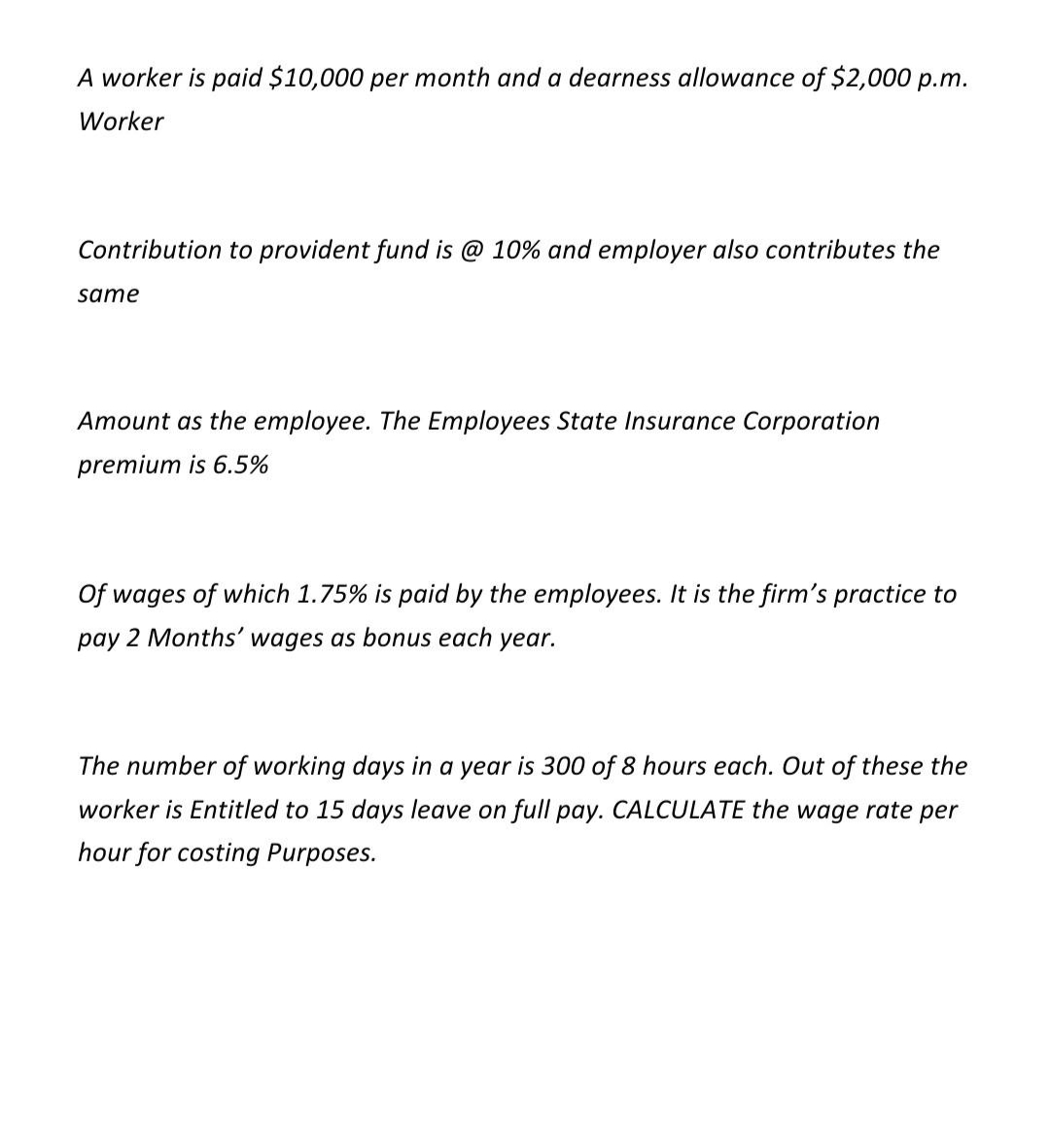

A worker is paid $10,000 per month and a dearness allowance of $2,000 p.m. Worker Contribution to provident fund is @ 10% and employer also contributes the same Amount as the employee. The Employees State Insurance Corporation premium is 6.5% Of wages of which 1.75% is paid by the employees. It is the firm's practice to pay 2 Months' wages as bonus each year.

A worker is paid $10,000 per month and a dearness allowance of $2,000 p.m. Worker Contribution to provident fund is @ 10% and employer also contributes the same Amount as the employee. The Employees State Insurance Corporation premium is 6.5% Of wages of which 1.75% is paid by the employees. It is the firm's practice to pay 2 Months' wages as bonus each year.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 32E

Related questions

Question

Transcribed Image Text:A worker is paid $10,000 per month and a dearness allowance of $2,000 p.m.

Worker

Contribution to provident fund is @ 10% and employer also contributes the

same

Amount as the employee. The Employees State Insurance Corporation

premium is 6.5%

Of wages of which 1.75% is paid by the employees. It is the firm's practice to

pay 2 Months' wages as bonus each year.

The number of working days in a year is 300 of 8 hours each. Out of these the

worker is Entitled to 15 days leave on full pay. CALCULATE the wage rate per

hour for costing Purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub