Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to 2 decimal places except $ amounts.) Income Statement Sales Cost of goods sold Depreciation Selling and administrative expenses EBIT Interest expense Taxable income Taxes Net income Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities 2020 $5,720,000 3,010,000 298, 200 1,597,000 $ $ $ 814,800 167,000 647,800 293,500 354,300 Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 2020 $ $ $ 1,095,700 2,876,000 $ 3,971,700 43,200 $ 81,000 604,000 1,404,300 448,500 976,800 $ 2,462,100 5,752,000 $ 8,214,100 318,300 496,000 814,300 1,913,700 $ 2,728,000 311,400 932,300 $ 2019 $ 1,243,700 $ 3,971,700 $ 990,000 1,215,300 $ 2,205,300 4,859,400 $ $ 7,064,700 311,400 838,000 $ 1,149,400 $ 8,214,100

Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to 2 decimal places except $ amounts.) Income Statement Sales Cost of goods sold Depreciation Selling and administrative expenses EBIT Interest expense Taxable income Taxes Net income Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities 2020 $5,720,000 3,010,000 298, 200 1,597,000 $ $ $ 814,800 167,000 647,800 293,500 354,300 Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 2020 $ $ $ 1,095,700 2,876,000 $ 3,971,700 43,200 $ 81,000 604,000 1,404,300 448,500 976,800 $ 2,462,100 5,752,000 $ 8,214,100 318,300 496,000 814,300 1,913,700 $ 2,728,000 311,400 932,300 $ 2019 $ 1,243,700 $ 3,971,700 $ 990,000 1,215,300 $ 2,205,300 4,859,400 $ $ 7,064,700 311,400 838,000 $ 1,149,400 $ 8,214,100

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 1FSA: Financial statement analysis The financial statements for Nike, Inc., are presented in Appendix D at...

Related questions

Question

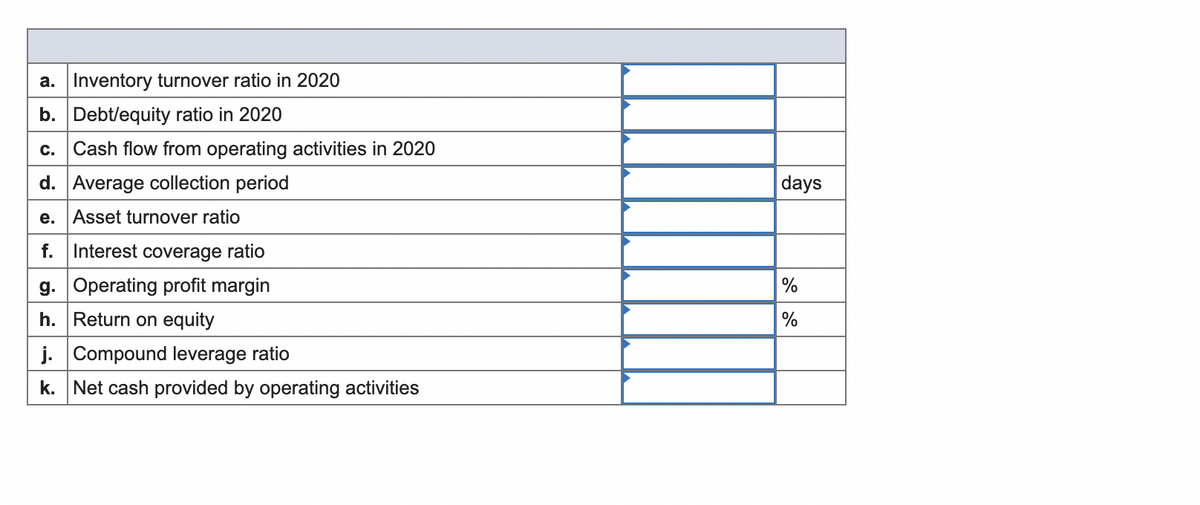

Transcribed Image Text:a. Inventory turnover ratio in 2020

b. Debt/equity ratio in 2020

c. Cash flow from operating activities in 2020

d. Average collection period

e. Asset turnover ratio

f. Interest coverage ratio

g. Operating profit margin

h. Return on equity

j. Compound leverage ratio

k. Net cash provided by operating activities

days

%

%

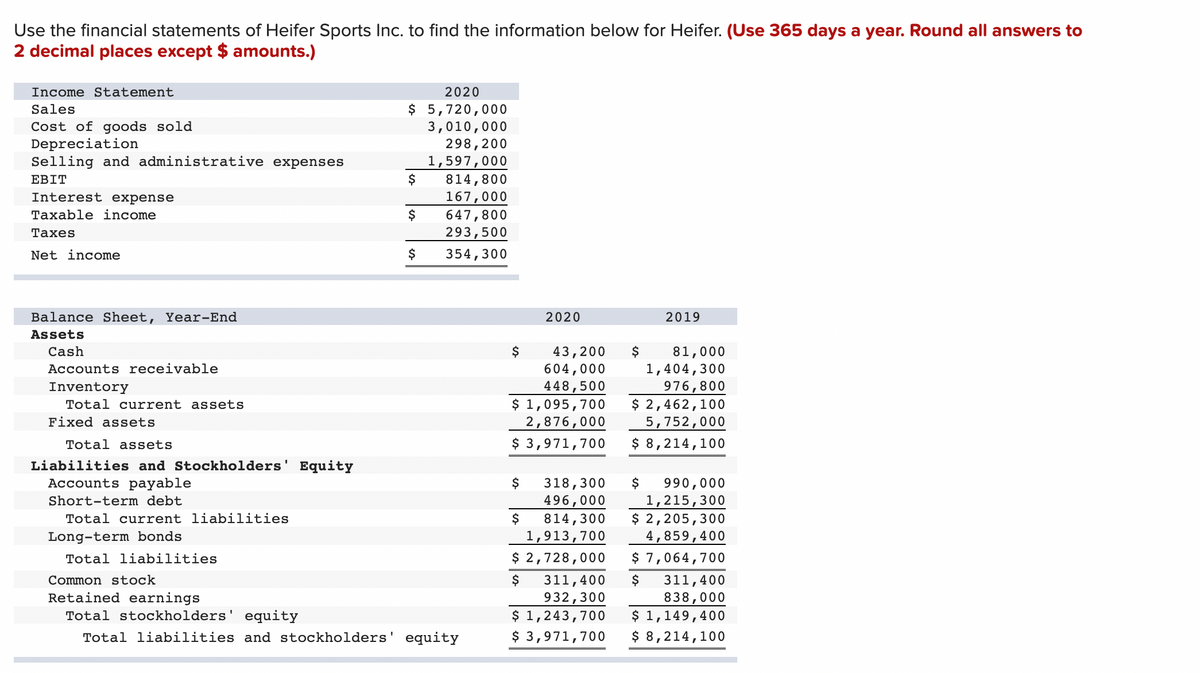

Transcribed Image Text:Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to

2 decimal places except $ amounts.)

Income Statement

Sales

Cost of goods sold

Depreciation

Selling and administrative expenses

EBIT

Interest expense

Taxable income

Taxes

Net income

Balance Sheet, Year-End

Assets

Cash

Accounts receivable

Inventory

Total current assets

Fixed assets

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Short-term debt

Total current liabilities

Long-term bonds

Total liabilities

2020

$ 5,720,000

3,010,000

298, 200

1,597,000

$

$

$

814,800

167,000

647,800

293,500

354,300

Common stock

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

$

$

2020

$ 1,095,700

2,876,000

$ 3,971,700

318,300

496,000

814,300

1,913,700

$ 2,728,000

$

$

43,200 $ 81,000

604,000 1,404,300

448,500

976,800

$ 2,462,100

5,752,000

$ 8,214,100

2019

311,400 $

932,300

$ 1,243,700

$ 3,971,700

$ 990,000

1,215,300

$ 2,205,300

4,859,400

$ 7,064,700

311,400

838,000

$ 1,149,400

$ 8,214,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

please see incorrect or unanswered questions, ty

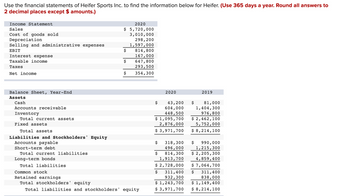

Transcribed Image Text:Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to

2 decimal places except $ amounts.)

Income Statement

Sales

Cost of goods sold

Depreciation

Selling and administrative expenses

EBIT

Interest expense

Taxable income

Taxes

Net income

Balance Sheet, Year-End

Assets

Cash

Accounts receivable

Inventory

Total current assets

Fixed assets

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Short-term debt

Total current liabilities

Long-term bonds

Total liabilities

2020

$ 5,720,000

3,010,000

298, 200

1,597,000

$

$

$

814,800

167,000

647,800

293,500

354,300

Common stock

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

$

$

-es

$ 1,095,700

2,876,000

$ 3,971,700

2020

318,300

496,000

814,300

1,913,700

$ 2,728,000

$

43,200 $

604,000

448,500

$

311,400

932,300

$ 1,243,700

$ 3,971,700

2019

81,000

1,404,300

976,800

$ 2,462,100

5,752,000

$ 8,214,100

$ 990,000

1,215,300

$ 2,205,300

4,859,400

$ 7,064,700

311,400

838,000

$

$ 1,149,400

$ 8,214,100

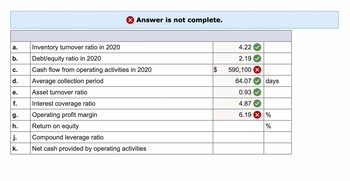

Transcribed Image Text:a.

b.

C.

d.

e.

f.

g.

h.

Inventory turnover ratio in 2020

Debt/equity ratio in 2020

Cash flow from operating activities in 2020

Average collection period

Asset turnover ratio

Interest coverage ratio

Operating profit margin

Return on equity

X Answer is not complete.

j. Compound leverage ratio

k.

Net cash provided by operating activities

$

4.22

2.19

590,100 X

64.07

0.93

4.87

6.19 X %

%

days

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning