Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 27, Problem 11P

Boisjoly Watch Imports has agreed to purchase 15,000 Swiss watches for 1 million francs at today’s spot rate. The firm’s

On the same day, Desreumaux agrees to purchase 15,000 more watches in 3 months at the same price of 1 million Swiss francs.

- a. What is the cost of the watches in U.S. dollars, if purchased at today’s spot rate?

- b. What is the cost in dollars of the second 15,000 batch if payment is made in 90 days and the spot rate at that time equals today’s 90-day forward rate?

- c. If the exchange rate for is 0.50 Swiss francs per dollar in 90 days, how much will Desreumaux have to pay (in dollars) for the watches?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

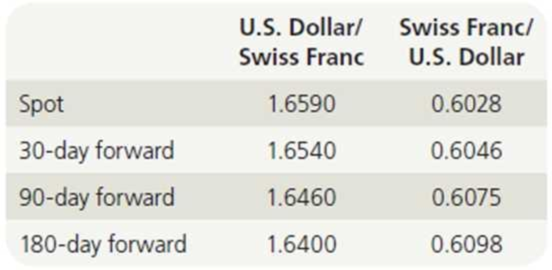

Boisjoly Watch Imports has agreed to purchase 15,000 Swiss watches for 1 million francs at today's spot rate. The firm's financial manager, James Desreumaux, has noted the following current spot and forward rates:

U.S. Dollar / Franc

Franc / U.S. Dollar

Spot

1.6590

0.6028

30-day forward

1.6540

0.6046

90-day forward

1.6460

0.6075

180-day forward

1.6400

0.6098

On the same day, Desreumaux agrees to purchase 15,000 more watches in 3 months at the same price of 1 million francs.

What is the cost of the watches, in U.S. dollars, if purchased at today's spot rate?

Cost of Watches

=

Swiss Francs

/

Franc/U.S

Dollar

Intelledex, Inc., a robotics manufacturer based in Corvallis, Oregon, has won a bid to deliver robotics equipment to a Swiss automobile company. The bid is SF8 million. Intelledex will receive the entire SF8 million upon delivery of the equipment six months from now. The present spot rate for the Swiss franc is SF8.000/$, and the six-month forward rate is SF8.2000/$. Intelledex can borrow U.S. dollars at 12% per annum or Swiss francs at 17% per annum. Its opportunity cost of capital is 14% per annum.

1. Explain the various ways in which Intelledex could cover its foreign exchangeexposure. 2. What would the bread-even opportunity cost of capital have to be for them to beindifferent between the various alternatives?3. Explain how economic exposure might change the expected profitability of this order.

Kristo Asafo Tools Ltd is filling an order from a Korean industrial company for machinery worth 160,000,000 Won. The export sale is denominated in Korean Won and is on a one-year open account basis. The opportunity cost of funds for Kristo Asafo Tools Ltd is 8%

The Current spot rate between Won and Dollars is 800 Won/$. The forward Won sells at a discount of 12% per annum, but the finance staff of Kristo Asafo Tools Believes that the Won will drop only 9% in value over the next year. Kristo Asafo Tools Ltd faces the following choices

This question compares the cost of a money market hedge with a forward hedge, and considers both alternatives against the possibility of remaining unhedged.

a) Wait one year to receive the won amount and exchange Won for dollars at that time

b) Sell the Won proceeds of the sale forward today

c) Borrow Won from a Seoul bond at 20% per annum against the expected future receipt of the Korean importer’s payment

d) What do you recommend and why?

Chapter 27 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 27 - Define each of the following terms: a....Ch. 27 - Prob. 2QCh. 27 - Prob. 3QCh. 27 - Prob. 4QCh. 27 - If the United States imports more goods from...Ch. 27 - Prob. 6QCh. 27 - Should firms require higher rates of return on...Ch. 27 - Prob. 8QCh. 27 - Prob. 9QCh. 27 - Prob. 10Q

Ch. 27 - Prob. 1PCh. 27 - The nominal yield on 6-month T-bills is 7%, while...Ch. 27 - Prob. 3PCh. 27 - If euros sell for 1.50 (U.S.) per euro, what...Ch. 27 - Suppose that the exchange rate is 0.60 dollars per...Ch. 27 - Prob. 6PCh. 27 - Prob. 7PCh. 27 - Prob. 8PCh. 27 - Prob. 9PCh. 27 - Prob. 10PCh. 27 - Boisjoly Watch Imports has agreed to purchase...Ch. 27 - Prob. 12PCh. 27 - Prob. 13PCh. 27 - Prob. 14PCh. 27 - Prob. 1MCCh. 27 - Prob. 2MCCh. 27 - Prob. 3MCCh. 27 - Prob. 4MCCh. 27 - Prob. 5MCCh. 27 - Prob. 6MCCh. 27 - Prob. 7MCCh. 27 - Prob. 8MCCh. 27 - Prob. 9MCCh. 27 - Prob. 10MCCh. 27 - Prob. 11MCCh. 27 - Prob. 13MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Azar Plc, which imports optical equipment from Germany for sale to UKproviders of ophthalmic services, has ordered 50 ophthalmic testing machines from a German supplier at a price of Euro 7,500 each. The supplier will deliver the machines during the coming month, but Azar Plc has agreed with the supplier that it will not have to pay for the machines until Azar Plc has installedthem and been paid by its customers, so it has negotiated payment in three months’ time. Azar Plc has an arrangement with its banks whereby it can borrow to cover short-term cash shortages at 2.0% above base rate, and can invest surplus funds at 0.25% below base rate, in both the UK and Germany. Current exchange rates Euro/£Spot 1.1415 -3 months forward 1.1424365 -Current base rates 1.1385Germany 1.0%UK 0.5% Using the information above, do calculations to evaluate three ways in which Azar Plc take action to reduce…arrow_forwardArvin Australian Imports has agreed to purchase 15,000cases of Australian wine for 4 million Australian dollars at today’s spot rate. The firm’sfinancial manager, Sarah Vintnor, has noted the following current spot and forward rates: On the same day, Vintnor agrees to purchase 15,000 more cases of wine in 3 months at thesame price of 4 million Australian dollars. a. What is the price of the wine in U.S. dollars if it is purchased at today’s spot rate?b. What is the cost in U.S. dollars of the second 15,000 cases if payment is made in90 days and the spot rate at that time equals today’s 90-day forward rate?c. If the exchange rate for the Australian dollar is 1.20 to $1 in 90 days, how much willVintnor have to pay for the wine (in U.S. dollars)?arrow_forwardAshGold Products is completing a new factory building in Canada and must make a final construction payment of C$28,000,000 in six months. Foreign exchange and interest rate quotations are as follows:Present spot rate:C$ 1.4000/US$Six-month forward rate:C$ 1.4200/US$Canadian six-month interest rate:13% per annumU.S. six-month interest rate10% per annumThe financial manager’s own analysis suggests that in six months the following spot rates can be expected:Highest expected rate:C$1.4000/US$Most likely rate:C$1.4300/US$Lowest expected rate:C$1.4500/US$Ashgold Products does not presently have any excess dollar cash balances. However, it expects to obtain adequate cash from an income tax refund due in six months. Ashgold’s weighted average cost of capital is 20% per annum. What alternatives are available for making payment, and what are the advantages or disadvantages of each? (2) A key issue facing financial executives of multinational firms is exposure to exchange rate changes.a. Define…arrow_forward

- AshGold Products is completing a new factory building in Canada and must make a final construction payment of C$28,000,000 in six months. Foreign exchange and interest rate quotations are as follows:Present spot rate:C$ 1.4000/US$Six-month forward rate:C$ 1.4200/US$Canadian six-month interest rate:13% per annumU.S. six-month interest rate10% per annumThe financial manager’s own analysis suggests that in six months the following spot rates can be expected:Highest expected rate:C$1.4000/US$Most likely rate:C$1.4300/US$Lowest expected rate:C$1.4500/US$Ashgold Products does not presently have any excess dollar cash balances. However, it expects to obtain adequate cash from an income tax refund due in six months. Ashgold’s weighted average cost of capital is 20% per annum. What alternatives are available for making payment, and what are the advantages or disadvantages of each?arrow_forwardHudson Valley Distributors wants to be sure it has 10,000 cases of Beaujolais Nouveau to sell next November. In January, they enters into an agreement to buy the wine at a price of 30 euro per case. Payment will be due at the end of November. They expect to sell the wine to restaurants and retailers for $63 per case. If Hudson Valley does not hedge its position and the exchange rate in November is $1.50 /euro, what is the gross profit on the wine? (Round to the nearest dollar.) a. 330,000 b. 150,000 c. (180,000) d. 180,000arrow_forwardHithergreen Products is completing a new factory building in Canada and must make a final construction payment of C$28,000,000 in six months. Foreign exchange and interest rate quotations are as follows: Present spot rate: C$ 1.4000/US$ Six-month forward rate: C$ 1.4200/US$ Canadian six-month interest rate: 13% per annum U.S. six-month interest rate 10% per annum The financial manager’s own analysis suggests that in six months the following spot rates can be expected: Highest expected rate: C$1.4000/US$ Most likely rate: C$1.4300/US$ Lowest expected rate: C$1.4500/US$ Hithergreen Products does not presently have any excess dollar cash balances. However, it expects to obtain adequate cash from an income tax refund due in six months. Hithergreen’s weighted average cost of capital is 20% per annum. What alternatives are available for making payment, and what are the advantages or…arrow_forward

- Marula Breweries of Limpopo, South Africa, has received an order for 10 000cartons of beer from Alicante Importers of Alicante, Spain. The beer will be exportedto Spain under the terms of a letter of credit issued by a Madrid bank on behalf ofAlicante Importers. The letter of credit specifies that the face value of the shipment,US$720 000, will be paid 90 days later, after the Madrid bank accepts a draft drawnby Marula Breweries in accordance with the terms of the letter of credit.The current discount rate on a three-month banker’s acceptance is 8% per annum,and Marula Breweries estimates its weighted average cost of capital to be 20% perannum. The commission for selling a banker’s acceptance in the discount market is1.2% of the face amount.How much cash will Marula Breweries receive from the sale if it holds theacceptance until maturity? Do you recommend that Marula Breweries hold theacceptance until maturity, or discount it at once in the U.S. banker’s acceptancemarket?arrow_forwardABC is asked to quote a price in Jamaican dollars for computer sales to a Jamaican company. The computers will be paid for in four equal, quarterly installments, beginning 90 days from now. ABC requires a minimum price of $2.5 million to accept this contract. Suppose the spot and forward rates for the J$ are as follows: Spot 90-Day 180-Day 270-Day 360-Day $0.0307 $0.0302 $0.0298 $0.0293 $0.0287 What is the minimum J$ price that ABC should quote for this order? a. J$ 87,108,014 b. J$ 82,781,457 c. J$ 84,745,763 d. J$ 81,433,225arrow_forwardArvin Australian Imports has agreed to purchase 15,000 cases of Australian wine for 5 million Australian dollars at today's spot rate. The firm's financial manager, Sarah Vintnor, has noted the following current spot and forward rates: U.S. Dollar/Australian Dollar Australian Dollar/U.S. Dollar Spot 0.7259 1.3776 30-day forward 0.7264 1.3767 90-day forward 0.7279 1.3738 180-day forward 0.7289 1.3719 On the same day, Vintnor agrees to purchase 15,000 more cases of wine in 3 months at the same price of 5 million Australian dollars. What is the price of the wine in U.S. dollars if it is purchased at today's spot rate? Round your answer to the nearest cent. $ What is the cost in U.S. dollars of the second 15,000 cases if payment is made in 90 days and the spot rate at that time equals today's 90-day forward rate? Round your answer to the nearest cent. $ If the exchange rate for the Australian dollar is 1.29 to $1 in 90 days, how much will Vintnor have to pay for…arrow_forward

- Arvin Australian Imports has agreed to purchase 15,000 cases of Australian wine for 6 million Australian dollars at today's spot rate. The firm's financial manager, Sarah Vintnor, has noted the following current spot and forward rates: U.S. Dollar/Australian Dollar Australian Dollar/U.S. Dollar Spot 0.7285 1.3727 30-day forward 0.7287 1.3723 90-day forward 0.7294 1.3710 180-day forward 0.7306 1.3687 On the same day, Vintnor agrees to purchase 15,000 more cases of wine in 3 months at the same price of 6 million Australian dollars. a. What is the price of the wine in U.S. dollars if it is purchased at today's spot rate? Round your answer to the nearest cent. $ ___ b. What is the cost in U.S. dollars of the second 15,000 cases if payment is made in 90 days and the spot rate at that time equals today's 90-day forward rate? Round your answer to the nearest cent. $ ___ c. If the exchange rate for the Australian dollar is 1.31 to $1 in 90 days, how much will Vintnor have to…arrow_forwardYou are the managing Director of Sunkwa limited a food processing company based in Atlanta in the United States of America. You are planning to visit Geneva, Switzerland in three months’ time to attend an international business conference. You expect to incur the total cost of SF 5,000 for lodging, meals and transportation during your stay. As of today, the spot exchange rate is $0.60/SF and the three-month forward rate is $0.63/SF. You can buy the three-month call option on SF with the exercise rate of $0.64/SF for the premium of $0.05 per SF. Assume that your expected future spot exchange rate is the same as the forward rate. The three-month interest rate is 6 percent per annum in the United States and 4 percent per annum in Switzerland. 1. calculate the future dollar cost of meeting this SF obligation if you decide to hedge using a forward contract. 2. at what future spot exchange rate will you be…arrow_forwardYou are the managing Director of Sunkwa limited a food processing company based in Atlanta in the United States of America. You are planning to visit Geneva, Switzerland in three months’ time to attend an international business conference. You expect to incur the total cost of SF 5,000 for lodging, meals and transportation during your stay. As of today, the spot exchange rate is $0.60/SF and the three-month forward rate is $0.63/SF. You can buy the three-month call option on SF with the exercise rate of $0.64/SF for the premium of $0.05 per SF. Assume that your expected future spot exchange rate is the same as the forward rate. The three-month interest rate is 6 percent per annum in the United States and 4 percent per annum in Switzerland. QuestionCalculate your expected dollar cost of buying SF5, 000 if you choose to hedge via call option on SF.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Foreign Exchange Risks; Author: Kaplan UK;https://www.youtube.com/watch?v=ne1dYl3WifM;License: Standard Youtube License