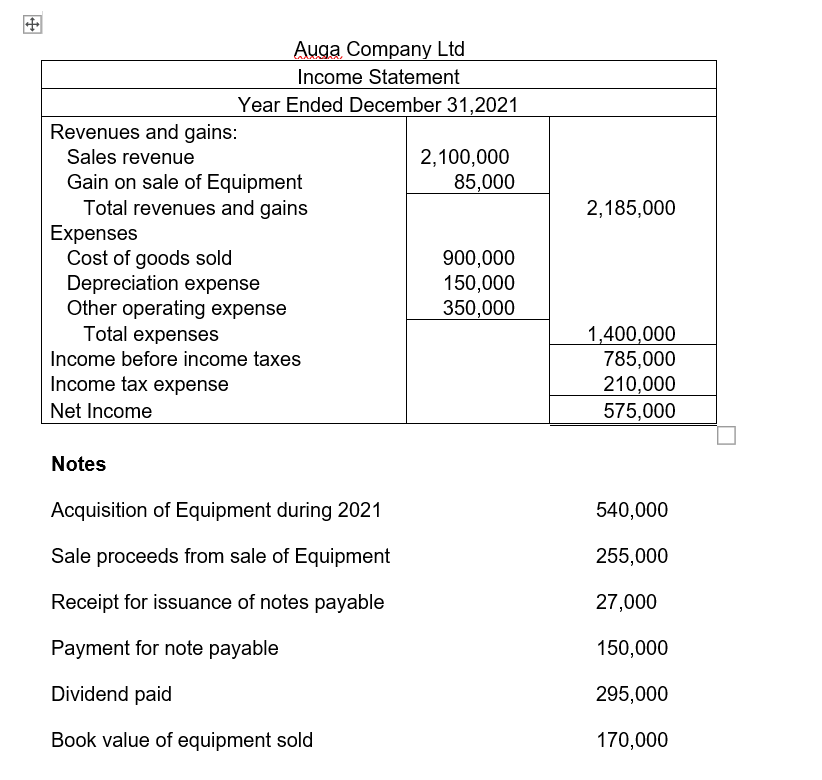

Auga Company Ltd Income Statement Year Ended December 31,2021 Revenues and gains: Sales revenue 2,100,000 85,000 Gain on sale of Equipment Total revenues and gains Expenses Cost of goods sold Depreciation expense Other operating expense Total expenses 2,185,000 900,000 150,000 350,000 1,400,000 785,000 210,000 575,000 Income before income taxes Income tax expense Net Income Notes Acquisition of Equipment during 2021 540,000 Sale proceeds from sale of Equipment 255,000 Receipt for issuance of notes payable 27,000 Payment for note payable 150,000 Dividend paid 295,000 Book value of equipment sold 170,000

Auga Company Ltd Income Statement Year Ended December 31,2021 Revenues and gains: Sales revenue 2,100,000 85,000 Gain on sale of Equipment Total revenues and gains Expenses Cost of goods sold Depreciation expense Other operating expense Total expenses 2,185,000 900,000 150,000 350,000 1,400,000 785,000 210,000 575,000 Income before income taxes Income tax expense Net Income Notes Acquisition of Equipment during 2021 540,000 Sale proceeds from sale of Equipment 255,000 Receipt for issuance of notes payable 27,000 Payment for note payable 150,000 Dividend paid 295,000 Book value of equipment sold 170,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2E: Cost of Goods Sold and Income Statement Schuch Company presents you with the following account...

