 (the exchange rate was $100 JMD to one United States Dollar (USD)) and sold 3 years afterwards. The motor vehicle was used 100% for the purposes of the trade. The tota allowances on this motor vehicle over the three year period (ignoring any possible balancing allowances) would be: Select one: O a $687,500 O b. $343,750 $1.581,250 O d. $1,031,250

Q: For the following situations, identify whether the situation represents a violation or a correct…

A: There are principles and assumptions based on which whole accounting depends regarding how to enter…

Q: Cost of goods sold is also called cost of sales.

A: Cost of goods sold is the direct cost of producing those goods which are sold by the company during…

Q: A note is honored when it is not fully paid at maturity.

A: Note is a kind of instrument which is used to show any future payment to be received or made. For…

Q: 3. Total Wine is a wine wholesaler in Ridgewood, New Jersey. The company uses the LIFO inventory…

A: LIFO- LIFO means last in first out. It is a method which is used for valuation of the inventories in…

Q: created balance sheet for HME Sdn Bhd From the following particulars, prepare a balance sheet HME…

A: Answer

Q: 17. Which one of the following accounts would not appear on a post-closing trial balance? O A.…

A: The post-closing trial balance includes all the permanent accounts. The closing entries are used to…

Q: The cross over point for two types of machine producing widgets is 625 units. Machine A has a fixed…

A:

Q: Commando Corp. agrees to sell 100 of its products to M&H Co. for P30,000 in August 2021. (P300 per…

A: The original sale price of the products sold prior to alteration will not be modified. As previously…

Q: explain the specific identification approach

A: Introduction: Inventory valuation is an accounting practice used by businesses to determine the…

Q: Draw time lines for (1) a $100 lump sum cash flow at the end of Year 2, (2) an ordinary annuity of…

A: Cash Flow: Cash flow refers to the amount of cash or cash equivalents that a firm earns or spends as…

Q: Which of the following s he violated?

A: An employee working in an organization must have some ethics and values. The employee should work…

Q: Based on the above and the result of your audit, answer the following(Round off present value…

A: Here discuss about the details of the notes receivable and its interest income collection for the…

Q: A company aims to generate £70,000 profit in the coming period, during which it expects to sell…

A: Required sales units in order to achieve a target profit = (Profit + Fixed cost) / Contribution…

Q: eds a new HVAC system for his home. He is comparing these three models. One Temp Happier…

A: Depreciation : It is the reduction in the value of assets due to its continuous use and wear and…

Q: What is the difference between an imposed budget and a participatory budget? Define and explain a…

A: Introduction A budget is a financial statement that the management develops to evaluate the…

Q: Crane Company reported net income of $148,500. For 2020, depreciation was $45,100, and the company…

A: Cash flow from operating activities indicates the cash inflow or outflow transactions related to the…

Q: In May direct labor was 30% of conversion cost. If the manufacturing overhead for the month was…

A: Direct labour costs are those costs of labour which is directly used in manufacturing purpose.…

Q: Journalize Apr. 30 Aug. 30 the following, assuming a 360-day year is used for interest computations:…

A: Journal Entry: A Journal entry is the demonstration of keeping or making records of any exchanges…

Q: 1. Compute the profitability index for each project. 2. Based on the profitability index, which…

A: Answer

Q: About accounting

A: Financial Accounting- Financial accounting is the process of documenting, compiling, and disclosing…

Q: Suppose an investment has conventional cash flows with positive NPV. How would it impact your…

A: Ratio Analysis- Ratio analysis is a tool for analyzing and evaluating a company's financial status.…

Q: For each of the following items, indicate whether it would appear on a materials requisition form…

A: As, there are different departments in an organization, to perform the various activities, because…

Q: Unearned Delivery Fees of FDNACCT Co. before adjustments amounted to P80,000. % of the unearned…

A: Unearned sales Revenue: Unearned sales Revenue means money received from the customer in advance for…

Q: Requirement 1. Record the transactions. Deerborn's general journal. (Record debits first, then…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: please answet the following question thanks

A: Minimum transfer price is the amount which is paid to one division by the other after purchasing the…

Q: For years one through five, a proposed expenditure of £350,000 on a non- current asset with an…

A: Answer:- Payback period meaning:- The payback period can be defined as the amount of time which is…

Q: Find the monthly house payment necessary to amortize the following loan. In order to purchase a…

A: Loan: When money is lent to another party in return for regular repayment of the loan principle…

Q: Accounting Explne

A: The business maintains its records in the form of accounting. The business being small or larger, it…

Q: Which if the following is not an inclusion in gross income?

A: Gross income is an income from all sources including returns , discounts and…

Q: Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains…

A: Lets understand the basics. Variable overhead rate variance indicates the variance between the rate…

Q: Is ABC Manufacturing is properly using the budget process to plan for next year's expenses? You have…

A: The budget can be defined as the process of estimating revenues, expenses, and income. The budget is…

Q: Based on the information above, discuss the ways in which fraud/ theft could be perpetrated at…

A: A fraud could be made by the employees of the company whenever there is a loophole in the system in…

Q: Inventories Materials January 1 January 31 302,000 278,000 Work in process 215,600 238,200 Finished…

A: The statement of cost of goods manufactured includes the direct and indirect costs incurred during…

Q: ssume this individual's friend decides to pursue postsecondary education. What are two types of…

A: Loan is the loan means it is a burden upon the shoulders of the taker which has to repay the same to…

Q: Question 10 of 20: Select the best answer for the question Here's a partial trial balance taken from…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: For each of the following prepare the journal to record the adjusting entry on December 31, 2020 for…

A: journal entry of above transaction areas follows

Q: our company buys a computer server that it expects to use for eight years and then intends to sell…

A: Useful life refers to the life of an asset till which a particular asset can be used by the company.…

Q: William sold Section 1245 property for $28,000 in 2021. The property cost $41,000 when it was…

A: Given that, Sales value of property = $28,000 Cost of property = $41,000 Depreciation claimed =…

Q: Commando Corp. agrees to sell 100 of its products to M&H Co. for P30,000 in August 2021. (P300 per…

A: The original sale price of the products before alteration will not be modified. As previously…

Q: The adjustment for accrued expense eliminates the understatement in Total liabilities O Total…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Ferrero Rocher Inc.’s only temporary difference at the beginning and end of 2020 is caused by a…

A: In the context of the given question, we are required to compute the deferred tax liability on…

Q: Target Ltd manufactures dart boards and its budget for its first month of trading showed the…

A: Lets understand the basics. Generally two costing system are followed by the entity which are, (1)…

Q: Alexandra and Beatrice are deciding where to live during college. Alexandra can live at her parents…

A: "Since you have posted a question with multiple subparts, we will solve the first three subparts for…

Q: Select the best answer for the question. 4. Which one of the following accounts is both opened and…

A: In accounting, accounts are mainly classified as: Assets accounts Liabilities accounts Capital…

Q: The following items were taken from the records of Slow Boat Company, which uses a periodic…

A: The income statement is an essential part of the financial statements of the company. It is prepared…

Q: On January 1, 2022, Durant Corporation agrees to lease equipment to Irving Corporation. The term of…

A: Year Lease Payment Discount Factor Present Value 1 113,913.00 1 113,913.00 2…

Q: Based on the information below of FDNACCT Co., how much should be recorded as total assets in the…

A: Long-term Payable, Notes Payable, Accounts Payable, Unearned Income, Accrued Expenses are considered…

Q: You are conducting an audit on your client's revenue cycle for the 2019 financial year. Your client…

A: The auditor is appointed to form an opinion on the financial statement and the auditor before…

Q: Materials Labor Overhead Requirements Fixed Manufacturing Overhead is $705,000 annually. $ 19.00 $…

A: Selling price=Manufacturing cost per unit×Percentage of manufacturing cost

Q: Taylor’s is a popular restaurant that offers customers a large dining room and comfortable bar area.…

A: In the given question Taylor’s is a popular restaurant that offers customers a large dining room and…

Step by step

Solved in 2 steps

- During December of the current year, Teletex Systems, Inc., a company based in Seattle, Washington, entered into the following transactions: Dec. 10 Sold seven office computers to a company located in Colombia for 8,229,000 pesos. On this date, the spot rate was 390 pesos per U.S. dollar. 12 Purchased computer chips from a company domiciled in Taiwan. The contract was denominated in 420,000 Taiwan dollars. The direct exchange spot rate on this date was $0.0428. (a) Your answer is correct. Prepare journal entries to record the transactions above on the books of Teletex Systems, Inc. The company uses a periodic inventory system. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit…During December of the current year, Teletex Systems, Inc., a company based in Seattle, Washington, entered into the following transactions: Dec. 10 Sold seven office computers to a company located in Colombia for 8,229,000 pesos. On this date, the spot rate was 390 pesos per U.S. dollar. 12 Purchased computer chips from a company domiciled in Taiwan. The contract was denominated in 420,000 Taiwan dollars. The direct exchange spot rate on this date was $0.0428. (a) Prepare journal entries to record the transactions above on the books of Teletex Systems, Inc. The company uses a periodic inventory system. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit CreditDuring December of the current year, Exide company based in America, entered into the following transactions; Dec 10 Sold machinery to company located in Colombia for 6,500,000 pesos. On this date, the spot rate was 365 pesos per U.S. Dollar. Dec 12 Purchased Machine parts from a company domiciled in Japan. The contract was denominated in 600,000 Japan yen. The direct exchange spot rate on this date was $.0392. Required: Prepare journal entries to record the transactions above on the books of Exide company. The company uses a periodic inventory system. Prepare journal entries necessary to adjust the accounts as of December 31. Assume that on December 31 the direct exchange rates were as follows: Colombia peso $.00265 Japan yen .0353 Prepare journal entries to record settlement of both open accounts on January 10. Assume that the direct exchange rates on the settlement dates were as follows:…

