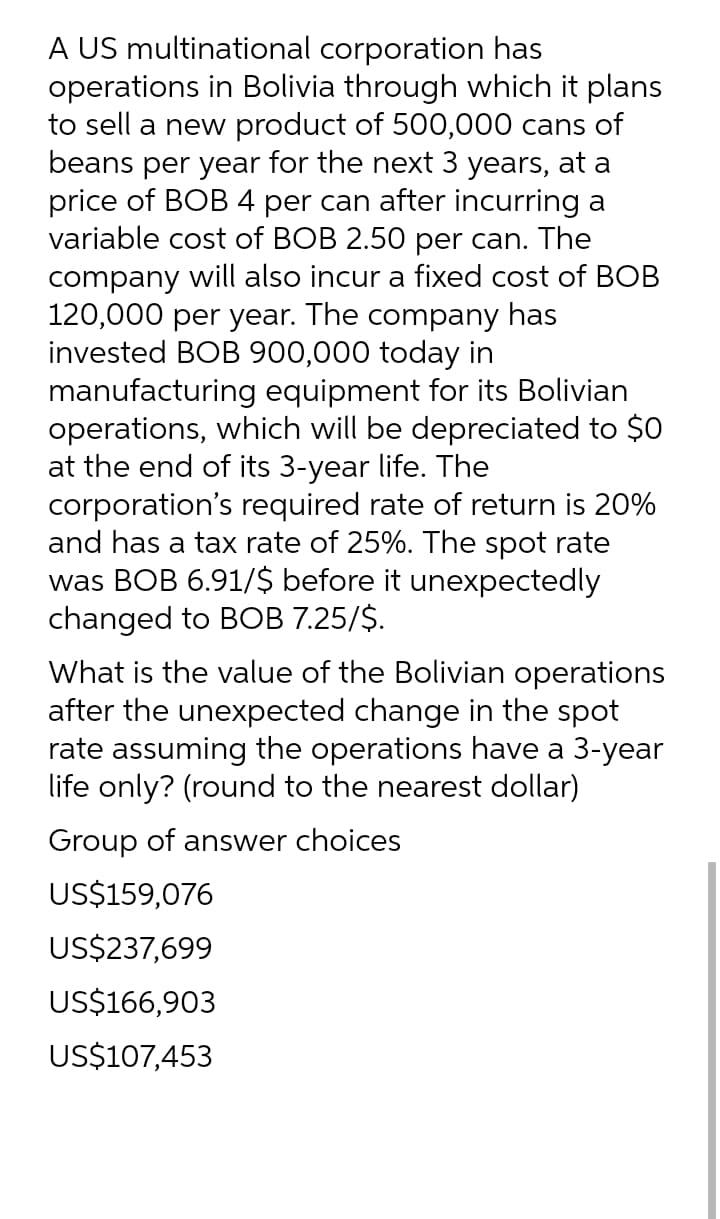

A US multinational corporation has operations in Bolivia through which it plans to sell a new product of 500,000 cans of beans per year for the next 3 years, at a price of BOB 4 per can after incurring a variable cost of BOB 2.50 per can. The company will also incur a fixed cost of BOB 120,000 per year. The company has invested BOB 900,000 today in

Q: Asgone plc is considering an investment to increase its manufacturing capacity from 10,000 units per…

A: The question is based on the concept of capital budgeting techniques for the selection of the most…

Q: Border Supply Company is considering opening a plant in Vietnam, The company anticipates gross…

A: The net benefit is derived by deducting all the costs of the project from the profit generated by…

Q: With the possibility of the US Congress relaxing restrictions on cutting old growth forests, Timber…

A: “Hey, since there are multiple questions posted, we will answer first three questions. If you want…

Q: 1. The company Cintas Adhesivas del Norte, S.A. wants to expand its production capacity in response…

A: The question is based on the concept of capital budgeting technique for the selection of a more…

Q: Solar Hydro manufactures a revolutionary aeration system that combines coarse and fine bubble…

A: EAC is computed below:

Q: Asgone plc is considering an investment to increase its manufacturing capacity from 10,000 units per…

A: Net present value (NPV) is the value of all the cash flow of the investment (positive and negative)…

Q: With the possibility of the US Congress relaxing restrictions on cutting old growth forests, Timber…

A: Break-Even Point: It is the point of sales at which entity neither earns a profit nor suffers a…

Q: Shimada Products Corporation of Japan plans to introduce a new electronic component to the market at…

A: Target cost per unit = Target selling price per unit - Return per unit where, Return per unit =…

Q: The Wod Chemical Company produces a chemical compound that is used as a lawn fertilizer. The…

A: Economic order quantity is the level of quantity at which incurs minimum costs towards ordering…

Q: Shimada Products Corporation of Japan plans to introduce a new electronic component to the market at…

A: Target cost is the cost which need to incurred by a entity in order to arrive the predetermined…

Q: Wilson Partners manufactures thermocouples for remote temperature monitoring of electronics…

A: Cost of current structure: Workings:

Q: 1: Mars Technologies is considering setting up a plant in a foreign country. The plant will have an…

A: "Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: How does Standard Oil maximize its profits?

A: Profit maximization: Profit maximization can be defined as the process which the company uses to…

Q: A component manufacturer currently produces 200,000 units a year. It buys component lids from an…

A: For NPV calculation , cost saving is the cash inflows

Q: You have taken over the family business, making custom furniture for sale in South Africa and for…

A: The debt-equity ratio is used to measure funds taken from creditors to invest in the business in…

Q: In addition to its Australian business, Big Red Bicycle is considering manufacturing a new range of…

A: As you posted multiple sub parts in questions we are answering first question only kindly repost the…

Q: Truffles Chocolate Factory has decided to expand. Last year, the company paid TCC; a marketing…

A: NPV is a technique under Capital budgeting which help in decision making on the basis of future cash…

Q: Toshovo Computer owns four production plants at which computer workstations are produced. The…

A:

Q: Rosario Company, which is located in Buenos Aires, Argentina, manufactures a component used in farm…

A: 1.

Q: Sandro Aero Inc. produces satellite earth station that sells for RM100,000 each. The firm’s fixed…

A: Given information: Sales RM 100,000 each 50 units of earth stations produced and sold each year,…

Q: Wilson Partners manufactures thermocouples for remote temperature monitoring of electronics…

A: Excel Spreadsheet: Excel Workings:

Q: Apothic Inc is nestled in the beautiful wine country of British Columbia. It is considering the…

A: ""Since you have posted the question with multiple sub-parts we will solve first three sub-parts for…

Q: t cash flows of P5,000 per year for 2 years. Process Y will cost P11,500 and will produce cash flows…

A:

Q: FLY corporation manufactures stamp pad that sells for Php 65.00 each. It costs FLY corporation Php…

A: Selling price per unit = Php. 65 Cost per unit = Php. 50 Contribution per unit = Selling price-Cost…

Q: Shimada Products Corporation of Japan plans to introduce a new electronic component to the market at…

A: Target Cost = Selling Price per unit - Return per unit

Q: If the Rhine Company ignores the possibility that other firms may enter its market, it should set a…

A: Calculation of Present values when Selling Price of the unit is $10,000 and Firms enter into the…

Q: NUBD Inc. is considering two average-risk alternative ways of producing its patented polo shirts.…

A:

Q: BHP Billiton is the world's largest mining firm. BHP expects to produce 2.25 billion pounds of…

A: (Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: A software company is considering translating its program into French. Each unit of the program…

A: Internal Rate of Return: IRR is the annual rate of growth an investment is expected to generate.…

Q: Arel, which produces X Goods, plans a total investment of 5,000,000 pounds using 3,000,000 TI of…

A: Break-Even Point (BEP) define as the amount of revenue needed to cover all costs, variable and fixed…

Q: If the Rhine Company ignores the possibility that other firms may enter its market, it should set a…

A: Calculation of present value of earning (PVOE) using excel when the price of product is $10,000:

Q: RG Motors has been approached by a new customer with an offer to purchase 5,000 units of its…

A: Relevant costs means the costs that will affect the decision.

Q: Rosario Company, which is located in Buenos Aires, Argentina, manufactures a component used in farm…

A: Compute the break-even point in units... Answer)BEP units=Fixed cost/Contribution margin per…

Q: U.S. Steel is planning a plant expansion to produce austenitic, precipitation-hardened, duplex and…

A: Net Present Value (NPV) is the technique used to determine the net actual cash flow in the present…

Q: Dell is evaluating the proposal of a new factory in an overseas country (Germany). The currency in…

A: The lift of the project is 5 years. The cash flows from year 1 to year 5 are same as there are no…

Q: NUBD Inc. is considering two average-risk alternative ways of producing its patented polo shirts.…

A: NPV refers to net present value and is it calculated as the present value of all future cash flows…

Q: Do you think the company should make this investment? Why?

