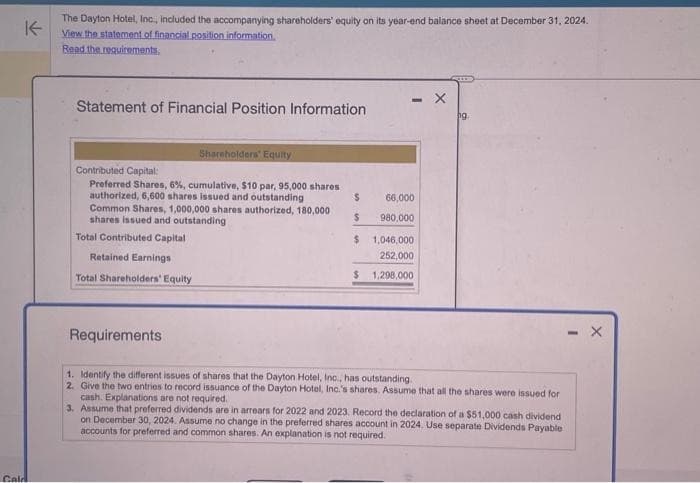

The Dayton Hotel, Inc., included the accompanying shareholders' equity on its year-end balance sheet at December 31, 2024. View the statement of financial position information. Read the requirements. Statement of Financial Position Information Shareholders' Equity Contributed Capital: Preferred Shares, 6%, cumulative, $10 par, 95,000 shares authorized, 6,600 shares issued and outstanding Common Shares, 1,000,000 shares authorized, 180,000 shares issued and outstanding Total Contributed Capital Retained Earnings Total Shareholders' Equity Requirements $ $ $ 66,000 980,000 1,046,000 252,000 $ 1,298,000 X 1. Identify the different issues of shares that the Dayton Hotel, Inc., has outstanding. 2. Give the two entries to record issuance of the Dayton Hotel, Inc.'s shares. Assume that all the shares were issued for cash. Explanations are not required. 3. Assume that preferred dividends are in arrears for 2022 and 2023. Record the declaration of a $51,000 cash dividend on December 30, 2024. Assume no change in the preferred shares account in 2024. Use separate Dividends Payable accounts for preferred and common shares. An explanation is not required.

The Dayton Hotel, Inc., included the accompanying shareholders' equity on its year-end balance sheet at December 31, 2024. View the statement of financial position information. Read the requirements. Statement of Financial Position Information Shareholders' Equity Contributed Capital: Preferred Shares, 6%, cumulative, $10 par, 95,000 shares authorized, 6,600 shares issued and outstanding Common Shares, 1,000,000 shares authorized, 180,000 shares issued and outstanding Total Contributed Capital Retained Earnings Total Shareholders' Equity Requirements $ $ $ 66,000 980,000 1,046,000 252,000 $ 1,298,000 X 1. Identify the different issues of shares that the Dayton Hotel, Inc., has outstanding. 2. Give the two entries to record issuance of the Dayton Hotel, Inc.'s shares. Assume that all the shares were issued for cash. Explanations are not required. 3. Assume that preferred dividends are in arrears for 2022 and 2023. Record the declaration of a $51,000 cash dividend on December 30, 2024. Assume no change in the preferred shares account in 2024. Use separate Dividends Payable accounts for preferred and common shares. An explanation is not required.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 16E: Contributed Capital Adams Companys records provide the following information on December 31, 2019:...

Related questions

Question

Subject:

Transcribed Image Text:K

The Dayton Hotel, Inc., included the accompanying shareholders' equity on its year-end balance sheet at December 31, 2024.

View the statement of financial position information.

Read the requirements.

Cald

Statement of Financial Position Information

Shareholders' Equity

Contributed Capital:

Preferred Shares, 6%, cumulative, $10 par, 95,000 shares

authorized, 6,600 shares issued and outstanding

Common Shares, 1,000,000 shares authorized, 180,000

shares issued and outstanding

Total Contributed Capital

Retained Earnings

Total Shareholders' Equity

Requirements

- X

$

66,000

$ 980,000

$

$

1,046,000

252,000

1,298,000

ng

1. Identify the different issues of shares that the Dayton Hotel, Inc., has outstanding.

2. Give the two entries to record issuance of the Dayton Hotel, Inc.'s shares. Assume that all the shares were issued for

cash. Explanations are not required.

3. Assume that preferred dividends are in arrears for 2022 and 2023. Record the declaration of a $51,000 cash dividend

on December 30, 2024. Assume no change in the preferred shares account in 2024. Use separate Dividends Payable

accounts for preferred and common shares. An explanation is not required.

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College