A variety of interested parties-including existing and prospective creditors (such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitors-conduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specific facet of the business's condition or performance may vary. e following parties are either currently affiliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following descriptio answer the question "Who Am I?" and (2) identify the class of financial ratios that they might be interested in. ell materials to GPI and could go out of business quickly if I don't collect the payments for my goods. When I perform a ratio analysis of my tomers, I should focus on the following: Does GPI pay its current bills in full and on time? This is reflected by GPI's Because GPI can pay my bill using either current earnings or borrowed fun debt management ratios. for me to examine GPI's

A variety of interested parties-including existing and prospective creditors (such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitors-conduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specific facet of the business's condition or performance may vary. e following parties are either currently affiliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following descriptio answer the question "Who Am I?" and (2) identify the class of financial ratios that they might be interested in. ell materials to GPI and could go out of business quickly if I don't collect the payments for my goods. When I perform a ratio analysis of my tomers, I should focus on the following: Does GPI pay its current bills in full and on time? This is reflected by GPI's Because GPI can pay my bill using either current earnings or borrowed fun debt management ratios. for me to examine GPI's

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

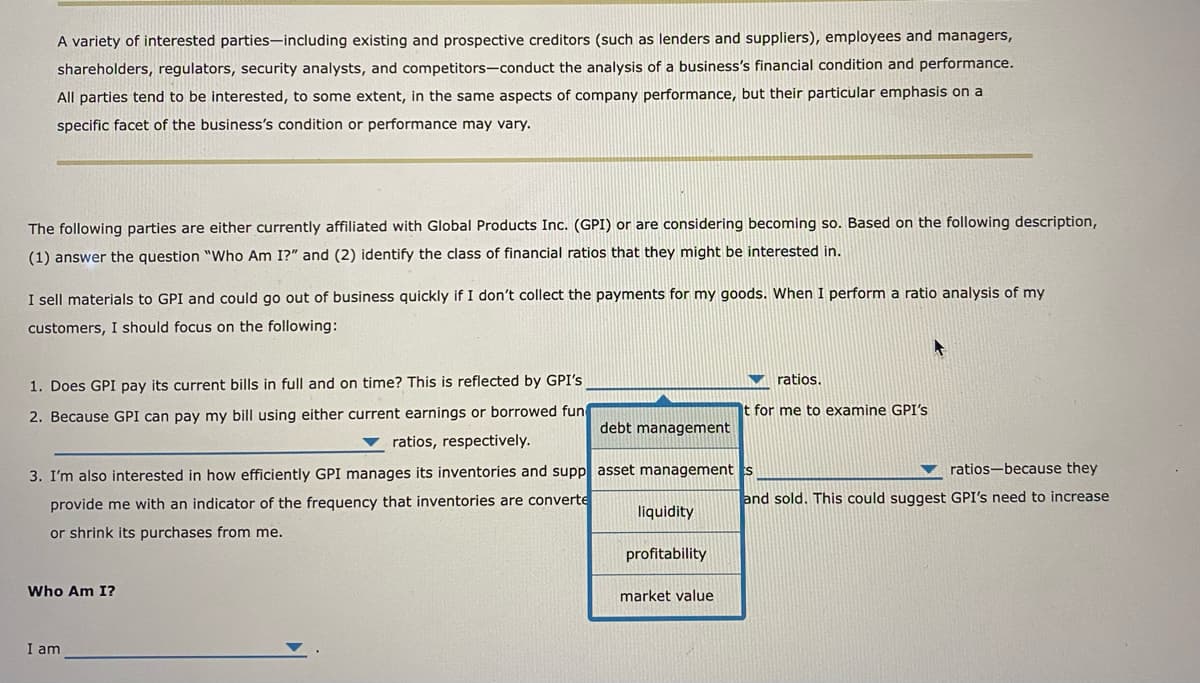

Transcribed Image Text:A variety of interested parties-including existing and prospective creditors (such as lenders and suppliers), employees and managers,

shareholders, regulators, security analysts, and competitors-conduct the analysis of a business's financial condition and performance.

All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a

specific facet of the business's condition or performance may vary.

The following parties are either currently affiliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following description,

(1) answer the question "Who Am I?" and (2) identify the class of financial ratios that they might be interested in.

I sell materials to GPI and could go out of business quickly if I don't collect the payments for my goods. When I perform a ratio analysis of my

customers, I should focus on the following:

1. Does GPI pay its current bills in full and on time? This is reflected by GPI's

2. Because GPI can pay my bill using either current earnings or borrowed fun

ratios, respectively.

Who Am I?

debt management

3. I'm also interested in how efficiently GPI manages its inventories and supp asset management s

provide me with an indicator of the frequency that inventories are converte

or shrink its purchases from me.

I am

liquidity

profitability

market value

ratios.

for me to examine GPI's

ratios-because they

and sold. This could suggest GPI's need to increase

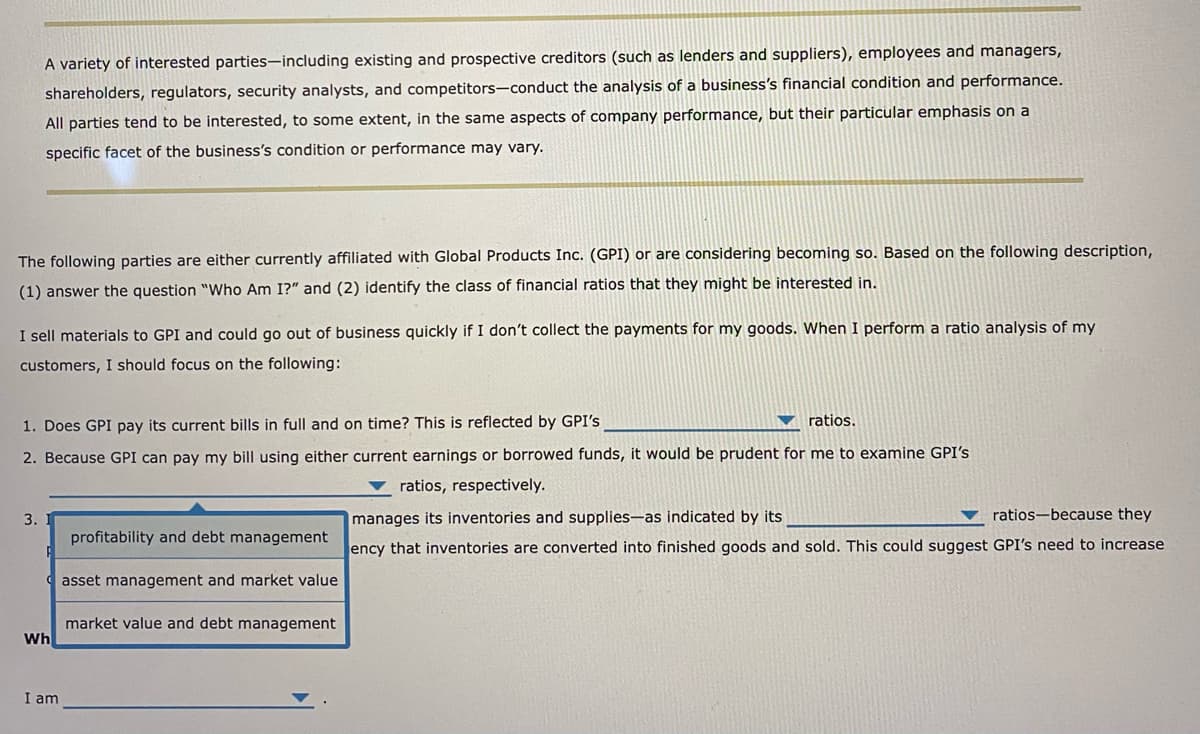

Transcribed Image Text:A variety of interested parties-including existing and prospective creditors (such as lenders and suppliers), employees and managers,

shareholders, regulators, security analysts, and competitors-conduct the analysis of a business's financial condition and performance.

All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a

specific facet of the business's condition or performance may vary.

The following parties are either currently affiliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following description,

(1) answer the question "Who Am I?" and (2) identify the class of financial ratios that they might be interested in.

I sell materials to GPI and could go out of business quickly if I don't collect the payments for my goods. When I perform a ratio analysis of my

customers, I should focus on the following:

1. Does GPI pay its current bills in full and on time? This is reflected by GPI's

ratios.

2. Because GPI can pay my bill using either current earnings or borrowed funds, it would be prudent for me to examine GPI's

ratios, respectively.

manages its inventories and supplies-as indicated by its

ratios because they

ency that inventories are converted into finished goods and sold. This could suggest GPI's need to increase

3.

Wh

I am

profitability and debt management

asset management and market value

market value and debt management

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education