A: Calculating the annual cash flow Formula

Q: Suppose that Sea Shell Oil Company (SS) is pumping oil at a field off the coast of Nigeria. At this…

A: Sea Shell oil company (SS) is pumping oil at a field off the coast of Nigeria

Q: Your options for shipping $100,000 of machine parts from Baltimore to Kuala Lumpur, Malaysia, are…

A: Shipping cost refers to the cost of transferring the goods from one location to another. Holding…

Q: NUBD Inc. is considering two average-risk alternative ways of producing its patented polo shirts.…

A: Project X Annual Cash flows P5,000.00 Present value of an ordinary annuity of $1 at 10% for 2…

Q: A Chinese automobile company is going to use one of its unused manufacturing plants in China to…

A: The details of the question are as below: Yearly Production (in units) 20,000 $…

Q: Agyenim Boateng, owner of the Best Pineapple Company Ltd will be receiving 20,000 British pounds…

A: The international financial market involves trade between different countries. It involves the…

Q: If the Rhine Company ignores the possibility that other firms may enter its market, it should set a…

A: Net present value of future sales revenue at both price levels.

Q: ted to be only $1.50 a lid. The necessary machinery would cost $150,000 and would last 10 years.…

A: For NPV calculation , cost saving is the cash inflows

Q: Propose whether operating income increase or decrease if the order is accepted with calculation…

A: Relevant cost refers to all those costs that change (increase or decrease) due to the change in…

3ñ

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Boisjoly Watch Imports has agreed to purchase 15,000 Swiss watches for 1 million francs at today’s spot rate. The firm’s financial manager, James Desreumaux, has noted the following current spot and forward rates: On the same day, Desreumaux agrees to purchase 15,000 more watches in 3 months at the same price of 1 million Swiss francs. What is the cost of the watches in U.S. dollars, if purchased at today’s spot rate? What is the cost in dollars of the second 15,000 batch if payment is made in 90 days and the spot rate at that time equals today’s 90-day forward rate? If the exchange rate for is 0.50 Swiss francs per dollar in 90 days, how much will Desreumaux have to pay (in dollars) for the watches?Dell is evaluating the proposal of a new factory in an overseas country (Germany). The currency in the overseas country is Euro. Dell will be renting a premise of 50,000 Square feet for this facility. Annually the factory expects to sell 20,000 units of Keyboard at 3 euro per keyboard. Total capital cost is 20,000 euro and is depreciated using the straight-line method over five years to a zero-salvage value. The monthly salary expense will be 3000 euro, whereas annual utility and other expense will be 2,000 euro. The annual total rent is 5,000 euro. Variable costs are 10 per cent of annual sales revenue. Assume; initially, Dell will require 4,000 euro in working capital for this project. However, after the project, Dell will not receive anything from the working capital. Besides, there are no additional cash inflows and outflows from this project. The project does not have any tax implication. Calculate cash flows from the asset (CFFA) for this project.Nashville Co. presently incurs costs of about 12 million Australian dollars (A$) per year for research and development expenses in Australia. It sells the products that are designed each year, and all of the products sold each year are invoiced in U.S. dollars. Nashville anticipates revenue of about $20 million per year, and about half of the revenue will be from sales to customers in Australia. The Australian dollar is presently valued at $1 (1 U.S. dollar), but it fluctuates a lot over time. Nashville Co. is planning a new project that will expand its sales to other regions within the United States, and the sales will be invoiced in dollars. Nashville can finance this project with a 5-year loan by (1) borrowing only Australian dollars, or (2) borrowing only U.S. dollars, or (3) borrowing one-half of the funds from each of these sources. The 5-year interest rates on an Australian dollar loan and a U.S. dollar loan are the same. If Nashville wants to use the form of financing that will…

- A Chinese automobile company is going to use one of its unused manufacturing plants in China to produce 20,000 cars a year. The cars will then be sold in the United States for $40,000 per vehicle. The plant has been fully depreciated. Production and assembly costs in China will be RMB 120,000 per vehicle and selling and administrative costs in the U.S. will be $30 million per year. The company will pay taxes in China at a rate of 35% and will not pay taxes in the U.S. Assume the current exchange rate is 7 RMB/$. It is expected that the plant will operate for 5 years and then cease operations. What are the expected yearly sales, expressed in RMB, assuming the current exchange rate? 5,600,000,000 800,000,000 560,000,000 3,600,000,000 What is the expected yearly net after-tax cash flow, expressed in RMB, assuming the exchange rate stays constant? 5,600,000,000 1,943,500,000 3,170,000,000 2,990,000,000 What is the change in cash flow, in RMB, if the RMB appreciates to 6.5…Thanks to the acquisition of a key patent, your company now has exclusive production rights for producing a new product called BigGassers (BGs) in North America. Production facilities for 200,000 BGs per year will require a $25 million capital expenditure. Production costs are estimated at $65 per BG. The BG marketing manager is confident that all 200,000 units can be sold for $100 per unit (in real terms) until the patent runs out five years hence. After the patent expires, other companies will enter the market and the price will go down. Assume that: The real cost of capital is 9% The technology to produce BGs will not change. Capital and production technology will stay the same in real terms. If your company invests immediately, full production begins after 12 months. Competitors know the technology and can enter as soon as the patent expires, that is, they can construct new plants in year 5 and start selling BGs in year 6 There are no taxes BG production facilities last 12 years.…Kristo Asafo Tools Ltd is filling an order from a Korean industrial company for machinery worth 160,000,000 Won. The export sale is denominated in Korean Won and is on a one-year open account basis. The opportunity cost of funds for Kristo Asafo Tools Ltd is 8% The Current spot rate between Won and Dollars is 800 Won/$. The forward Won sells at a discount of 12% per annum, but the finance staff of Kristo Asafo Tools Believes that the Won will drop only 9% in value over the next year. Kristo Asafo Tools Ltd faces the following choices This question compares the cost of a money market hedge with a forward hedge, and considers both alternatives against the possibility of remaining unhedged. a) Wait one year to receive the won amount and exchange Won for dollars at that time b) Sell the Won proceeds of the sale forward today c) Borrow Won from a Seoul bond at 20% per annum against the expected future receipt of the Korean importer’s payment d) What do you recommend and why?

