A US based IT firm required GBP 100000 in 180 days. The company feels that exchange rates are expected to fluctuate in the next 6 months. Their near accurate estimate based on a good quality research were as below: Current Rate of GBP = USD 1.50 %3D 180 days forward rate for GBP = USD 1.48 Call premium USD 0.02 (strike price of USD 1.50 for 180 days) help need Interest Rates in London for deposits - 4.5% and for loans - 5.1% Interest Rates in New York for deposits - 4.5% and for loans - 5.1% A fair estimate of exchange rate after 180 days is expected to be USD 1.44 with a probability of 209% TISD 46 with a probabilit

A US based IT firm required GBP 100000 in 180 days. The company feels that exchange rates are expected to fluctuate in the next 6 months. Their near accurate estimate based on a good quality research were as below: Current Rate of GBP = USD 1.50 %3D 180 days forward rate for GBP = USD 1.48 Call premium USD 0.02 (strike price of USD 1.50 for 180 days) help need Interest Rates in London for deposits - 4.5% and for loans - 5.1% Interest Rates in New York for deposits - 4.5% and for loans - 5.1% A fair estimate of exchange rate after 180 days is expected to be USD 1.44 with a probability of 209% TISD 46 with a probabilit

Chapter21: Risk Management

Section: Chapter Questions

Problem 3P

Related questions

Question

i need the answer quickly

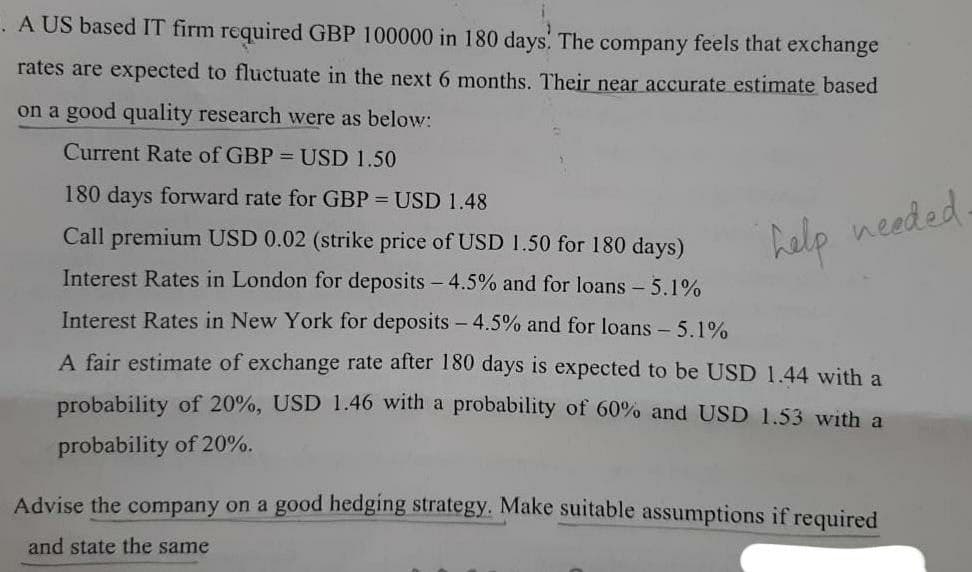

Transcribed Image Text:. A US based IT firm required GBP 100000 in 180 days. The company feels that exchange

rates are expected to fluctuate in the next 6 months. Their near accurate estimate based

on a good quality research were as below:

Current Rate of GBP = USD 1.50

180 days forward rate for GBP = USD 1.48

Call premium USD 0.02 (strike price of USD 1.50 for 180 days)

help needed.

Interest Rates in London for deposits - 4.5% and for loans - 5.1%

Interest Rates in New York for deposits - 4.5% and for loans - 5.1%

A fair estimate of exchange rate after 180 days is expected to be USD 1.44 with a

probability of 20%, USD 1.46 with a probability of 60% and USD 1.53 with a

probability of 20%.

Advise the company on a good hedging strategy. Make suitable assumptions if required

and state the same

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT