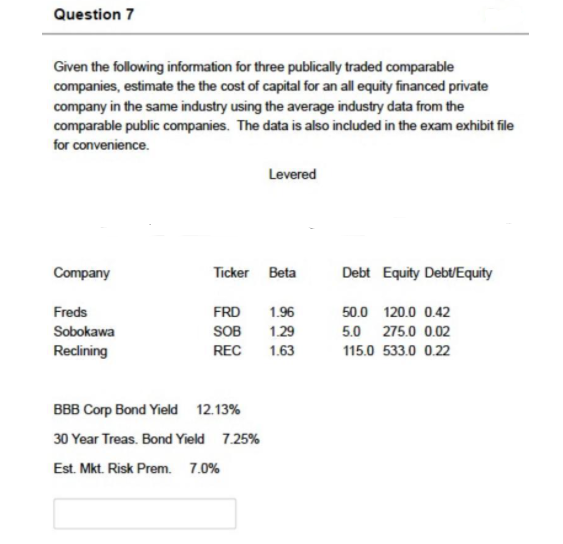

Question 7 Given the following information for three publically traded comparable companies, estimate the the cost of capital for an all equity financed private company in the same industry using the average industry data from the comparable public companies. The data is also included in the exam exhibit file for convenience. Levered Company Ticker Beta Debt Equity DebUEquity Freds FRD 1.96 50.0 120.0 0.42 SOB REC Sobokawa 1.29 5.0 275.0 0.02 Reclining 1.63 115.0 533.0 0.22 BBB Corp Bond Yield 12.13% 30 Year Treas. Bond Yield 7.25% Est. Mkt. Risk Prem. 7.0%

Question 7 Given the following information for three publically traded comparable companies, estimate the the cost of capital for an all equity financed private company in the same industry using the average industry data from the comparable public companies. The data is also included in the exam exhibit file for convenience. Levered Company Ticker Beta Debt Equity DebUEquity Freds FRD 1.96 50.0 120.0 0.42 SOB REC Sobokawa 1.29 5.0 275.0 0.02 Reclining 1.63 115.0 533.0 0.22 BBB Corp Bond Yield 12.13% 30 Year Treas. Bond Yield 7.25% Est. Mkt. Risk Prem. 7.0%

Chapter12: Capital Structure

Section: Chapter Questions

Problem 9PROB

Related questions

Question

Please send complete handwritten solution for Q7

only handwritten solution accepted

Transcribed Image Text:Question 7

Given the following information for three publically traded comparable

companies, estimate the the cost of capital for an all equity financed private

company in the same industry using the average industry data from the

comparable public companies. The data is also included in the exam exhibit file

for convenience.

Levered

Company

Ticker Beta

Debt Equity DebUEquity

Freds

FRD

1.96

50.0 120.0 0.42

SOB

REC

Sobokawa

1.29

5.0 275.0 0.02

Reclining

1.63

115.0 533.0 0.22

BBB Corp Bond Yield 12.13%

30 Year Treas. Bond Yield 7.25%

Est. Mkt. Risk Prem. 7.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1 Computation of cost of capital of FREDS

VIEWStep 2 Computation of cost of capital of FREDS

VIEWStep 3Computation of cost of capital of FREDS

VIEWStep 4 Computation of cost of capital of SOBOKAWA

VIEWStep 5 Computation of cost of capital of SOBOKAWA

VIEWStep 6 Computation of cost of capital of SOBOKAWA

VIEWStep 7 Computation of cost of capital of RECLINING

VIEWStep 8 Computation of cost of capital of RECLINING

VIEWStep 9 Computation of cost of capital of RECLINING

VIEWStep 10 Computation of cost of capital of all equity financed private company

VIEWStep by step

Solved in 10 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning