(a) What is the optimal solution and the total profit contribution (in $)? DRB DRW total profit contribution $ (b) Another supplier offered to provide Deegan Industries with an additional 500 pounds of the steel alloy at $2 per pound. Should Deegan purchase the additional pounds of the steel alloy? Explain. O Yes, there is no surplus of steel so any additional steel that becomes available should be purchased. O Yes, the dual value for steel available is 8.8. Each pound of steel will increase profits more than the $2 per pound that the supplier is offering. O No, there is a slack value of 6,273, so additional pounds of steel will not increase profits. O No, the dual value for steel available is 0.6. Each pound of steel will not increase profits enough to justify the $2 per pound that the supplier is offering. O No, the allowable increase for steel is only 24 pounds, so the additional profits are not applicable for 500 pounds. (c) Deegan is considering using overtime to increase the available assembly time. What would you advise Deegan to do regarding this option? Explain. Constraint ? has a slack. Increasing the number of hours of assembly time will ---Select---✓ profits.

(a) What is the optimal solution and the total profit contribution (in $)? DRB DRW total profit contribution $ (b) Another supplier offered to provide Deegan Industries with an additional 500 pounds of the steel alloy at $2 per pound. Should Deegan purchase the additional pounds of the steel alloy? Explain. O Yes, there is no surplus of steel so any additional steel that becomes available should be purchased. O Yes, the dual value for steel available is 8.8. Each pound of steel will increase profits more than the $2 per pound that the supplier is offering. O No, there is a slack value of 6,273, so additional pounds of steel will not increase profits. O No, the dual value for steel available is 0.6. Each pound of steel will not increase profits enough to justify the $2 per pound that the supplier is offering. O No, the allowable increase for steel is only 24 pounds, so the additional profits are not applicable for 500 pounds. (c) Deegan is considering using overtime to increase the available assembly time. What would you advise Deegan to do regarding this option? Explain. Constraint ? has a slack. Increasing the number of hours of assembly time will ---Select---✓ profits.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter6: Optimization Models With Integer Variables

Section: Chapter Questions

Problem 48P

Related questions

Question

100%

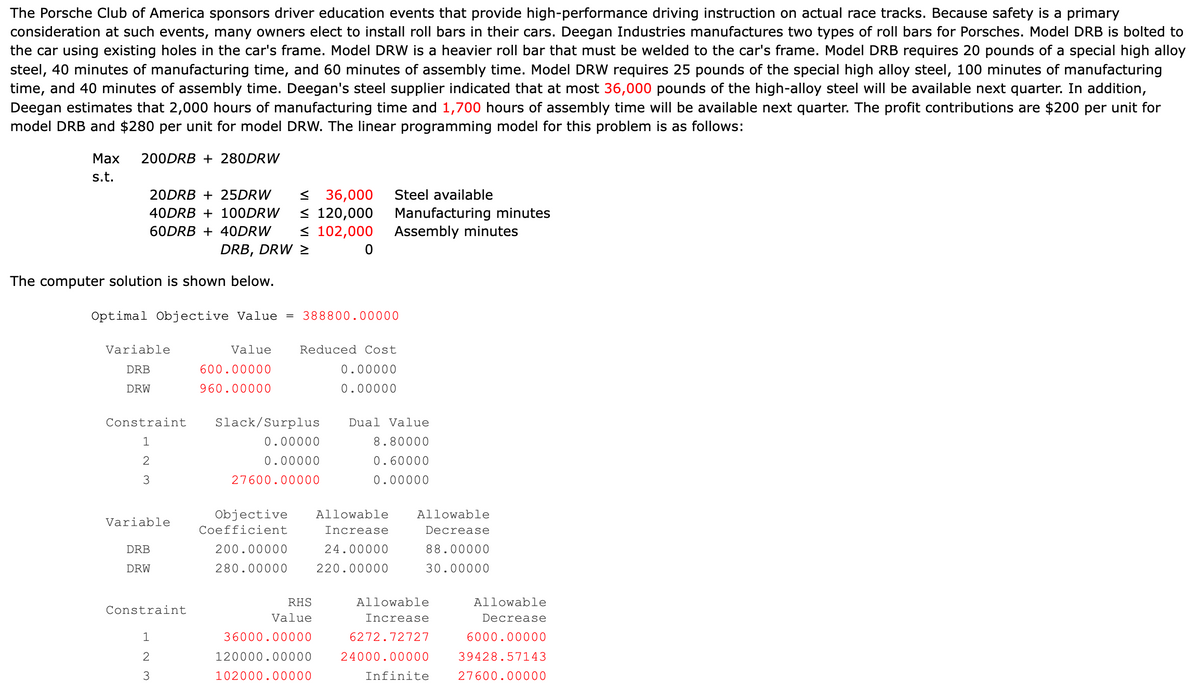

Transcribed Image Text:The Porsche Club of America sponsors driver education events that provide high-performance driving instruction on actual race tracks. Because safety is a primary

consideration at such events, many owners elect to install roll bars in their cars. Deegan Industries manufactures two types of roll bars for Porsches. Model DRB is bolted to

the car using existing holes in the car's frame. Model DRW is a heavier roll bar that must be welded to the car's frame. Model DRB requires 20 pounds of a special high alloy

steel, 40 minutes of manufacturing time, and 60 minutes of assembly time. Model DRW requires 25 pounds of the special high alloy steel, 100 minutes of manufacturing

time, and 40 minutes of assembly time. Deegan's steel supplier indicated that at most 36,000 pounds of the high-alloy steel will be available next quarter. In addition,

Deegan estimates that 2,000 hours of manufacturing time and 1,700 hours of assembly time will be available next quarter. The profit contributions are $200 per unit for

model DRB and $280 per unit for model DRW. The linear programming model for this problem is as follows:

Max

s.t.

200DRB + 280DRW

The computer solution is shown below.

20DRB + 25DRW

40DRB + 100DRW

60DRB + 40DRW

DRB, DRW >

Variable

DRB

DRW

Optimal Objective Value = 388800.00000

Constraint

1

2

3

Variable

DRB

DRW

Constraint

1

2

W N

3

≤36,000

≤ 120,000

≤ 102,000

0

Value

600.00000

960.00000

Slack/Surplus

Reduced Cost

0.00000

0.00000

0.00000

0.00000

27600.00000

200.00000

280.00000

Steel available

Manufacturing minutes

Assembly minutes

Objective Allowable Allowable

Coefficient

Decrease

Increase

24.00000

88.00000

220.00000

30.00000

RHS

Value

36000.00000

120000.00000

102000.00000

Dual Value

8.80000

0.60000

0.00000

Allowable

Increase

6272.72727

24000.00000

Infinite

Allowable

Decrease

6000.00000

39428.57143

27600.00000

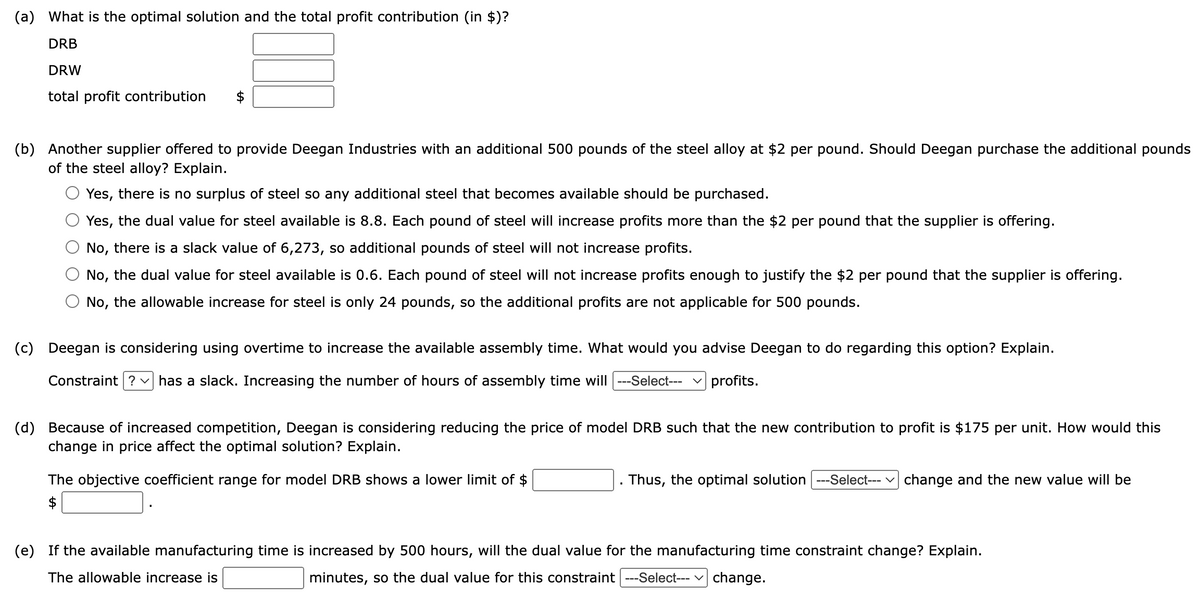

Transcribed Image Text:(a) What is the optimal solution and the total profit contribution (in $)?

DRB

DRW

total profit contribution

(b) Another supplier offered to provide Deegan Industries with an additional 500 pounds of the steel alloy at $2 per pound. Should Deegan purchase the additional pounds

of the steel alloy? Explain.

Yes, there is no surplus of steel so any additional steel that becomes available should be purchased.

Yes, the dual value for steel available is 8.8. Each pound of steel will increase profits more than the $2 per pound that the supplier is offering.

No, there is a slack value of 6,273, so additional pounds of steel will not increase profits.

No, the dual value for steel available is 0.6. Each pound of steel will not increase profits enough to justify the $2 per pound that the supplier is offering.

No, the allowable increase for steel is only 24 pounds, so the additional profits are not applicable for 500 pounds.

(c) Deegan is considering using overtime to increase the available assembly time. What would you advise Deegan to do regarding this option? Explain.

Constraint ? ✓ has a slack. Increasing the number of hours of assembly time will |---Select--- profits.

(d) Because of increased competition, Deegan is considering reducing the price of model DRB such that the new contribution to profit is $175 per unit. How would this

change in price affect the optimal solution? Explain.

The objective coefficient range for model DRB shows a lower limit of $

$

Thus, the optimal solution ---Select--- change and the new value will be

(e) If the available manufacturing time is increased by 500 hours, will the dual value for the manufacturing time constraint change? Explain.

The allowable increase is

minutes, so the dual value for this constraint ---Select--- ✓ change.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,