Related questions

Question

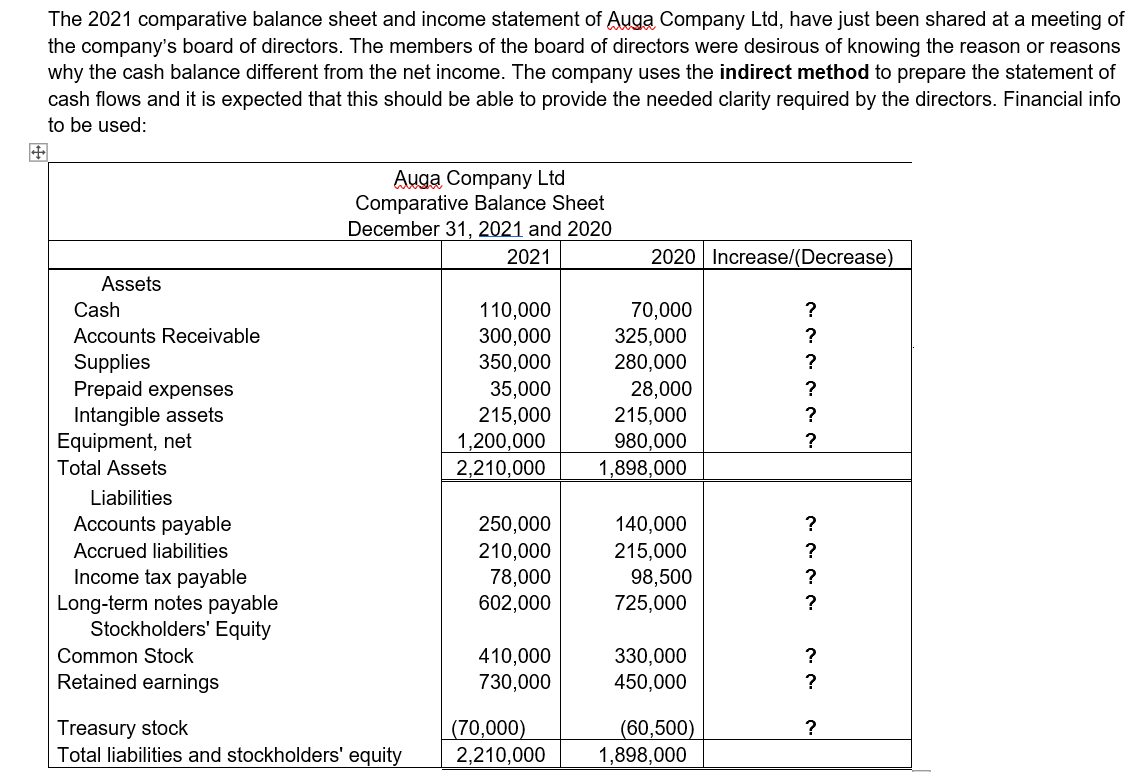

The 2021 comparative balance sheet and income statement of Auga Company Ltd, have just been shared at a meeting of the company’s board of directors. The members of the board of directors were desirous of knowing the reason or reasons why the cash balance different from the net income. The company uses the indirect method to prepare the statement of

Using the attached Comparative Balance sheet and Income statement:

- Reconstruct the company’s comparative balance sheet for 2020/2021, compute and show the missing figures to include the appropriate sign as a positive or negative figure.

- Prepare a complete statement of cash flows for 2021 using the indirect method.

Transcribed Image Text:Auga Company Ltd

Income Statement

Year Ended December 31,2021

Revenues and gains:

Sales revenue

2,100,000

85,000

Gain on sale of Equipment

Total revenues and gains

Expenses

Cost of goods sold

Depreciation expense

Other operating expense

Total expenses

2,185,000

900,000

150,000

350,000

1,400,000

785,000

210,000

575,000

Income before income taxes

Income tax expense

Net Income

Notes

Acquisition of Equipment during 2021

540,000

Sale proceeds from sale of Equipment

255,000

Receipt for issuance of notes payable

27,000

Payment for note payable

150,000

Dividend paid

295,000

Book value of equipment sold

170,000

Transcribed Image Text:The 2021 comparative balance sheet and income statement of Auga Company Ltd, have just been shared at a meeting of

the company's board of directors. The members of the board of directors were desirous of knowing the reason or reasons

why the cash balance different from the net income. The company uses the indirect method to prepare the statement of

cash flows and it is expected that this should be able to provide the needed clarity required by the directors. Financial info

to be used:

Auga Company Ltd

Comparative Balance Sheet

December 31, 2021 and 2020

2021

2020 Increase/(Decrease)

Assets

70,000

325,000

280,000

Cash

110,000

300,000

350,000

35,000

215,000

1,200,000

2,210,000

Accounts Receivable

?

Supplies

Prepaid expenses

Intangible assets

Equipment, net

?

28,000

215,000

980,000

Total Assets

1,898,000

Liabilities

Accounts payable

250,000

210,000

78,000

602,000

140,000

Accrued liabilities

215,000

?

Income tax payable

Long-term notes payable

Stockholders' Equity

98,500

725,000

Common Stock

Retained earnings

410,000

730,000

330,000

450,000

?

Treasury stock

Total liabilities and stockholders' equity

(70,000)

2,210,000

(60,500)

1,898,000

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning