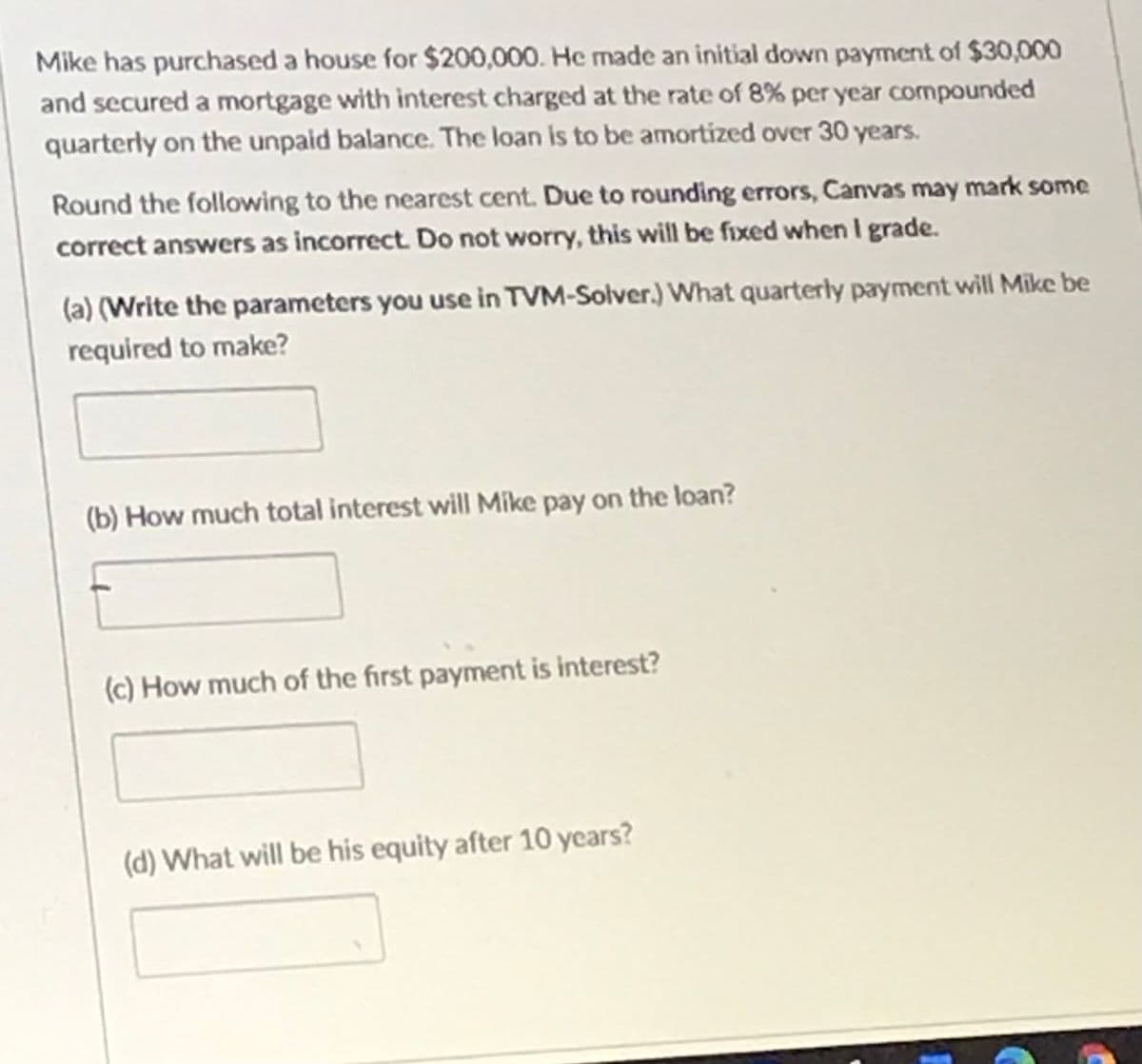

(a) (Write the parameters you use in TVM-Solver.) What quarterly payment will Mike be required to make? (b) How much total interest will Mike pay on the loan? (c) How much of the first payment is interest?

Q: What does the financial breakeven point shows?

A: A breakeven point is a situation of no loss no profit. The breakeven point is generally calculated a...

Q: Growing linearly, the balance owed on your credit card doubles from $700 to $1400 in 6 months, If th...

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: n item is 10000, payable in 10 days but if paid in 30 days there will be a P30 discount. Find the ra...

A: Simple interest = Principal * rate* time (n).

Q: Mrs. Go make deposits that forms a geometric gradient that increases at 6% per month for 1 year. She...

A: Deposit per month is P500 Growth rate of deposits is 6% Interest rate is 12% compounded monthly To...

Q: How do disclosure and analysis help users of financial statements assess performa

A: Step 1 Financial statement analysis is a method of examining business finances for choice purposes...

Q: You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: Perform the calculation for each ratio, and provide an explanation of the result. a. Return on equi...

A: Ratio Analysis is used to study a company's financial health, profitability, and operational efficie...

Q: How is risk defined and measured? How might the magnitude of the market risk premium impact someone’...

A: In financial terms, the risk is referred to as the possibility that an outcome's actual gains will d...

Q: Debit cards allow an individual to transfer funds directly in a checkable account to a merchant with...

A: Debit card transactions involve the transfer of funds from a bank account. The checkable deposit, no...

Q: Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return...

A: The majority of businesses employ a combination of equity and (debt) loan funding.The rate of return...

Q: A government bond pays coupons at an annual rate of 6%. It has a nominal value of K100 and it will b...

A: Dirty price of a bond The bond price is called dirty price when it included the accrued interest. Ac...

Q: Consider a newly issued 4-year, 3.11% annual-pay bond trading at par. The present values of each of ...

A: Macaulay duration It is the weighted average time required before the cash flows of the bond is rece...

Q: Big Rock has several investment portfolios with a local mutual fund company. One of the company’s di...

A: Sharpe ratio is calculated by dividing the difference of return on asset with risk free return by st...

Q: Ann got a 30 year Fully Amortizing FRM for $1,000,000 at an annual interest rate of 6% compounded mo...

A: Here, Fully Amortizing FRM = $1,000,000 Annual interest rate = 6% compounded monthly Refinancing cos...

Q: . A civil engineer plans to own a 300 m² lot after 5 years for an estimated cost of 570,000. To accu...

A: When a number of payments or receipts of equal amount is made at equal intervals of time, it is call...

Q: Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash F...

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for yo...

Q: Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash F...

A: NPV or Net present value is determined by adding the discounted value of all inflows and outflows to...

Q: Basic Opfion Strafegies Profif Computation Assume the below prices for calls and puts: Call Put Stri...

A: Call option A call option gives its holder the right to purchase the stock at the strike price. With...

Q: Nigel is considering an investment in split shares of SPL Corp. The company has been in business for...

A: Types of shares and their characteristics: A company can issue two types of shares. They are: Commo...

Q: Choices for last three requirements 3. What is the approximate IRR of Project A? a. 28% b. 18% c. ...

A: IRR is the internal rate of return. It is the rate at which NPV (net present value) becomes nil.

Q: nie purchases a television from a salesman who promises her 25,000 if she returns it in 61 days. Ann...

A: The simple interest is interest without the impact of the compounding that is the plain interest wit...

Q: Question 3 What is the price of Thera Corpn's zero coupon bond with 10 years to maturity? The bond w...

A: Present Value can be calculated using PV function in excel PV (rate, nper, pmt, [Fv], [type]) Rat...

Q: Suppose the yield on a 10-year T-bond is currently 5.05% and that on a 10-year Treasury Inflation Pr...

A: A Bond refers to an instrument that represents the loan being made by the investor to the company an...

Q: Anle Corporation has a current stock price of $19.49 and is expected to pay a dividend of $1.25 in o...

A: Equity cost of capital = (Expected stock price after dividend + Dividend - Current stock price) / Cu...

Q: Explain what a corporate bond is b. Outline the characteristics of the bond market d. Explain the be...

A: A company can raise capital and secure financing through different mediums of debt and equity. Corpo...

Q: Date Closing Market Index value Closing Price for PG Closing Price for F 01/02/2017 227...

A: Aggresive Vs Defensive portfolio:- Betas larger than one indicate aggressive portfolios, whereas bet...

Q: all ankual ihcome of $300,000. Jim is looking to buy a house with monthly property taxes of $1200 an...

A: Loans are paid by monthly payments that carry the payment of interest and payment of the principal a...

Q: Quantitative Problem 2: Today, you invest a lump sum amount in an equity fund that provides an 10% a...

A: Present Value can be calculated using PV function in excel PV (rate, nper, pmt, [Fv], [type]) Rat...

Q: 1. If the yield to maturity for a two year zero coupon bond is 5.8% and the yield to maturity for a...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: Nicole loans P900,000 from bank today which gives her 10% interest rate compounded annually. Based o...

A: Loan amount (L) = P 900000 r = 10% n = 10 payments Let the annual payment = A

Q: 1. Discuss: Firms often involve themselves in projects that do not result directly in profits. For e...

A: Direct profit is defined as the amount of money earned from sales after deducting direct costs. This...

Q: Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are t...

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts a...

Q: Harper Electronics is considering investing in manufacturing equipment expected to cost $250,000. Th...

A: Capital Budgeting methods: Managers use several capital budgeting methods while evaluating investmen...

Q: You receive a tax slip from your Canadian mutual fund showing $1,000 of capital gains, $100 of divid...

A: Capital gains and dividend income show that the equity investment is made through the fund.

Q: plockchain financial transactions?

A: Blockchain helps in making transparency in the financing industry while users are considering the pu...

Q: Cash Conversion Cycle. Will each of the following events increase or decrease cash conversion cycles...

A: Cash conversion cycle represent the number of days taken by the company to convert its goods into ca...

Q: A stock does not currently pay required return is 6%. What is the value of the stock?

A: Stock price is defined as the maximum price that an investor is ready to pay for a stock. It is calc...

Q: Krell Industries has a share price of $21.88 today. If Krell is expected to pay a dividend of $1.1...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: Barry Company is considering a project that has the following cash flow and WACC data. What is the p...

A: Net present value (NPV) NPV is a capital budgeting tool to help in deciding whether a capital projec...

Q: d. At what discount rate would you be indifferent between these two projects? (Do not round intermed...

A: Since, specifically Part D is asked, so the following solution also relates to Part D only. Solution...

Q: Lucy bought a house for $100,000. Lucy's annual cost of ownership net of tax savings is exactly equa...

A: Cost of House $1,00,000.00 LTV 80% Buying Cost 5% Selling Cost 8% Annual Growth rate 4.50%

Q: If you invest your P3,000 every year at 4% interest rate, how many months does it take to be worth P...

A: Annual investment (A) = P 3000 r = 4% n = Years to accumulate P 117247.80

Q: If the discounted amount is P8200 while the discount rate is 22% then wha amount of the money? O 114...

A: Loans are given at the discount to the future value of money and this discount on money represents t...

Q: vny does the Fed use the RRF rate as a supplem the interest on reserve balances rate? Because financ...

A: Federal bank maintain money supply by the increase or decrease the RRP ON Reverse repo rate and IORB...

Q: I'm stuck in Question 4

A: Since Question 4 is specifically asked, so the following solution is for Question 4. Solution 4:- Ca...

Q: or an investor who plans to purchase a bond that matures in one year, the primary concern should be ...

A: Step 1You obtain the face amount of the bond and any interests that have accumulated since the last ...

Q: When discussing a mix of risky assets please briefly explain the following concepts, making sure you...

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts fo...

Q: Lloyd is a divorce attorney who practices law in Florida. He wants to join the American Divorce Lawy...

A: We need to apply the concept of time value of money. The concept states that money today has more wo...

Q: Mr. Sanchez's new machine has been installed. Based on the contract and warranty, there will be no m...

A: Here, Life of Machine is 16 years Maintenance Cost for first 2 years is $0 Maintenance Cost from 3rd...

Q: Which of the following statements is not correct about Medicaid? Multiple Choice The Social Security...

A: Medicaid is a government-run health-care programme in the United States for low-income people. Medic...

Step by step

Solved in 2 steps

- M purchased a small lot in a subdivision, paying P200,000 down and promising to pay P15.000 every 3 months for the next 10 years. The seller figured interest at 12% compounded quarterly. (Include the cash flow diagram) (a) What was the cash price of the lot? (b) If M missed the first 12 payments, what must he pay at the time the 13th is due to bring himself up to date? (c) After making 8 payments. M wished to discharge his remaining indebtedness by a single payment at the time when the 9th regular payment was due, what must he pay in addition to the regular payment then due? (d) If M missed the first 10 payments, what must he pay when the 11th payment is due to discharge his entire indebtedness? Ans (a) P546,722; (b) P234,270; (e) P300,006; (d) P479,948M purchased a small lot in a subdivision, paying P200, 000 down and promising to pay P15, 000 every 3 months for the next 10 years. The seller figured interest at 12% compounded quarterly. (a) What was the cash price of the lot? (b) If M missed the first 12 payments, what must he pay at the time the 13th is due to bring him up to date? (c) After making 8 payments, M wished to discharge his remaining indebtedness by a single payment at the time when the 9th regular payment was due, what must he pay in addition to the regular payment then due? (d) If M missed the first 10 payments, what must he pay when the 11th payment is due to discharge his entire indebtedness?Include cashflow if possibleM purchased a small lot in a subdivision, paying ₱200,000 down and promising to pay₱15,000 every 3 months for the next 10 years. The seller figured interest at 12%compounded quarterly.(a) After making 8 payments, M wished to discharge his remaining indebtedness by asingle payment at the time when the 9th regular payment was due, what must he payin addition to the regular payment then due?(b) If M missed the first 10 payments, what must he pay when the 11th payment is dueto discharge his entire indebtedness? (c) Cashflow Diagram

- While buying a new car, Mitchell made a down payment of $1,000 and agreed to make month-end payments of $240 for the next 4 years and 9 months. He was charged an interest rate of 1% compounded semi-annually for the entire term. a. What was the purchase price of the car? b. What was the total amount of interest paid over the term?The Turners have purchased a house for $170,000. They made an initial down payment of $10,000 and secured a mortgage with interest charged at the rate of 5.5%/year on the unpaid balance. (Interest computations are made at the end of each month.) Assume that the loan is amortized over 30 years. (Round your answers to the nearest cent.) (a) What monthly payment will the Turners be required to make? $ (b) What will be their total interest payment? $ (c) What will be their equity (disregard depreciation) after 10 years?A man purchased a secondhand truck with a cash price of P350, 000 for his hollow block business. He was able to negotiate with the seller to allow him to pay only a down payment of 20 percent and the balance payable in equal 48 end of the month installment at 1.5 percent per month interest rate. On the day he paid the 20th installment, he decided to pay the remaining balance. How much is the remaining balance?

- M purchased a small lot in a subdivision. paying P200 000 down and promising to pay P15 000 every 3 months for the next 10 years. The seller figured interest at 12% compounded quarterly. (a) What was the cash price of the lot? (b) If M missed the first 12 payments what must he pay at the time the 13th is due to bring himself up to date? (c) After making 8 payments. M wished to discharge his remaining indebtedness by a single payment at the time when the 9th regular payment was due what must he pay in addition to the regular payment then due? Include the Cash Flow Diagram.While buying a new car, Thomas made a down payment of $1,000.00 and agreed to make month-end payments of $350.00 for the next 4 years and 7 months. If she was charged an interest rate of 3.00% compounded quarterly for the entire term, answer the following, rounding to the nearest cent. a. What was the cost of the car when Thomas purchased it? Round to the nearest cent b. What was the total amount of interest paid over the term?Ancog purchased a parcel of land somewhere in Brgy Tignapoloan. She paid P150,000 for the down payment and agreed to pay P20,000 every 3 months for the succeeding 10 years. Assuming that the seller’s interest is at 10% compounded quarterly. What was the cash price of the lot? If Engr. Ancog was not able to pay for the first 12 payments, what amount should she pay at the time the 13th is due to bring her payments updated? After paying for 8 payments, Engr. Ancog wants to pay the entire remaining amount by a single payment at the time when the 9th regular payment will be due. How much should she pay including her 9th payment? If Engr. Ancog failed to pay her first 10 payments, how much should she pay when the 11th payment is due to pay her entire debt?

- While buying a new car, Austin made a down payment of $1,000.00 and agreed to make month-end payments of $270.00 for the next 3 years and 4 months. If she was charged an interest rate of 5.00% compounded quarterly for the entire term, answer the following, rounding to the nearest cent. 1. What was the cost of the car when Austin purchased it? Round to the nearest cent 2. What was the total amount of interest paid over the term? Round to the nearest centAn engineer deposited her annual bonus of $10,000 into an account that pays interest at 8% per year, compounded semiannually. She withdrew $1000 in months 2, 11, and 23. Now, she wants to know the total value of the account at the end of 3 years. Solve by assuming (a) no interperiod compounding and (b) that interperiod compounding is providedMarcel Thiessen purchased a home for $205,600 and obtained a 15-year, fixed-rate mortgage at 7% after paying a down payment of 10%. Of the first month's mortgage payment, how much is interest and how much is applied to the principal? (Round your answer to the nearest cent.)