- On July 15, 2XX6, Liz converts 627,000 U.S. dollars to Japanese yen in the spot foreign exchange market (¥109.92/$) and purchase a six-month forward contract (¥100.89/$) to convert yen into dollars. What is Liz's profit or loss in U.S. dollars at the end of six months? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16). Use a negative sign to denote a loss.)MAKATI Exports Corp sold metal crafts to a US firm for $70,000 and pertinent information on exchange conversion rates related to this trasnaction were as follows: Conversion Rate (Peso to US) Nov 04 Receipt of order P27.40 Nov 22 Date of shipment 27.50 Dec 31 Balance sheet date 27.60 Jan 06 Date of collection 27.00 The sale would be appropriately recorded at A. 1,890,000 B. 1,925,000 C. 1,918,000 D. 1,925,000ABC Corp. imported a machine from the US for $50,000 on October 10, 20x1. A letter of credit was opened with a local bank based on the commercial invoice for $50,000, on which ABC Corp. made a 100% deposit cover based on the exchange rate of $1 to P27.50. Shipment of the machine was effected on December 3, 20x1, at which time the exporter collected the proceeds of the letter of credit when the prevailing exchange rate was $1 to P28.00. From the exchange rate fluctuation, ABC Corp. realized how much gain or loss or no gain, no loss? AU Co. acquired a fixed asset for $36,000 on November 1, 20x1 when the exchange rate was $1 = P23.00. At December 31, 20x1, the entity's year-end, the supplier of the fixed asset has not been paid and the exchange rate at that time was $1 = P25.00. On the December 31, 20x1 statement of financial position, what will be the values for the fixed asset and the creditor who was unpaid? On January 1, 20x6, the Riza Co. purchased equipment for P300,000. The…

- (a) ABC Co has a year end of 31 December 20X1 and uses the dollar ($) as its functional currency. On 25 October 20X1 ABC Co buys goods from a Swedish supplier for Swedish Krona (SWK) 286,000. Rates of exchange: 25 October 20X1 $1 = SWK 11.16 16 November 20X1 $1 = SWK 10.87 31 December 20X1 $1 = SWK 11.02 Required: Show the accounting treatment for the above transactions if: (a) A payment of SWK286,000 is made on 16 November 20X1. (b) The amount owed remains outstanding at the year-end date.Rochester, Incorporated purchased cameras from a Japanese company at a price of 4.9 million yenOn the purchase date, the exchange rate was $0.0100 per Japanese yen, bu when RochesterIncorporated, paid the liabilitythe exchange rate was $0.0103 per yen. When this foreign account payable was paid, RochesterIncorporated, recorded aLocal Corp imported a heavy machine from the US for US$50,000 on October 10, 2019. A letter of credit was opened with a Makati branch based on the commercial invoice for US$50,000, on which Local Corpl made a 100% deposit cover based on the exchange rate of $1.00 to P27.50. Shipment of the heavy machine was effected on December 30, 2019, at which time the exporter collected the proceeds of the letter of credit when the prevailing exchange rate was $1.00 to P28.00. From the exchange rate fluctuation, Local Corp realized: Group of answer choices A. P25,000 gain B.P25,000 loss C. P5,000 gain D. No gain, No loss

- On November 1, 20x1, Pain Co. received a sale order for equipment from Gain Co., a foreign entity, for 300,000 foreign currency units (FCU) when the local currency unit (LCU) equivalent was 96,000 LCUs. Pain shipped the equipment on December 1, 20x1, and billed the customer for 300,000 FCUS when the local currency unit equivalent was 100,000 LCUS. On December 31, 20x1, the local currency unit equivalent of the 300,000 FCUS was 103,000LCUS. Pain received the payment on January 6, 20x2 when the local currency unit equivalent of the 300,000 FCUS was 105,000 LCUS. Requirement: Provide the journal entries in 20x1 and 20x2Thomas who lives in Vancouver purchased a piece of equipment from Australia for A$44,230. She was charged 11% duty, 5% GST, and 7% PST to import it. Calculate the total cost of the equipment. Assume that the exchange rate was C$1 = A$1.0291. Tax is charged on the price of the equipment after applying the duty. What was the total cost of the equipment?Max Ltd sells equipment to Star Ltd, a U.S. company on 30/01/2020 for US$250,000. Goods are invoiced in US dollars. Payment is made on 5/03/2020. The company also buys parts from the USA, also invoiced in US$, value US$187,500 on 20/4/2020. The functional currency of Max Ltd is AUD$. As at 30/06/2020, this debt unpaid. Rates: 30/01 – A$1 = US$0.93 5/03 – A$1 = US$0.92 20/4 – A$1 = US$0.94 30/6 – A$1 = US$0.91 Required: SHOW YOUR WORKINGS Prepare journal entries for the above transactions. (Round answers to the nearest dollar, e.g. $200,263.57 = $200,264).