- Thanks to acquisition of a key patent, your company now has exclusive production rights for barkelgassers (BGs) in North America. Production facilities for 210,000 BGs per year will require a $25.2 million immediate capital expenditure. Production costs are estimated at $67 per BG. The BG marketing manager is confident that all 210,000 units can be sold for $102 per unit (in real terms) until the patent runs out five years hence. After that, the marketing manager hasn’t a clue about what the selling price will be. Assume the real cost of capital is 10%. To keep things simple, also make the following assumptions: The technology for making BGs will not change. Capital and production costs will stay the same in real terms. Competitors know the technology and can enter as soon as the patent expires, that is, they can construct new plants in year 5 and start selling BGs in year 6. If your company invests immediately, full production begins after 12 months, that is, in year 1. (Assume it…Thanks to acquisition of a key patent, your company now has exclusive production rights for barkelgassers (BGs) in North America. Production facilities for 245,000 BGs per year will require a $25.9 million immediate capital expenditure. Production costs are estimated at $74 per BG. The BG marketing manager is confident that all 245,000 units can be sold for $109 per unit (in real terms) until the patent runs out five years hence. After that, the marketing manager hasn’t a clue about what the selling price will be. Assume the real cost of capital is 10%. To keep things simple, also make the following assumptions: The technology for making BGs will not change. Capital and production costs will stay the same in real terms. Competitors know the technology and can enter as soon as the patent expires, that is, they can construct new plants in year 5 and start selling BGs in year 6. If your company invests immediately, full production begins after 12 months, that is, in year 1. (Assume it…The MGC Company has a contract with a hauler to transport its naptha requirements of 3,600,000 liter per year from a refinery in Batangas to its site in Paco at a cost of P1.05 per liter. It is proposed that the company buys a tanker with a capacity of 18,000 liters to service its requirements at a first cost of P 8,000,000 life is 6 years and a salvage value of P 800,000. Other expenses are as follows: a.) Diesel fuel at P7.95 per liter and the tanker consumers 120 liter per round trip from Paco to Batangas and back.b.) Lubricating oil servicing is P3,200 per month.c.) Labor including overtime and fringe benefits for one driver and one helper is P21,000 per month.d.) Annual taxes and insurance. 5% of first cost.e.) General maintenance per year is P40,000f.) Tires cost P 32,000 per set and will be renewed every 150 round trips. What should the MGC Company do if a 5% interest rate on investment is included in the analysis?

- Davao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? If the sales volume is estimated to be 2,100 tons in the next year, and if the prices and costs stay at the same levels and amounts next year, the after-tax income that Davao can expect for next year is? Assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao’s current after-tax income of P94,500?1: Mars Technologies is considering setting up a plant in a foreign country. The plant will have an estimated useful life of 4 years and the estimated costs of setting it up are $20 million. The company’s CFO has estimated the following cash flows associated with the new plant: Year 1 = $5.8 million Year 2 = $7.9 million Year 3 = $8.6 million Year 4 = $10.5 million The company is concerned about its current exports to the foreign country, which are expected to be reduced by $1,200,000 for each of the 4 years. Given that the company’s required rate of return is 12%, what is the NPV of the project? Q#2: Jupiter Inc.’s directors are considering expanding their operations in foreign markets. They estimate that the cost of expansion is approximately $42 million. The company’s CFO has estimated that new foreign operations will generate the following cash flows: Year 1 = $2,120,000 Year 2 = $2,838,000 Year 3 = $3,480,000 Year 4 = $4,570,000 Year 5 onward, the cash flow stream is going to…Davao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? Answer: 221,500 Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao’s current after-tax income of P94,500? Answer: 307.5