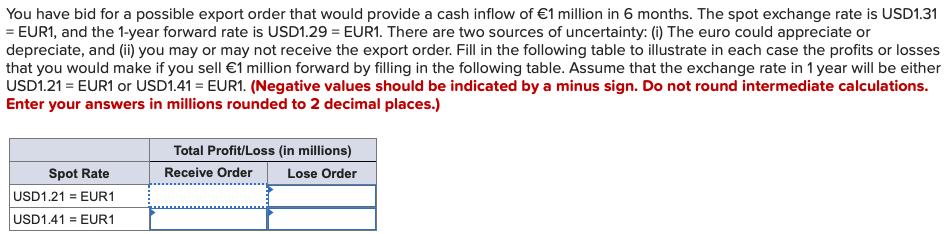

You have bid for a possible export order that would provide a cash inflow of €1 million in 6 months. The spot exchange rate is USD1.31 = EUR1, and the 1-year forward rate is USD1.29 = EUR1. There are two sources of uncertainty: (i) The euro could appreciate or depreciate, and (ii) you may or may not receive the export order. Fill in the following table to illustrate in each case the profits or losses that you would make if you sell €1 million forward by filling in the following table. Assume that the exchange rate in 1 year will be either USD1.21 = EUR1 or USD1.41 = EUR1. (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Total Profit/Loss (in millions) Spot Rate Receive Order Lose Order USD1.21 = EUR1 USD1.41 = EUR1

You have bid for a possible export order that would provide a cash inflow of €1 million in 6 months. The spot exchange rate is USD1.31 = EUR1, and the 1-year forward rate is USD1.29 = EUR1. There are two sources of uncertainty: (i) The euro could appreciate or depreciate, and (ii) you may or may not receive the export order. Fill in the following table to illustrate in each case the profits or losses that you would make if you sell €1 million forward by filling in the following table. Assume that the exchange rate in 1 year will be either USD1.21 = EUR1 or USD1.41 = EUR1. (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Total Profit/Loss (in millions) Spot Rate Receive Order Lose Order USD1.21 = EUR1 USD1.41 = EUR1

Chapter16: Country Risk Analysis

Section: Chapter Questions

Problem 29QA

Related questions

Question

Transcribed Image Text:You have bid for a possible export order that would provide a cash inflow of €1 million in 6 months. The spot exchange rate is USD1.31

= EUR1, and the 1-year forward rate is USD1.29 = EUR1. There are two sources of uncertainty: (i) The euro could appreciate or

depreciate, and (i) you may or may not receive the export order. Fill in the following table to illustrate in each case the profits or losses

that you would make if you sell €1 million forward by filling in the following table. Assume that the exchange rate in 1 year will be either

USD1.21 = EUR1 or USD1.41 = EUR1. (Negative values should be indicated by a minus sign. Do not round intermediate calculations.

Enter your answers in millions rounded to 2 decimal places.)

Total Profit/Loss (in millions)

Spot Rate

Receive Order

Lose Order

USD1.21 = EUR1

USD1.41 = EUR1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning