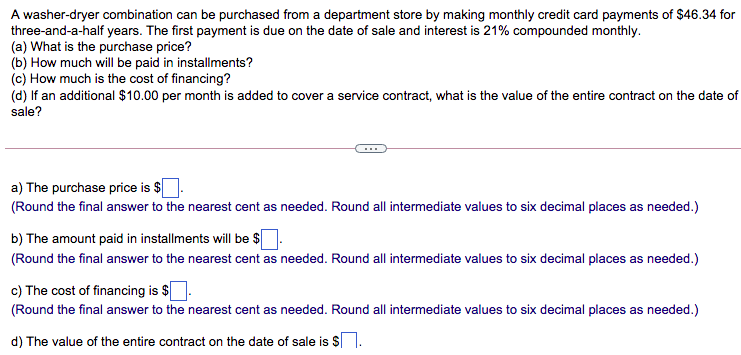

A washer-dryer combination can be purchased from a department store by making monthly credit card payments of $46.34 for three-and-a-half years. The first payment is due on the date of sale and interest is 21% compounded monthly. (a) What is the purchase price? (b) How much will be paid in installments? (c) How much is the cost of financing? (d) If an additional $10.00 per month is added to cover a service contract, what is the value of the entire contract on the date of sale?

A washer-dryer combination can be purchased from a department store by making monthly credit card payments of $46.34 for three-and-a-half years. The first payment is due on the date of sale and interest is 21% compounded monthly. (a) What is the purchase price? (b) How much will be paid in installments? (c) How much is the cost of financing? (d) If an additional $10.00 per month is added to cover a service contract, what is the value of the entire contract on the date of sale?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 3P: Del Hawley, owner of Hawleys Hardware, is negotiating with First City Bank for a 1-year loan of...

Related questions

Question

6

Transcribed Image Text:A washer-dryer combination can be purchased from a department store by making monthly credit card payments of $46.34 for

three-and-a-half years. The first payment is due on the date of sale and interest is 21% compounded monthly.

(a) What is the purchase price?

(b) How much will be paid in installments?

(c) How much is the cost of financing?

(d) If an additional $10.00 per month is added to cover a service contract, what is the value of the entire contract on the date of

sale?

a) The purchase price is $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

b) The amount paid in installments will be $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

c) The cost of financing is $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

d) The value of the entire contract on the date of sale is $.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning