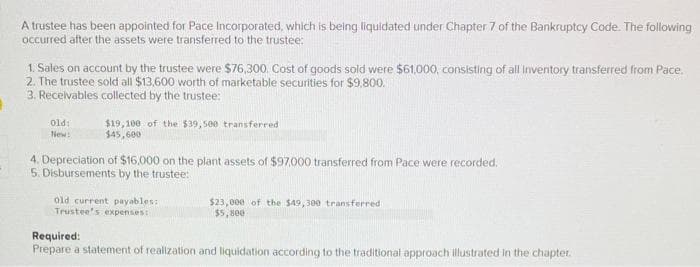

A trustee has been appointed for Pace Incorporated, which is being liquidated under Chapter 7 of the Bankruptcy Code. The following occurred after the assets were transferred to the trustee: 1. Sales on account by the trustee were $76,300. Cost of goods sold were $61,000, consisting of all inventory transferred from Pace. 2. The trustee sold all $13,600 worth of marketable securities for $9,800. 3. Receivables collected by the trustee: old: New: $19,100 of the $39,500 transferred $45,600 4. Depreciation of $16,000 on the plant assets of $97,000 transferred from Pace were recorded. 5. Disbursements by the trustee: Old current payables: Trustee's expenses: $23,000 of the $49,300 transferred $5,800 Required: Prepare a statement of realization and liquidation according to the traditional approach illustrated in the chapter.

A trustee has been appointed for Pace Incorporated, which is being liquidated under Chapter 7 of the Bankruptcy Code. The following occurred after the assets were transferred to the trustee: 1. Sales on account by the trustee were $76,300. Cost of goods sold were $61,000, consisting of all inventory transferred from Pace. 2. The trustee sold all $13,600 worth of marketable securities for $9,800. 3. Receivables collected by the trustee: old: New: $19,100 of the $39,500 transferred $45,600 4. Depreciation of $16,000 on the plant assets of $97,000 transferred from Pace were recorded. 5. Disbursements by the trustee: Old current payables: Trustee's expenses: $23,000 of the $49,300 transferred $5,800 Required: Prepare a statement of realization and liquidation according to the traditional approach illustrated in the chapter.

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:A trustee has been appointed for Pace Incorporated, which is being liquidated under Chapter 7 of the Bankruptcy Code. The following

occurred after the assets were transferred to the trustee:

1. Sales on account by the trustee were $76,300. Cost of goods sold were $61,000, consisting of all inventory transferred from Pace.

2. The trustee sold all $13,600 worth of marketable securities for $9,800.

3. Receivables collected by the trustee:

old:

New:

$19,100 of the $39,500 transferred

$45,600

4. Depreciation of $16,000 on the plant assets of $97,000 transferred from Pace were recorded.

5. Disbursements by the trustee:

old current payables:

Trustee's expenses:

$23,000 of the $49,300 transferred

$5,800

Required:

Prepare a statement of realization and liquidation according to the traditional approach illustrated in the chapter.

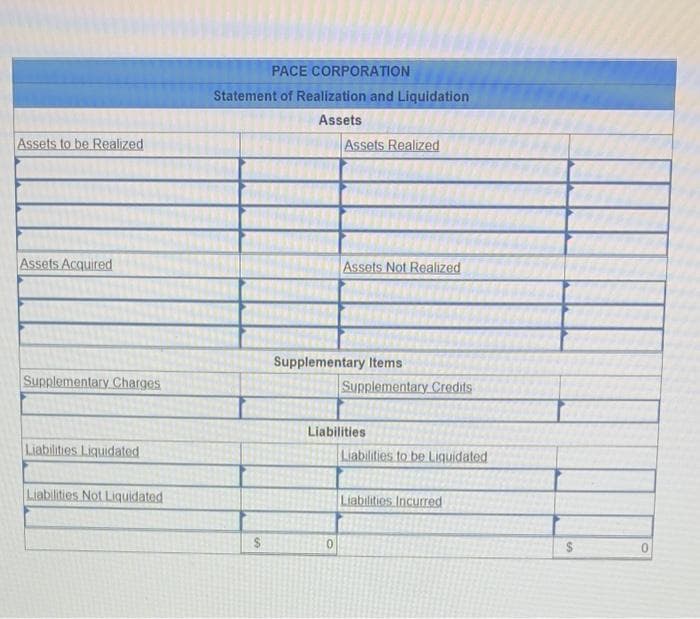

Transcribed Image Text:Assets to be Realized

Assets Acquired

Supplementary Charges

Liabilities Liquidated

Liabilities Not Liquidated

PACE CORPORATION

Statement of Realization and Liquidation

Assets

60

Assets Realized

Assets Not Realized)

Supplementary Items

Supplementary Credits

Liabilities

Liabilities to be Liquidated

Liabilities Incurred

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT