a) What is the Equilibrium Price and Equilibrium Quantity b) If the government imposes a $15 per unit tax on sellers on this good what is the new quantity sold in units, how much will the buyers pay, how much will sellers receive?, and how much will the government receive in tax revenue? c) What is the price elasticity of demand and over this price change? What about the supply? d) Based on the elasticities calculated above, who will bear a greater burden from the tax? Why?

a) What is the Equilibrium Price and Equilibrium Quantity b) If the government imposes a $15 per unit tax on sellers on this good what is the new quantity sold in units, how much will the buyers pay, how much will sellers receive?, and how much will the government receive in tax revenue? c) What is the price elasticity of demand and over this price change? What about the supply? d) Based on the elasticities calculated above, who will bear a greater burden from the tax? Why?

Chapter3: Market Demand And Supply

Section: Chapter Questions

Problem 13SQ

Related questions

Question

a) What is the

b) If the government imposes a $15 per unit tax on sellers on this good what is the new quantity sold in units, how much will the buyers pay, how much will sellers receive?, and how much will the government receive in tax revenue?

c) What is the price elasticity of

d) Based on the elasticities calculated above, who will bear a greater burden from the tax? Why?

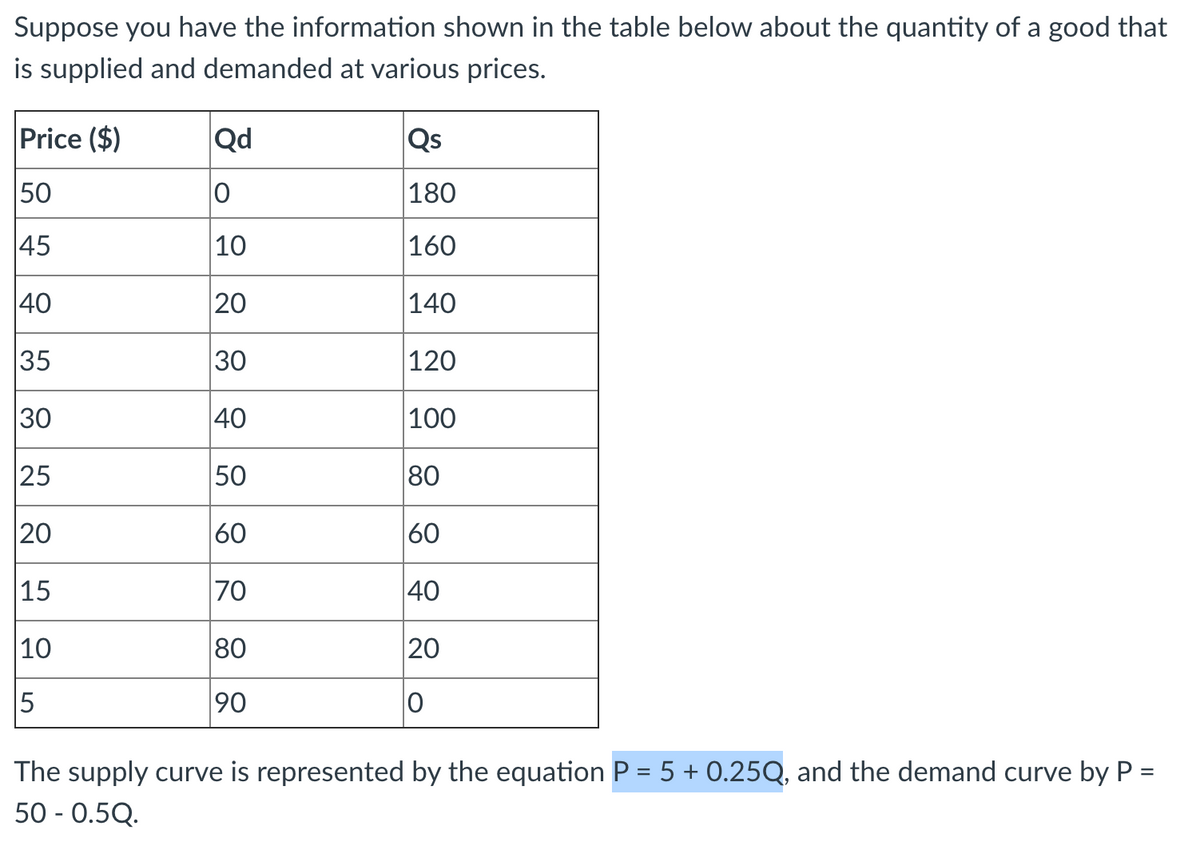

Transcribed Image Text:Suppose you have the information shown in the table below about the quantity of a good that

is supplied and demanded at various prices.

Price ($)

Qd

Qs

50

180

45

|10

|160

40

20

140

35

30

|120

30

40

100

25

50

80

20

60

60

|15

70

40

|10

80

20

5

90

The supply curve is represented by the equation P = 5 + 0.25Q, and the demand curve by P =

50 - 0.5Q.

Expert Solution

Step 1

We are going to find the tax incidence, equilibrium price and quantity to answer this question.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning